The thoughts and views of Professor John Barbour of the University of Strathclyde Business School.

10th April 2020

One of the sad features of the Covid-19 virus is that individuals with underlying health problems are especially vulnerable to attack. And the outcomes for those people are particularly bad.

It is now obvious, to those who want to see, that Premier League and the EFL’s constituent clubs are also such vulnerable individuals.

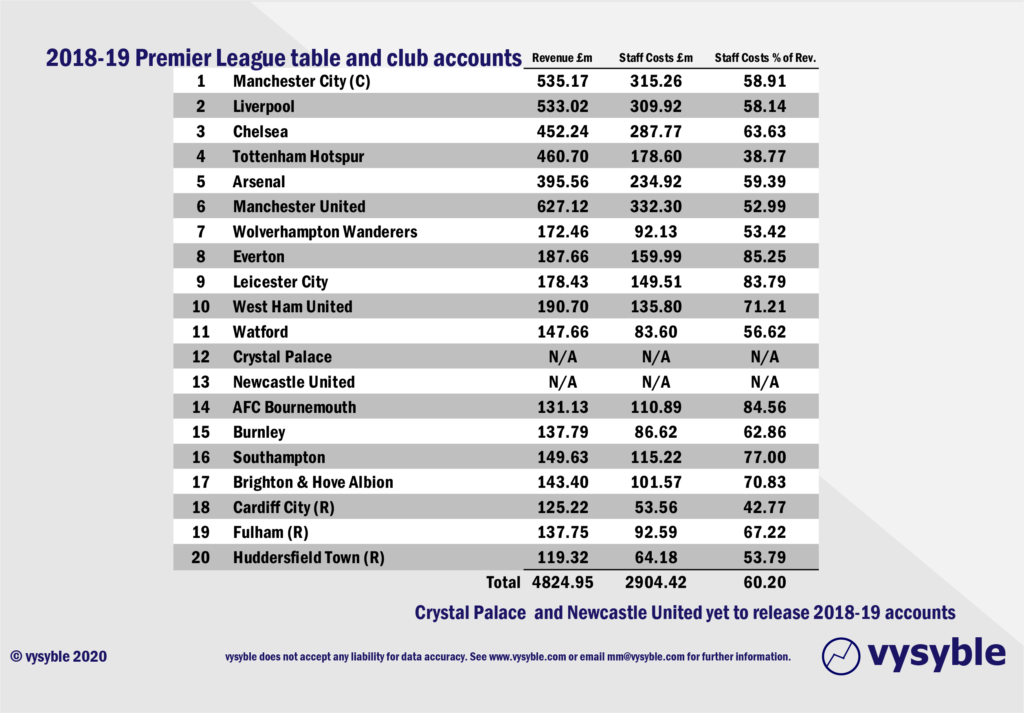

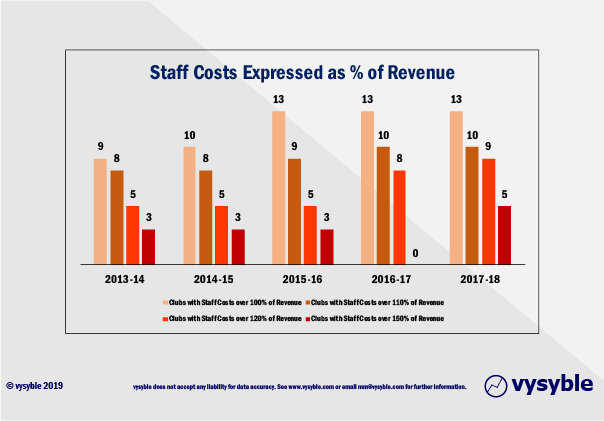

This is no surprise. Since 2016 (see above graphic) and well before the onslaught of Covid-19, we have shown that many of these clubs are not sustainable from an economic point of view. They do not make enough money to stay in business without handouts from wealthy owners or money from the TV companies.

In our view, there is a clear threat to English football as we know it today.

To be abundantly clear, Covid-19 is not the problem here. In our opinion, a poor standard of management at the Premier League, the EFL (English Football League) and at many football clubs is what has got us into this ridiculous position.

Even at this critical juncture in the nation’s response to the pandemic, the Premier League has somehow managed to become embroiled in a war of words with not only the Government but also with the players. A once-slick PR operation has become very leaden and seemingly ‘flat-footed’.

So how has management at the Premier League, the EFL and in many of the clubs failed English football?

In our view there are two main reasons:

1. Management Failings at the Administrative Level

The Premier League is an organisation which in its 2018/19 Report presents itself as some combination of a fan club; a charity; and a social service. The EFL’s annual report is not dissimilar.

Interesting though some of that be; we need to remember that the Premier League in particular has presided over what maybe the destruction of English football as we know it.

So instead of taking an early lead in acknowledging the real condition of the game in England and doing something positive; it has chosen to ignore reality and has effectively buried its head in the sand.

The vysyble blog has constantly informed the “fan in the street” about the economic reality facing English football for some time; and we have had concerned and informed dialogues with many of those people.

But nothing of substance has come from the Premier League; and the response from the EFL has been a well-documented dismissal and denial.

2. Management Failings at Club Level

Some of the clubs are, in effect, a rich man’s hobby or an expression of ‘soft power’ by state-controlled actors and that is fine until these benefactors become bored; or they get fed up writing cheques to support expensive footballers for the dubious pleasure of a special seat in the stand. Most clubs don’t have the benefit of those cheques.

We believe that many clubs are managed by people who may indeed have been successful in their own field of business but have somehow managed to leave whatever financial common sense they had in the club car park.

Having poor visibility of the financial condition of the business they are in charge of may be excusable for a short time; but a refusal to see the obvious and then dealing with that reality is unforgivable.

Their incompetence is revealed in many ways, including:

a. A willingness to vastly overpay the playing staff:

We have all been conned into believing that kicking a ball about is a very unusual and special talent which deserves huge reward when compared to the real world. Indeed, the best paid English footballers earn more in a day than an ICU nurse earns in a year. In such a situation it is difficult, given the current mood, to see the public supporting a state-sponsored or government bail out to address any short-term cashflow challenges.

To be clear, it is the clubs and specifically the owners who have allowed this to happen.

In addition, one has to wonder what kind of moral compass guides many of the club Chairmen who have furloughed their non-playing staff whilst continuing to pay their playing staff.

Should we also blame the players? We think not. For some years they and their agents have been taking advantage of a temporary insanity in their work environment. But they cannot be immune to the real economics of their employers for much longer.

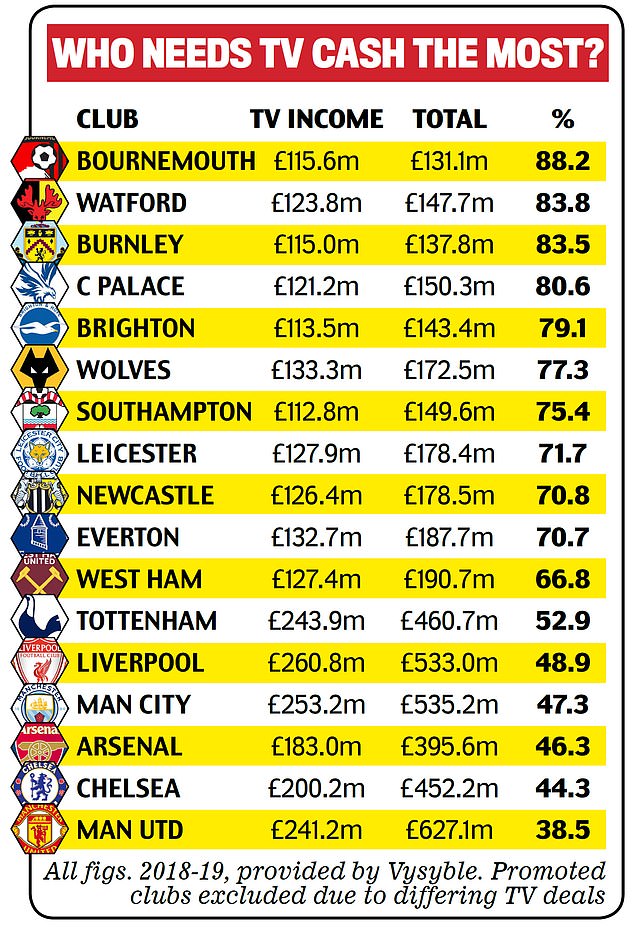

b. They have fooled themselves into believing that over-reliance on TV funding is sensible; and that the TV largesse will go on indefinitely:

We have been pointing out for some time to those who will listen that the “golden goose” of TV money had already started to lay smaller eggs because their own economics are becoming increasingly fragile. But the Premier League administration and most of the clubs buried their heads in the sand and hoped it would somehow all be OK, with the eggs continuing to grow in size.

So what needs to happen?

- At some point, once Covid-19 has been addressed, the Premier League will need to be completely restructured; with a new management team overseeing a much smaller number of clubs. This, in turn, will impact the EFL and its clubs.

- Some of the bigger English clubs will finally, and unfortunately, recognise that their future lies in a more international league and not in England. The bigger European clubs will come to the same conclusion; and the various national leagues will see them all leave. And that will have a big hit on the TV money available to lesser clubs.

- There is a danger that many of the existing professional clubs go into liquidation and will ultimately disappear. Neither the banks nor the Leagues will be willing or able to support them. We will hear all sorts of arguments that football clubs provide a social function. Whilst that may be true to some extent; it will not persuade fans to throw good money after bad in providing the cash that the clubs need.

- The surviving clubs will need to come up with a more feasible way of paying their playing staff. That may be a mandatory maximum wage; or adopting a “take it or leave it” position. Given the scale of the economic losses over the last decade, we believe that the clubs cannot be relied on to act sensibly without an imposed regulatory framework from a renewed or revitalised League structure or elsewhere – perhaps similar to those found in a number of US sports?

- A number of clubs will consolidate in a vain attempt to cut their costs. That will not be sustainable until the player wage issue is fixed.

The sheer incompetence of the management of many clubs has been laid bare by the public health emergency. They will need to be replaced by people with at least some understanding that they are running a business and not a charity.

Consequently, English football will be diminished; and that is a shame.

Follow vysyble on Twitter

Archive

4th November 2019 – The Ultimate Value Machine? – BMW creates good cars but does it also create shareholder value?

22nd October 2019 – Masters of Misfortune – Have modern business ‘apprentices’ got what it takes to succeed?

19th October 2019 – Pizza Distress – The Pizza Express financial menu causes serious indigestion

30th September 2019 – Thomas Cooked – Travel operator floored by absence of value-driven focus