25th November 2017

For several weeks, if not months, the future of Newcastle United has been the subject of huge conjecture across the media, within the city and the football world. Given that one of us is a Newcastle United fan, this time and rather unusually, it is not due to the immediate prospects of the team or whether Rafa Benitez is likely to stay for period long enough to build a team to rival Real Madrid. No, this time it is whether the club will be sold and if so for what price and more importantly for the fans, how much will Mr Benitez receive to build the team following the successful conclusion of an acquisition.

In The Guardian (21st November 2017 – “Ashley seeks improvement in Staveley’s near £300m bid for Newcastle United”- Louise Taylor), it was reported that Mr Ashley “had hoped to a make a greater profit by selling for a sum somewhat closer to £400m”. In a further development Jason Mellor, writing in The Daily Star (22nd November 2017), reports that Mr Ashley is seeking closer to £350m. So the “value” between the various parties seems to be between £290m at the lower end and £400m at the upper end of proceedings.

Valuation

As is so often the case, there has been no shortage of advice with regards to how a football club should be valued. One commentator from a UK university business school recently sought to value Newcastle United based on the price paid for a stake in Southampton FC – a club with a very different profile, fan-base, economic track record, marketing potential and so on. Indeed, such an approach is a “relative valuation” – unfortunately a very common position yet it is the intellectual equivalent of valuing a pair of “hand-made Jermyn Street shoes” on the same basis as a pair of ‘wellies’. It is an all-too-relaxed view but perhaps it is easier than actually having to think, consider and find answers to the inevitable trade-offs that come with such a transaction.

There are two broad approaches to valuation:

- The business is worth what someone will pay for it

- Used in the main by investment bankers and other analysts to estimate the potential price of an asset by examining the pricing of “comparable” assets relative to a common variable such as earnings, cash flows, book value, sales, etc

- Uses P/E and other heuristics “rules of thumb” to “value” (figure out what someone might pay for) the business

- Says little or nothing about what the intrinsic value of the business is

- The business is worth the present value of its future cash flows

- The “Investor” perspective

- “Fundamental” or “Intrinsic” value

The uses and misuses of relative valuation (“heuristic” valuation)

Prices are, in effect, “standardized” by using a common variable such as earnings, cash flows, book value or revenues, eg:

Earnings Multiples:

- Price/Earnings Ratio (PE) and variants

- Value/EBIT

- Value/EBITDA

- Value/Cash Flow

Book Value Multiples:

- Price/Book Value(of Equity) (PBV)

- Value/ Book Value of Assets

- Value/Replacement Cost (Tobin’s Q)

Revenue multiples:

- Price/Sales per Share (PS)

- Value/Sales

Industry Specific multiples:

- Price/subscriber, etc

Relative valuations might give some idea of “what similar businesses or assets are selling for.” However, because they are incomplete measures of performance, there is a danger that they tell us little about “what the asset or business is worth.”

Thus;

Belief: Price-Earnings Multiples determine value

Reality: Price-Earnings Multiples are a function of value

Arguably the investment community’s favourite valuation metric is the price-earnings (P/E) multiple. A measure of what investors will pay for a share, the multiple equals the stock price (P) divided by a company’s earnings (E).

Investors incorporate it in a deceptively simple valuation formula:

Shareholder value per share = (earnings per share (EPS)) x (P/E).

Since we know last year’s EPS or next year’s consensus EPS estimate, we need only to determine the appropriate P/E. However, since we have the denominator (earnings or E), the only unknown is the appropriate share price, or P. Therefore, we are left with a useless tautology: to estimate value, we require an estimate of value. This flawed logic underscores the fundamental point: the price earnings multiple does not determine value; rather, it derives from value. It is an economic cul-de-sac.

Not wishing to labour a point, one can get to the same answer by the following:

Price = Age of the CEO multiplied by Price divided by Age of the CEO

OR

Price = Number of potted plants in reception multiplied by Price divided by number of potted plants in reception

It would be wrong to draw the conclusion that waiting for the CEO to grow older or putting more potted plants in reception will lead to a higher share price, wouldn’t it?

The business is worth the present value of its future cash flow

Aswath Damodaran, Professor of Finance at the Stern School of Business at New York University (Kerschner Family Chair in Finance Education) states:

“The value of any asset is a function of the cash flows generated by that asset, the life of the asset, the expected growth in the cash flows and the riskiness associated with the cash flows”

Value Creation and Enhancement: Back to the Future – 1999

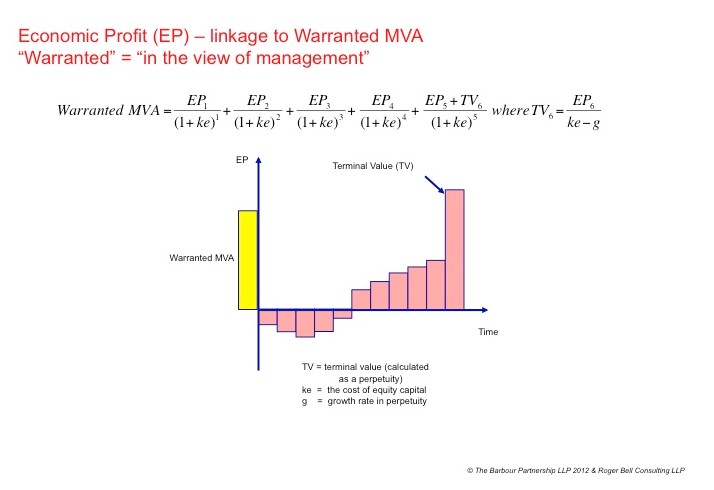

This is the basis of a fundamental cash flow approach to valuation. However, regular readers of our material will know that for a variety of reasons, most notably the inclusion of all of the costs of doing business, that the application of economic profit is fundamental to our research. It is perfectly consistent with the above quote from Damodaran to use forecasted economic profit to establish a business valuation for the reasons outlined below:

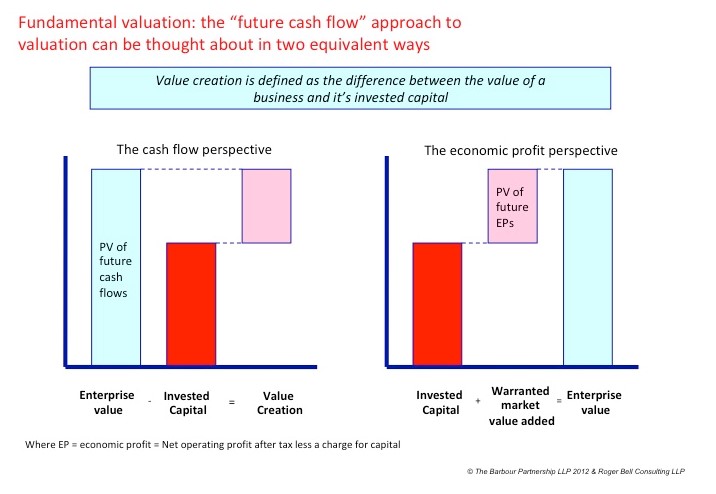

In other words, the Enterprise Value of an organisation is the present value of its future cash flows. Enterprise Value is also equivalent to Invested Capital plus the present value of the future stream of economic profit. Therefore, the present value of future cash flows = Invested Capital plus the future stream of economic profit (often known or referred to as the “warranted market value added”) – see below:

For those who want to read even more on this subject, the paper “Valuing Companies by Cash Flow Discounting: Ten Methods and Nine Theories,” by Pablo Fernandez (IESE Business School, University of Navarra), is both excellent and worthy of further investigation.

The Economic Performance of Newcastle United FC

So if we are going to prepare a valuation based on the forecast economic performance of Newcastle United – it might be a good idea to place on record the club’s recent performance.

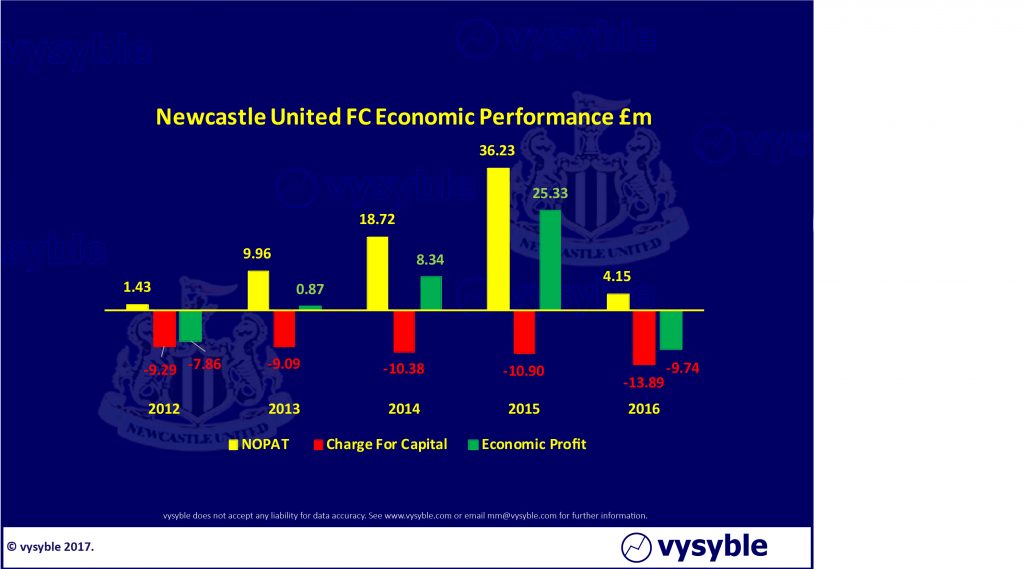

Newcastle United’s Economic Performance 2012-2016 (latest accounts). In three out of the most recent five years of accounts, the club has produced an economic surplus. The accumulated EP over the period is £16.9m ie an average of £3.38m per year. Over the last three years it is an average of £7.98m. NOPAT = Net Operating Profit After Tax (not No, Pet…).

From our work on the rest of the Premier League, the above track record is pretty good. Most clubs within the Premier League fail to produce any kind of economic surplus – in fact across all of the clubs within the Premier League going back to 2009 there is only a one in four chance of a club producing a positive economic return. In the last five years, Newcastle United have produced a positive return on three occasions.

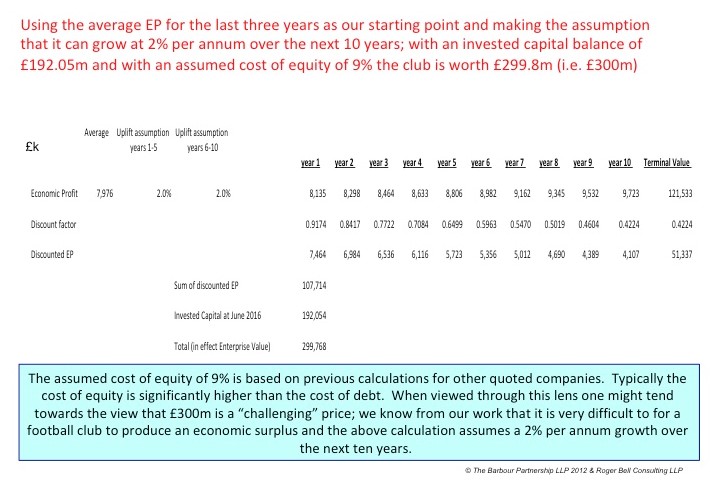

How much does economic profit have to grow to justify a purchase price of £300m (purchase price in this instance being the equity and the debt)?

At this point, we need to be very clear – we have not seen the latest numbers for the club. We are using the latest published annual accounts dated 30th June 2016, although it is highly likely that the economic performance declined in the year to 30th June 2017 as the club was relegated to the Championship. Clearly, any entity that conducts due diligence on the club will have access to the latest and unpublished accounts.

We are trying to prepare a fundamental valuation of club over the next 10 years, which we will discount back (pounds in the future are worth less than pounds now) at an assumed cost of equity.

Our assumptions are;

- Invested Capital – £192.05m (drawn from the annual accounts dated 30th June 2016)

- Average EP over the last three years – £7.98m

- Assumed cost of equity (Ke) = 9%

- Growth in EP; year 1 to year 5 = 2% per annum

- Growth in EP; year 6 to year 10 = 2% per annum

- Growth factor in terminal value = 1% per annum

The terminal value is designed to take account of any wealth or value creation, which might occur beyond the analysis period, in this case after the 10th year.

How much does economic profit have to grow to justify a valuation of £400m?

Our assumptions are;

- Invested Capital – £192.05m (drawn from the annual accounts dated 30th June 2016)

- Average EP over the last three years – £7.98m

- Assumed cost of equity (Ke) = 9%

- Growth in EP; year 1 to year 5 = 10% per annum

- Growth in EP; year 6 to year 10 = 10% per annum

- Growth factor in terminal value = 2% per annum

Incorporating those assumptions into our model produces an enterprise value of £400.8m.

Therefore, to reach a valuation of £400m, the growth in EP over the years 1 through to 10 has to be 5 times greater than the £300m valuation and the terminal value growth assumption has to be twice that of the £300m calculation.

We will leave the reader to decide whether the assumptions underpinning a £400m valuation are “achievable.”

For those fans who believe that the club can afford a £100m “transfer spree” in January – there is this sobering thought. The club’s cost of capital is probably around 7.5% and if the club was to spend £100m the incremental capital charge would be £7.5m – given that the average EP over the last three years is £7.98m – the capital charge together with the inevitable increase in wages would almost certainly push the club into negative economic territory.

Conclusion

In general, analysts use simplistic and inferior multiple-based methods (“easier than thinking”)

Stock valuation methodologies tend to fall into one of three categories:

- Earnings or cash flow multiples including: price-to-earnings ratios; relative price-to-earnings ratios where the benchmark is other firms in the industry; earnings before interest, tax, depreciation, and amortisation (EBITDA) multiples; and revenue multiples

- Asset multiples, which are often market-to-book ratios, where “book” refers to either equity (i.e., net asset) book value or total asset book value

- Multi-period DCF models typically use projected free cash flows, or economic profits, which are derived from comprehensive financial forecasts of firm performance along with estimated discount rates.

Analysts tend to use methodologies 1 and 2 outlined above – these are relative valuations.

No doubt there will be some who will say that “City Analysts” are correct but we are reminded of the quote from the great sage of Omaha, Warren Buffet;

From our perspective, what the above tells us is that a £300m acquisition price for Newcastle United is certainly a stretch but it can just about be defended when viewed through an optimistic lens. At £400m, the assumptions used to justify such a commitment are bordering on the incredible whereby EP has to grow at a rate 5 times greater than the EP assumption underpinning the £300m price tag. Furthermore, this particular line of thought seems to be based on an in-going assumption that there is an “investor premium” involved when acquiring a Premier League football club.

Finally, another health warning – we are using numbers relating to June 2016 and we have not had sight of the latest financial information – until this information becomes available we are loathe to produce a “fair value” assessment of what we would be prepared to pay (assuming that we had the money) for the great club that is Newcastle United FC.

vysyble