9th August 2018

Tomorrow (Friday 10th August) sees the beginning of the new English Premier League season with Manchester United entertaining the 2016 champions Leicester City – a big event in the life of Sky plc. However, on a scale beyond even the opening day of the new Premier League season is the saga of who will end up buying the glittering prize of Sky itself.

The Players

For those of you struggling to keep up with events, this is where we think we are:

- Rupert Murdoch’s 21st Century Fox currently owns 39% of Sky plc and is seeking to acquire the remaining 61%. This has been the subject of several enquiries regarding media pleurisy and independence, and along the way accounted indirectly for the resignation of a UK Cabinet Minister.

- Meanwhile Comcast, an American telecommunications business has made a bid higher than that of 21st Century Fox – £14.75 per share.

- At time of writing Sky is trading north of £15.00 which suggests that the capital markets are expecting an increased bid from Fox.

- In addition, on the 27th July 2018 Disney agreed terms and secured the appropriate shareholder approvals to acquire 21st Century Fox for $71.3bn.

- Under UK takeover rules 21st Century Fox has until the end of Thursday 9th August to formally post a bid to Sky’s shareholders.

Before the bid from 21st Century Fox was announced towards the end of 2016, Sky plc shares had been on something of a slide. At the beginning of 2016 they were trading at £11.12 before falling to £7.81 at the end of November in the same year – a fall of 29.7%. In fact, we covered the valuation in one of our earlier blog entries in late 2016 so as the title suggests, this is a return to familiar territory.

Since then, the interest from both Comcast and 21st Century Fox has almost doubled the November 2016 closing share price.

In many ways, the share price can be viewed as being similar to running on a treadmill – a higher price implies a faster pace or a higher quantum of performance from the business. That is, if the business can run at a higher pace and the market believes that this pace can be sustained then over time one can expect the share price to rise. Conversely, if it can’t sustainably run at that pace then over time one might expect the share price to fall.

Sky’s Economic Performance

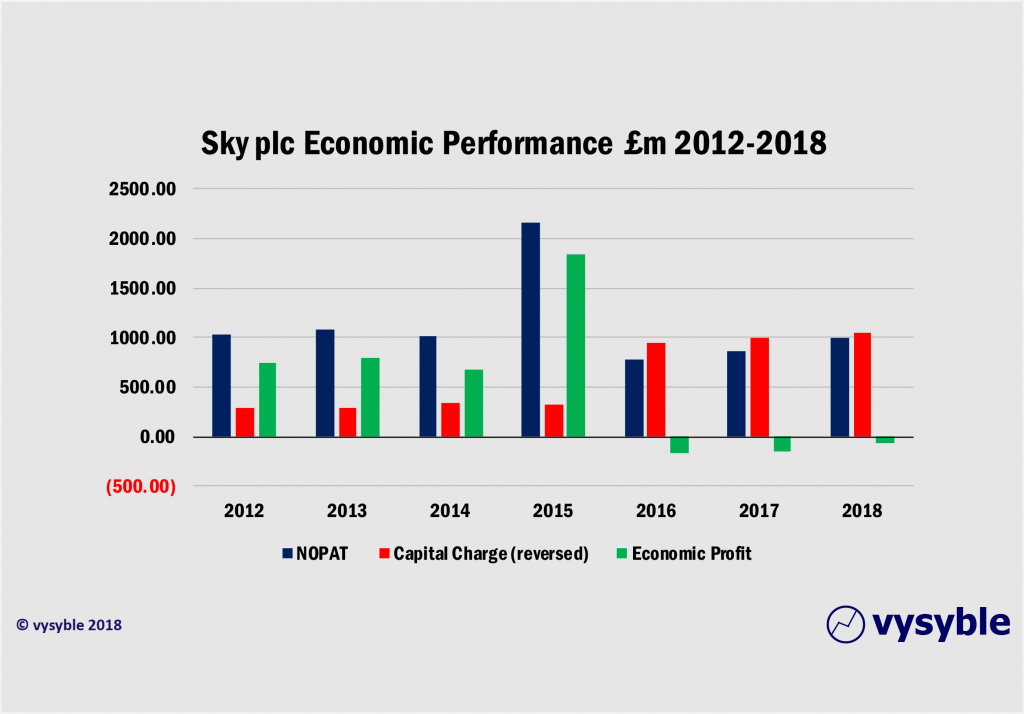

Set out below is a very basic and preliminary calculation of Sky’s economic performance over the period 2012 through to June 2018; a period encompassing seven years where we have split the standard Economic Profit calculation (see methodology) into its constituent parts – NOPAT (net operating profit after tax), the charge for capital and the resulting economic profit.

We have used a Weighted Average Cost of Capital (WACC) of 8% over the period 2012 through to 2017 and 7.5% for the 2018 charge for capital.

The 2018 numbers are: NOPAT = £993m, Invested Capital is £14.0bn so the capital Charge = £1.05bn, Economic Loss = -£59m.

Excluding the “one-off” items from 2015, the average Economic Profit over the 2012-18 period is £324m – but note that in more recent years as the contract with the Premier League has reached higher commitment levels, the Economic Profit of the business has become negative – in other words the company is NOT covering all of the costs of doing business. In 2018, the economic loss totalled £59m – not in anyway terminal but nonetheless a reflection that market conditions are perhaps more challenging than they were.

So, with an offer of £14.75 on the table at the time of writing, what does this infer in terms of performance expectations?

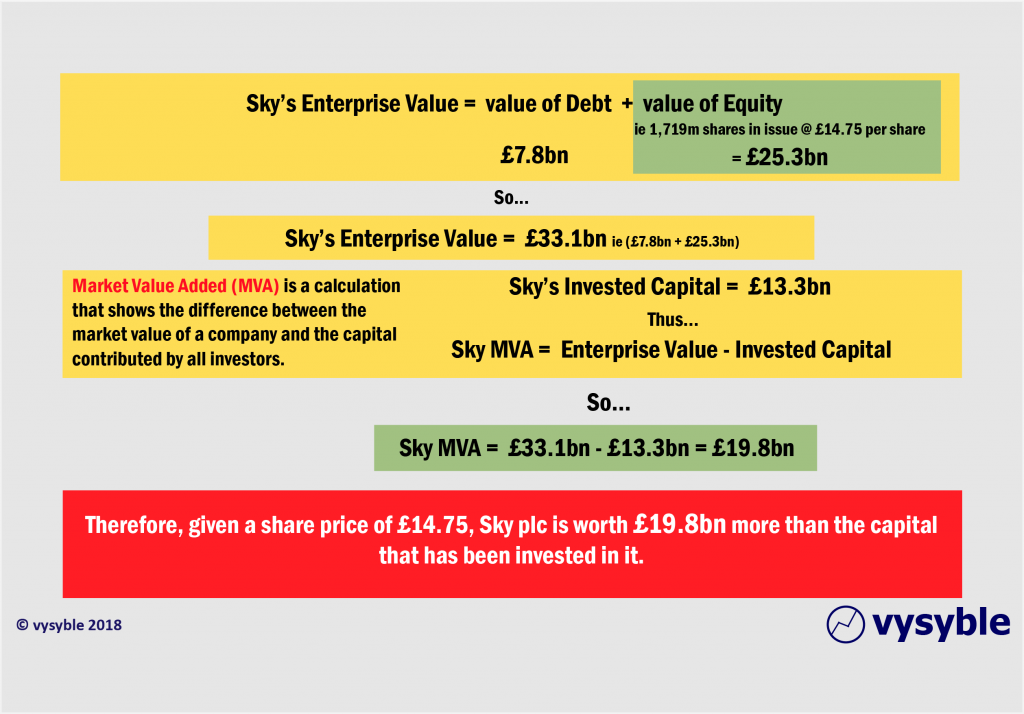

All relevant data has been taken from the company’s 2018 report. For a share price of £14.75, MVA totals £19.8bn – that is the discounted stream of future economic profit totals £19.8bn.

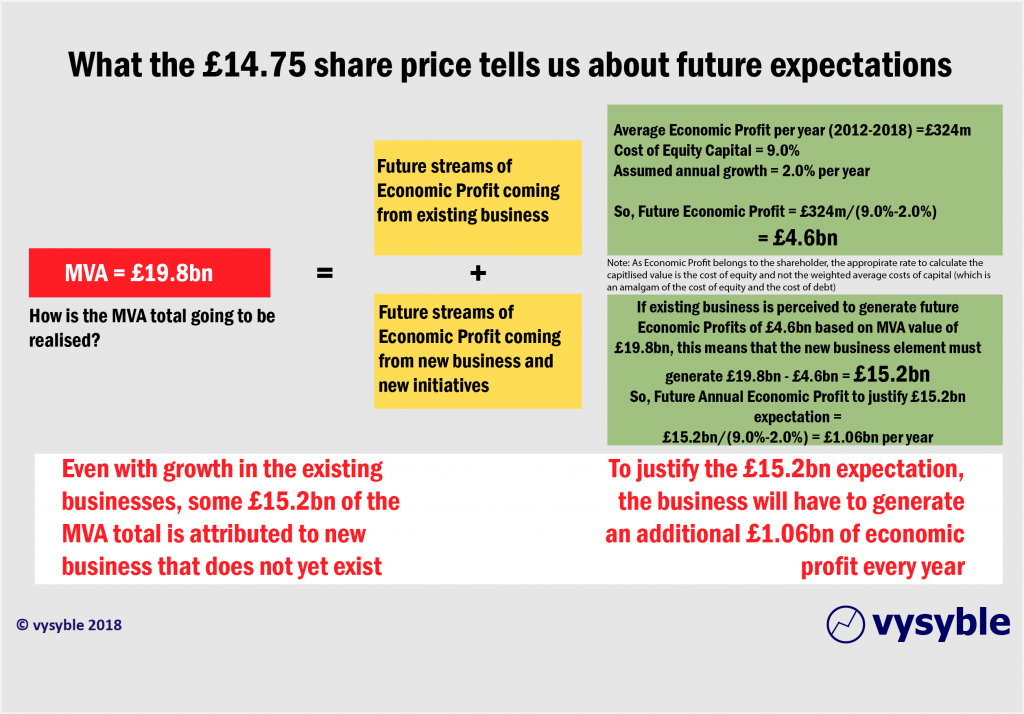

By using the method of applying a value to the existing businesses using the average Economic Profit achieved during the period 2012-18, we are arguably giving a more favourable/less demanding value that has to come from new, additional businesses and initiatives. In order to justify an acquisition price of £14.75 per share with an assumed cost of equity of 9.0% and a generous 2% growth per annum in perpetuity, the additional Economic Profit required from additional businesses is £1.06bn per annum!

The numbers are clearly challenging even if there is an ‘emotional’ premium factored into the share price.

If we reduced the cost of equity down to 5%, which in reality is highly unlikely, and deployed the same growth assumption in perpetuity, the additional annual Economic Profit required to justify a £14.75 share price comes to £456m (per year) – still some £132m (40.7%) higher than the average Economic Profit over the period 2012-18 (£324m) – which in itself is heavily skewed towards the earlier years.

None of this is intended to suggest that the executives from either Comcast or 21st Century Fox are losing their minds, but the sheer scale of the numbers is probably a reflection of the perceived strategic urgency to acquire Europe’s largest pay for TV provider. It may also reflect the opportunity cost in preventing Sky falling into the hands of an aggressive competitor. Certainly, it would take years and significant investment to build a meaningful alternative to the company. This deal is not so dirty, but it is definitely quicker.

With any deal of this size and nature there are going to be implications, particularly for the end-user/consumer. In the simplest terms, there is going to be a lot of debt to service once the sale has been concluded. Revenue per customer/subscriber will have to increase as a consequence. It remains to be seen how the business will manage content production and media inventory.

The elephant in the living room for Disney/Comcast/Sky senior executives is Netflix. The Netflix model is proving popular because of its relatively low cost, mass-market appeal and accessibility. How a re-modelled Disney or Comcast-driven Sky works in competition to it in light of the economic demands outlined previously is open to question.

Conversely, the business will no doubt look towards cost savings. For example, if Comcast is the eventual victor, we expect there to be some form of dialogue and engagement around the current English Premier League rights contracts for the UK and the USA (both run to 2022) given the company’s ownership of NBC. Any CEO would look to seek out improved terms when stacked against the economies of scale.

Above all, this is an excellent development for Sky’s current shareholders.

vysyble