Vysyble and The Barbour Partnership has undertaken an extensive financial study which for the first time calculates the proportion of the share price which is based upon the capital market’s future expectation of business performance using a proprietary Future Market Value (FMV) model. The model incorporates the economic profit metric as the measure of business performance.

The question facing many CEOs and their teams managing companies which are quoted on the capital markets in their strategy development discussions is ‘what is the required or implied economic performance necessary to sustain a given share price?’ This has implications for targets, objectives, new market entry, exit from existing markets, new product development, structure, reward, management appetite etc.

Perhaps it is helpful to think of the share price as something akin to the speed of running on a treadmill – as the share price rises so does the pace of the treadmill. Accordingly, can the management team find strategies and performance which will deliver against the heightened pace?

If they can, and with all other things being equal, then the rise in the share price can be sustained and could rise even further. Conversely, if they are unable to keep up then sooner or later, then the share price will fall as the capital markets adjust downwards to a lower level of expectation.

We believe that economic profit (defined as net operating profit after tax less a charge for ALL the capital used by the business) over time is the best surrogate for the trajectory of the share price. Our work confirms this and we would argue that it is now broadly accepted that share prices are set primarily over time by investor expectations of future economic performance and that a DCF (Discounted Cash Flow) valuation model is appropriate.

The question for the management team is how does it translate the share price into performance targets and objectives? In this endeavour there is the recent economic performance delivered by the company which we capitalise to reach a Current Market Value and then there is the market’s assessment of performance from activities not currently under management but which it (the market) assumes will be forthcoming and delivered by the company over time – this is the Future Market Value.

By calculating the Enterprise Value of the company and in making one or two reasonable assumptions, the Future Market Value for a given share price can be calculated.

How It Works

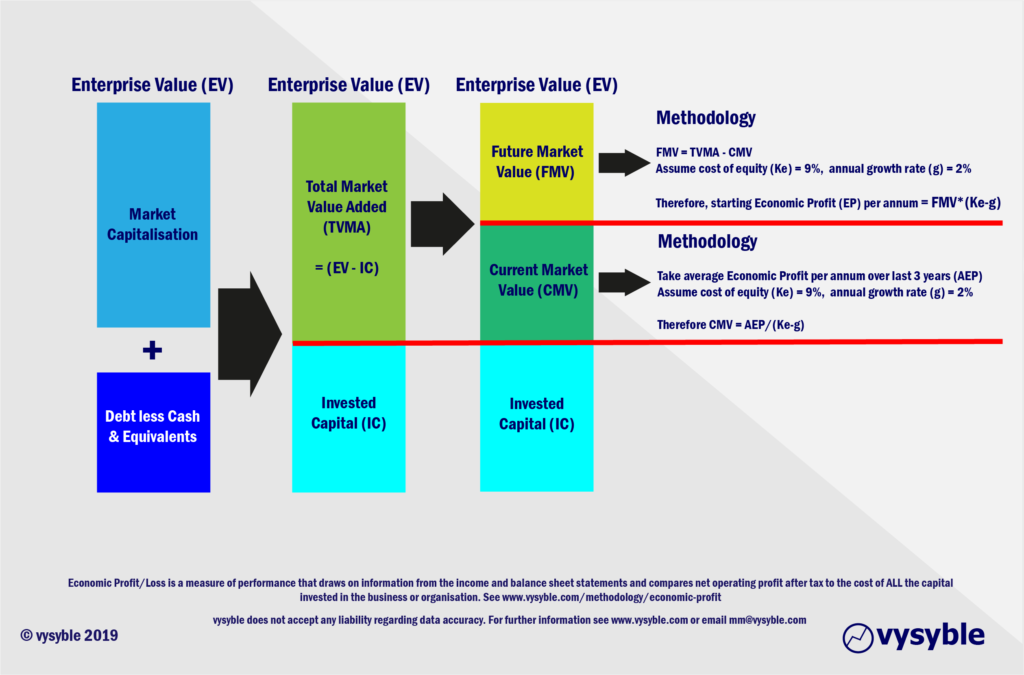

Enterprise Value (EV) is a measure of a company’s total value – in effect it represents the cash flows to be generated by the business from now into perpetuity. Some people find it helpful to think of EV as the acquisition price of a quoted company.

The simple formula for Enterprise Value is:

EV = Market Capitalisation + Market Value of Debt – Cash and Equivalents

and

EV = Invested Capital + Total Market Value Added

Where Total Market Value Added = Current Market Value + Future Market Value

Hence…

EV = Invested Capital + Current Market Value + Future Market Value

Therefore, the share price can also be broken down into three elements;

- Invested capital element – which we extract from the most recently published Balance Sheet

- Proportion of Enterprise Value based upon current business performance ie Current Market Value (To estimate Current Market Value we capitalize the recent and current Economic Profit delivered by the business.)

- Proportion of Enterprise Value based upon future business performance ie Future Market Value

The Future Market Value is the anticipated or future stream of economic profit from new and additional businesses required to justify the current share price. It represents value that investors somehow expect – either wisely or foolishly – will be delivered from assets not yet owned or controlled by the business.

Thus, by deploying the Future Market Value methodology, expectation of future performance is a directly measurable and quantifiable proposition for a given share price.

Why does this notion of Future Market Value matter? Simply because it represents the scale of the future financial challenge facing the managers of the business in justifying and sustaining the current share price.

Implications

For companies and shareholders, the Future Market Value Model demands clarity as to whether or not the business has the necessary capabilities and strategy to deliver against the now-measurable expectation element of the share price.

In particular, the FMV model brings heightened levels of scrutiny upon management capabilities in terms of how it will manage and achieve against the expectations of the capital markets as indicated by the Future Market Value proportion of the share price. For example;

- Do they recognise the scale and pressing nature of these challenges?

- Do they understand the consequences – both corporate and personal – of failing to deal with the challenges effectively?

- Are their strategies, priorities, and ways of working well-aligned with dealing with these challenges?

- Do they have the skill and will that will be required to deliver this quantum of value?

Experience tells us that the management teams who are the most successful in understanding their company’s performance from an economic perspective and the drivers of value creation will willingly make the necessary adjustments in how they:

- Set targets and objectives for the business and its components

- Measure and manage financial performance in ways that give visibility of value creation and destruction

- Go about developing and executing strategies

- Manage execution and performance

- Reward and incentivise managers

A Working Example

British Telecom plc (BT)

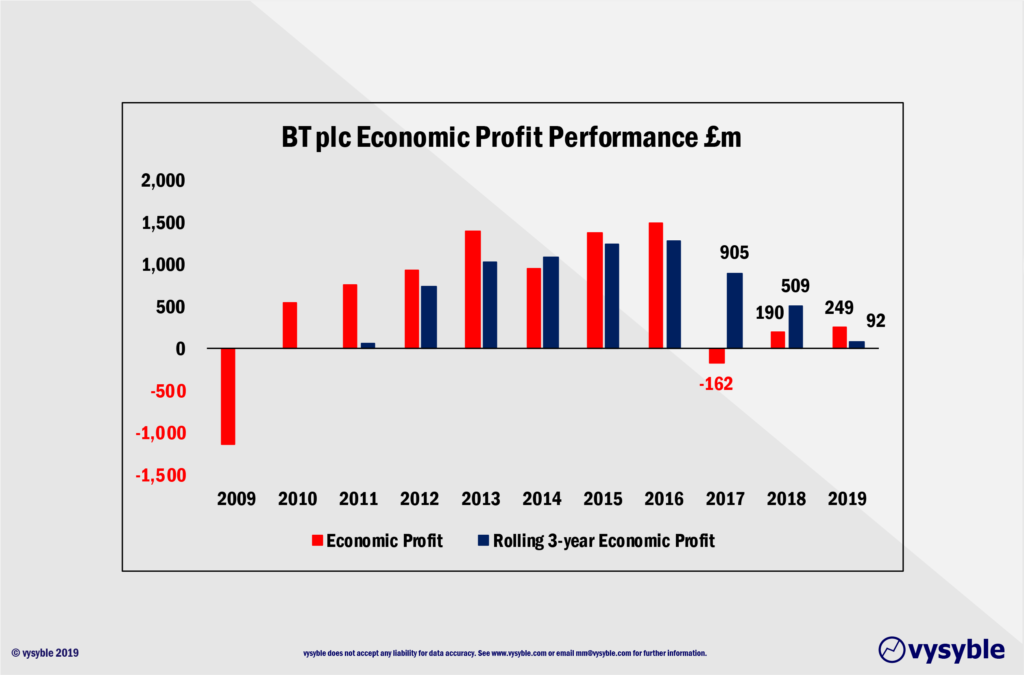

BT has faced a number of challenges in recent years including a well-publicised financial scandal in Italy. The share price has been beaten down from a high of £4.99 in November 2015 all the way to a very recent low of £1.61. The economic profit performance of the business has also been impacted as the following graphic illustrates:

As we commonly observe with many businesses, the share price tends to follow the economic profit performance trend.

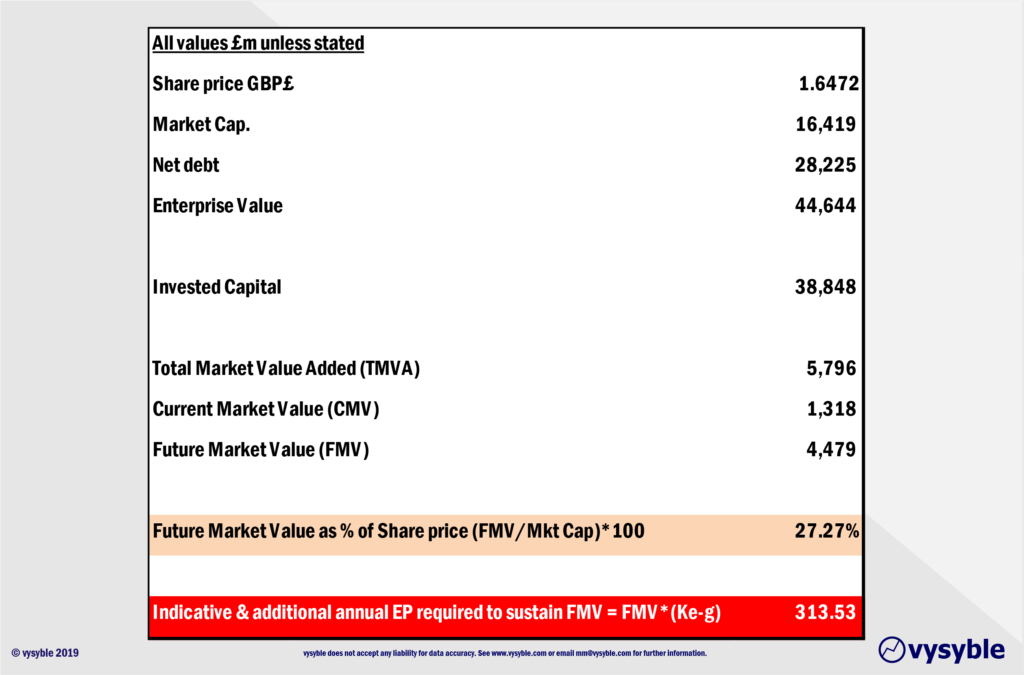

The FMV model calculations for BT are as follows:

The FMV model calculations demonstrate that the expectation of the capital markets is one of future growth with £0.44 of the £1.647 share price ie 27.27%, based upon a future performance which demands an additional £313m of economic profit on top of the latest rolling 3-year average of £92m.

Given the company’s diminishing economic profit performance over the most recent three years, it could be argued that the capital markets have got the measure of the business and have adjusted expectations accordingly.

However, if expectations are not met then it is entirely conceivable that the share price could drop further to around £1.20 ie £1.64 – £0.44, thus reflecting the adjustment in outlook as a result.

If you would like to know more about the application of the Future Market Value model to the world’s largest 15 Pharmaceutical companies by revenue, please complete the contact form on the home page.