5th July 2019

Knives out for boss who “nearly sank” Tesco

Over the weekend Oliver Shah of “The Sunday Times” published an interview with Lord McLaurin, the former Chairman of Tesco, during which he was highly critical of Terry Leahy who is seen by many as the most successful Tesco CEO of them all.

“Terry did a very good job for the first four or five years, and I was very pleased about that, but I think towards the end things went haywire,” MacLaurin, 82, told The Sunday Times.

“The board sort of went to pieces a bit, somehow. The whole thing went pear-shaped.”

We have covered the Tesco story previously but it is always worthy of a repeat visit in order to replenish a few essential items. In this instance given Lord McLaurin’s observations, we will remind ourselves of the main points.

As always, central to our work is a financial metric called Economic Profit defined as Net Operating Profit after tax less a charge for all the capital used by the business. We believe in this metric because it remedies the flaw inherent in traditional accounting metrics by including all of the costs of doing business. It is a much more demanding and informative measure of performance particularly when viewed over time.

Our version of the Tesco story goes along these lines:

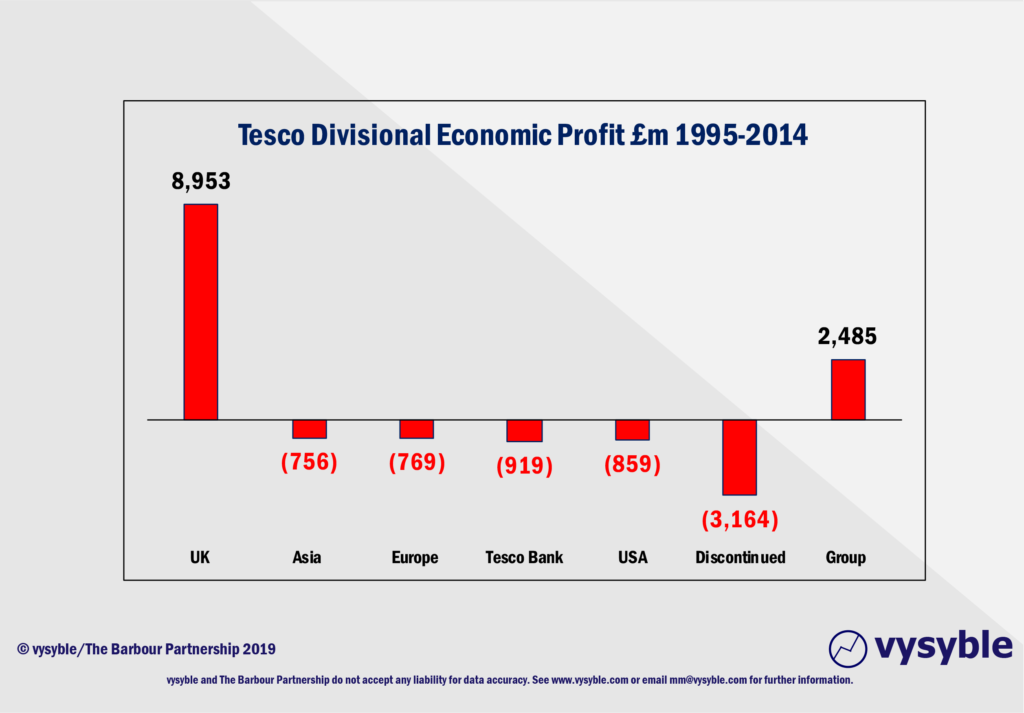

- Tesco under Leahy was hugely successful in creating value from the core UK retail business. Around £9bn in cumulative Economic Profit was generated in 1995 – 2014.

- But they felt they were under great pressure to grow the business.

- Their UK market share in food sales – but not in non-food – was already high. Apparently, it was hard to see how that would offer the required opportunities for growth.

- So, they invested very significant amounts of shareholders money – often over a number of years – in a number of “new” businesses. These included: Asia; Europe; the USA; and the Bank.

- The problem was that all these businesses were and remained economically unprofitable – they could not deliver an acceptable return on the capital that had been invested.

- When we include a very large loss called – rather vaguely – “discontinued” which on its own accounts for over £3bn in cumulative Economic losses in 1995 – 2014 we find that the cumulative Economic Loss from the “new” businesses was £6.5bn

- So, a £9bn success in the UK has been reduced to £2.5bn by the “new” businesses over a 20 year analysis period

- How were these “new” businesses evaluated and justified?

- Who thought they were feasible and acceptable?

- What made them believe that they could eventually be taken into economic profit?

- Why did they hang on for so long before they were jettisoned?

- Leahy leaves in 2010 and the Economic Profit delivered by the Group nosedives as the UK business struggles; the share price goes with it as investor expectations are adjusted.

So how should we view the Leahy era from a shareholder perspective? We think the answer needs to be “successful but ultimately deeply flawed”. He and his team fell into the common trap of focussing far too much on driving the growth of revenue without paying anything like enough attention to the capital needed to fuel that growth. This obsession with growth is spelled out in the Annual Reports of the time.

Suffice to say that the share price on his departure was around 390p. It is now 235p. Some of that drop will be due to the impact of the discounters; although in our view their impact is often exaggerated. But most of it is due to the poor state of the business that his successors inherited.

Can the current Tesco business be fixed? In our experience that will need the Board and the management team to:

- Re-focus the objective of the business to be more on driving returns to shareholders; as well as considering a broader range of stakeholders

- Understand more clearly what drives their share price on the capital markets

- Have better visibility of the where’s and why’s of value creation and destruction in and across their businesses

- Adopt a strategy process that works effectively

- Align management reward more closely with driving returns to shareholders

- Make large investments in developing the “skill and will” to manage the value of the business in their more senior managers

Will this happen? – a “five-year recovery plan” was set out by Dave Lewis in January 2015 when the share price was 209p. It is now 235p. It is not working. The share price on the date of Mr Clarke’s departure back in 2014 was 288p so the current share price is around 20% lower than a level deemed unacceptable 5 years ago.

Interesting times indeed. In the most recent annual results for the year ended Feb 2019, we calculate an economic deficit of £846m. In other words the strategies and tactics of the business have taken £0.85bn of the shareholder’s wealth and given it to other stakeholders.

To be fair, the 2019 result is £112m better than the number for 2018 which achieved an economic loss of £958m. Furthermore, the economic deficit in 2017 was £1,973m bringing the total economic loss for the last three years to £3.8bn.

So, whilst the trend over the last three years is encouraging, without a dramatic improvement in performance we worry that it could be another 5 years (at least) before the business breaks even from an economic perspective.

vysyble and The Barbour Partnership