Column – Prof. John Barbour

The thoughts and views of Professor John Barbour of the University of Strathclyde Business School.

4th November 2019

Not many people driving a BMW automobile would necessarily appreciate that the distinctive blue and white “propeller livery” is indeed a homage to the colours of the state flag of Bavaria. Furthermore, perhaps even fewer people would realise that “BMW” is short for Bayerische Motoren Werke, a company established during the first world war that specialised in the production and manufacture of engines.

At the end of World War Two the very existence of the company was threatened – its principal factory at Eisenach was under Soviet occupation and it wasn’t until the 1960s that the company started to prosper when a powerful shareholder, Herbert Quandt, directed the company towards the market which successfully leveraged its capabilities – “premium saloon cars.” These days the company is active in two distinct product ranges; cars and motorcycles and it is widely regarded as the embodiment of German “high-end” manufacturing supremacy

“A value-based” perspective?

Indeed, we were heartened to read that BMW tries to be a value-based business. In its 2018 annual report we read that:

“The business management system applied by the BMW Group follows a value-based approach that focuses on profitability, consistent growth, value enhancement for capital providers and job security. Capital is considered to be employed profitably when the amount of profit generated sustainably exceeds the cost of equity and debt capital. In this way, the desired degree of corporate autonomy is also secured in the long term”.

They also reassure us that in 2018 they:

- Posted “record sales for the eighth consecutive year” as well as

- Delivering “Group earnings before tax and annual net profit were both the second-highest in our history” and also

- Paying out the “the second-highest dividend the company has ever paid in its history”.

So given all that, how has the business performed for shareholders?

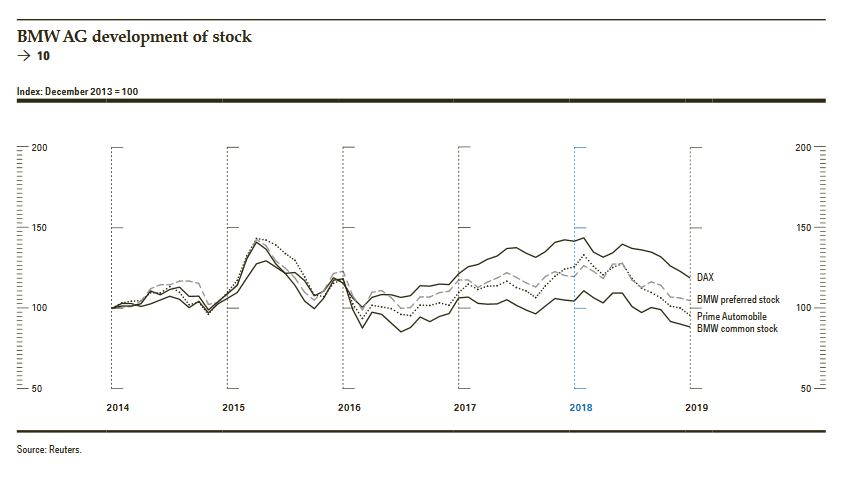

Not particularly well…the Common Stock is worth less in 2019 than it was in 2014. It has underperformed both the DAX and the Prime Automobile segment by a large degree.

So why does the company produce such inferior returns on the Stock Market? As usual, we have to look below the surface to understand the real situation.

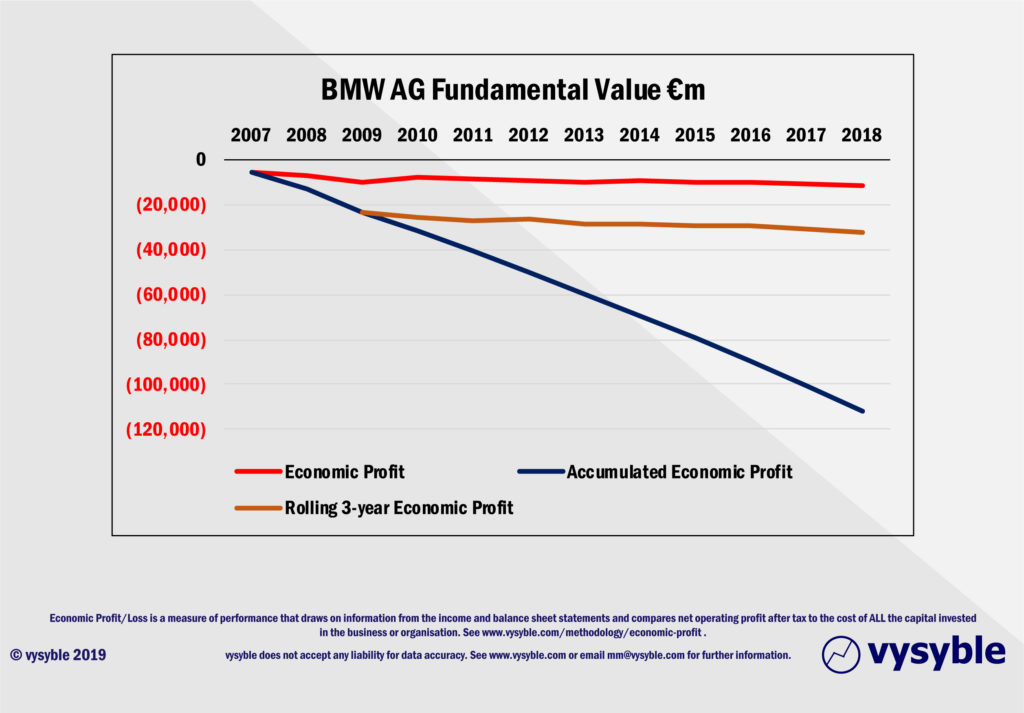

Here is the economic performance of BMW over time:

We have used use the company’s stated WACC (weighted average cost of capital) of 12% in 2018 and 2017 (a rate that seems very high by our calculations); and in each earlier year.

What we see is that the company has failed to deliver an annual positive Economic Profit (NOPAT less a charge for all the capital used by the business) in each of the past 12 years. If we add up the cumulative economic losses since 2007, we discover that the business has destroyed a staggering €106bn of Fundamental Value.

Note that the way we calculate Fundamental Value uses Book Equity thereby excluding the so-called vagaries of the Stock Market.

So, when viewed through this lens, we see why the share price has been depressed.

Value Drivers

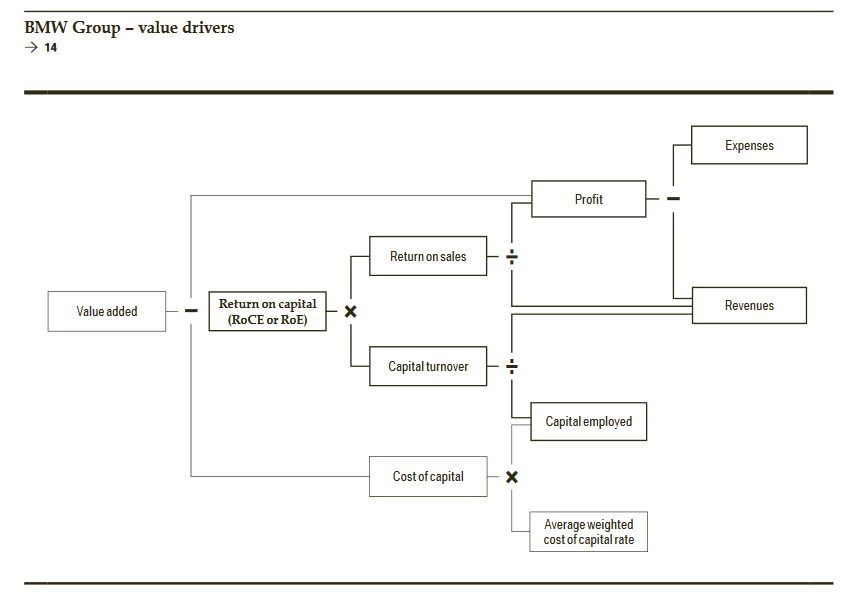

We were encouraged to see BMW taking a view of what it calls “value drivers”:

The above schematic is fine as a calculation of value added; but not as an articulation of “value drivers.” For some reason, the board of directors has failed to include growth as a value driver. This prompts some questions…

- Do the directors think that maximising ROCE is the same thing as maximising value?

- What if the push to raise ROCE caused a huge drop in volumes and revenues? Would that be a good idea?

They then disappoint us further by declaring:

- ”Due to the high level of aggregation, it is impractical to manage the business on the basis of value added. This key indicator therefore only serves for reporting purpose”

This is something that we do not accept at all. It may be hard to do well but failing to do it leaves the business strategically blind. This does not seem to be a good trade-off.

The water gets muddied further when they reassure us that:

“Strategic management and quantification of financial implications for long-term corporate planning are performed primarily at Group level. The key performance indicators are Group profit before tax and the size of the Group’s workforce at the year-end”

They then write at length about:

- Their use of ROCE (and their target for the Automotive Sector is 26%, for some reason)

- Their definition of Capital Employed

- Value Added

- Value-based Project Management

- EBIT margins

- Their strategy NUMBER ONE > NEXT” (an enigmatic title if there ever was one)

- And a slew of similar topics

It seems to me that BMW might well be confusing measuring value with managing value.

Let us remember that whatever the board is doing it isn’t working particularly well; either for shareholders or for the Fundamental Value of the business

So, good marks to BMW for trying; but poor marks for not getting it quite right. On current course and speed the company is unlikely to be the ultimate driving machine for anyone’s pension fund…