27th December 2016

Reaching For Sky

As the year draws to a close, one cannot help but feel that the last 12 months so have heralded enormous and profound changes on so many levels. With what seems to be an unusually high cull of cultural icons coupled with a significant and arguably a challenging shift in the political direction of the USA and Europe, the world feels more unpredictable than ever.

Since we began operations some six months ago, we had a good sense that there was a demand for some transparent thinking in regard to industry and company performance. We set about our initial analyses and actually uncovered far more than we anticipated in the world of football and with many of the individual corporate entities within our field of vision. In continuation of this theme, we will publish some disturbing detail about an industry that really has been keeping pundits and observers in the dark with regard to its true financial performance early in the New Year. The implications of what we have found so far will be very revealing indeed.

During our time earlier this month on TalkSPORT, we discussed our findings regarding the fragile financial dynamic that currently exists in football. The tweets and messages from listeners were telling. They all wanted to know whether or not their club was solvent or spending too much money. What they did not know was the typical story of their clubs’ reliance on TV money and the effect that a negative change to that revenue stream could have on the overall wellbeing of football in general. As we said at the time and in our report, the effects will not just be national or international but very much local too whereby a cut in revenue at the upper levels cascades very quickly down through the system to the lowest levels. This dependency relies on the broadcasters who, we might add, are currently suffering declining audience numbers, pirate transmissions of games and shrinking advertising revenues.

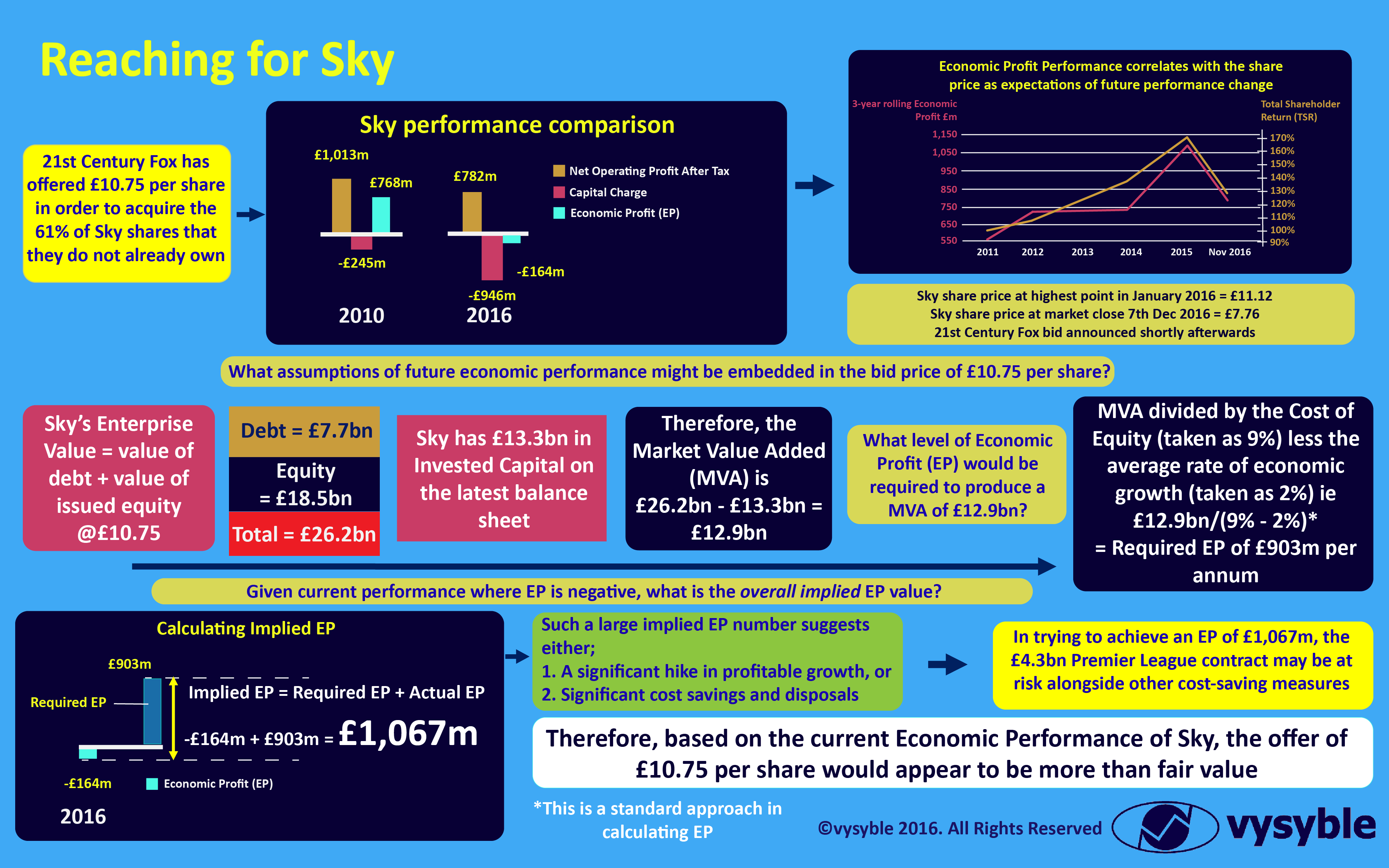

And so we come to Sky – the target of Rupert Murdoch’s 21st Century Fox media business which already owns 39% but would clearly like the other 61% too. This bid is a re-run of an earlier attempt in 2011 which was withdrawn due mainly to regulatory concerns and the fallout from the phone hacking scandal. This time around the political environment has changed and feels to be less concerned with the bid’s ramifications in terms of UK media dominance although governments do have a habit of changing their minds when it comes to the media. Some commentators have observed that the bid is necessary to enable Sky and its potential new parent to succeed in Europe. Maybe so. Certainly there is some pain in the current set-up on both sides as 21st Century Fox spent $250m on redundancies earlier this year whilst it is rumoured that Sky are targeting redundancies of 40% in some departments within the UK operation. Football, it would seem, comes at a price (or £4.3bn over 3 years) that for some is sadly very high indeed.

The share offer is set at £10.75. Here is our take on proceedings;

Finding £1,067m is, in our opinion, a tall order. Given current operational practice, cost-savings would appear to be the order of the day although the subscriptions uptake expected in Germany and Italy is starting to trickle through. Whether or not this is counter-balanced by the increasing churn rate of customers in the UK and Ireland remains to be seen. Indeed, if the bid is successful, is the net result going to be a tactical retreat from English football or will a revamped and rebadged Sky get back some of its old swagger and deliver newer and more innovative ways of consuming the national game once again? Our calculations indicate that the status quo cannot continue especially as the charge for capital is being driven sharply upwards by increasing assets and asset values (from £3.2bn in 2010 to £13.3bn in 2016) on the balance sheet. Eventually the Economic Loss will become overwhelming unless steps are taken to address it and reducing costs does seem to be the way forward for now.

We at vysyble suspect that the bid will be passed. How the enlarged business deals with the likes of Amazon, Netflix et al is the key to whether or not it will ultimately succeed on the global stage.

So, 2016 draws to a close. It is said that there is a global effort to keep Michael Stipe alive at all costs, otherwise it really will be the end of the world as we know it.

Happy New Year.

vysyble