10th October 2019

The media has been promoting the enormous debt pile held by Pizza Express as the cause of its current distress. However, and as usual, there are deeper issues at play that seem to have escaped most of the commentators.

What we are seeing at Pizza Express is a management team which seems to be hypnotised by trying to grow the revenue of the business. The 2018 Annual Report makes repeated comments about the drive for growth across markets, channels, and customer groups. Innovation is apparently about driving growth.

This is what they tell us in the 2018 Annual Report:

Why would they do this? Because they believed that the business was profitable, and that growth would therefore drive up the value of the business.

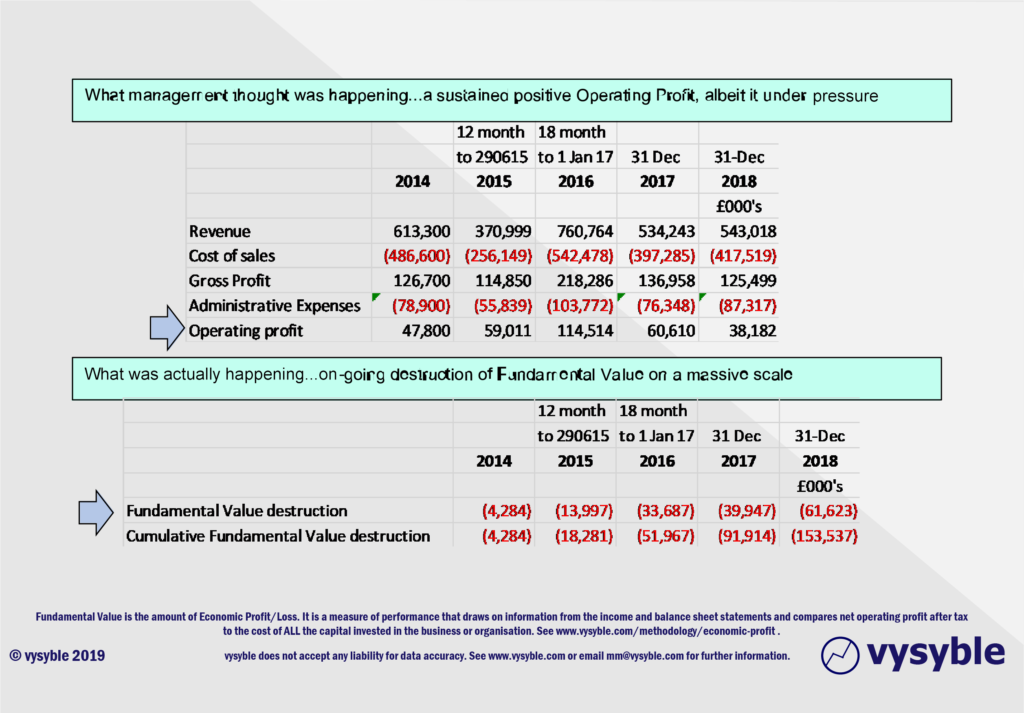

And – using the traditional accounting metrics that they seem to follow – that might well have appeared to them to be a sensible course of action.

This is a rookie error we see often because those same accounting numbers do not tell the full story.

The facts are that Pizza Express has been a consistent and large destroyer of Fundamental Value every year, at least since 2014, as we show below. We see positive annual Operating Profit and at the same time huge destruction of Fundamental Value…why did the management team not see this?

The outcome of this strategic blindness is that Management priorities and actions – again as stated by them in the 2018 annual report – are completely misaligned with the economic realities that face the business.

This on-going obsession with growing revenue was a mistake. What they should have been doing was getting full economic costs down (both operating costs and capital costs); and they should have been doing that since 2014…

- In 2018, according to our calculations, the team needed to take economic costs down by around £62m to reach economic breakeven.

- This £62m was part of a total economic cost base in 2018 of around £600m – a difficult task but not impossible.

In our view, the current situation is a result of misguided management and ineffective governance from directors and owners. In addition, we might wonder about what the auditors had to say about the viability of the on-going business.

All this is little comfort to the 14,000 or so team members within the business at this time as they fear for their jobs

They should be questioning the quality of Pizza Express governance and management over time – including how much they were paid for overseeing this destruction of Fundamental Value – as much as the weight of the debt pile.