19th March 2019

We discovered a few years ago that there are three certainties in life rather than the traditionally accepted two. They are death, taxes and a pathological dismissal (or fear) of the economic profit (value creation) concept. And yet we are able to quote success stories with the application of this ‘financial witchcraft’ in such organisations as Coca-Cola, Cadbury Schweppes, Gillette, Lloyds Bank amongst others.

What do we mean by value creation?

The guiding principle of value creation is a remarkably straightforward construct: companies that generate a return on capital which exceeds the cost of that capital, create value.

Given this principle, developed by the great economist Alfred Marshall (Principles of Economics – New York, Macmillan, 1890) and building upon the work of Adam Smith, it remains as relevant today as it did when it was first published nearly 130 years ago. Furthermore, when CEOs, Boards, Investors, advisors and indeed Governments tend to forget about it, the results have often been nothing short of calamitous for shareholders, employees and other stakeholders – the 2008 Banking Crash, the rise of conglomerates in the late 1960s and 70s and the “internet bubble” are good examples.

The problem with “accounting” earnings

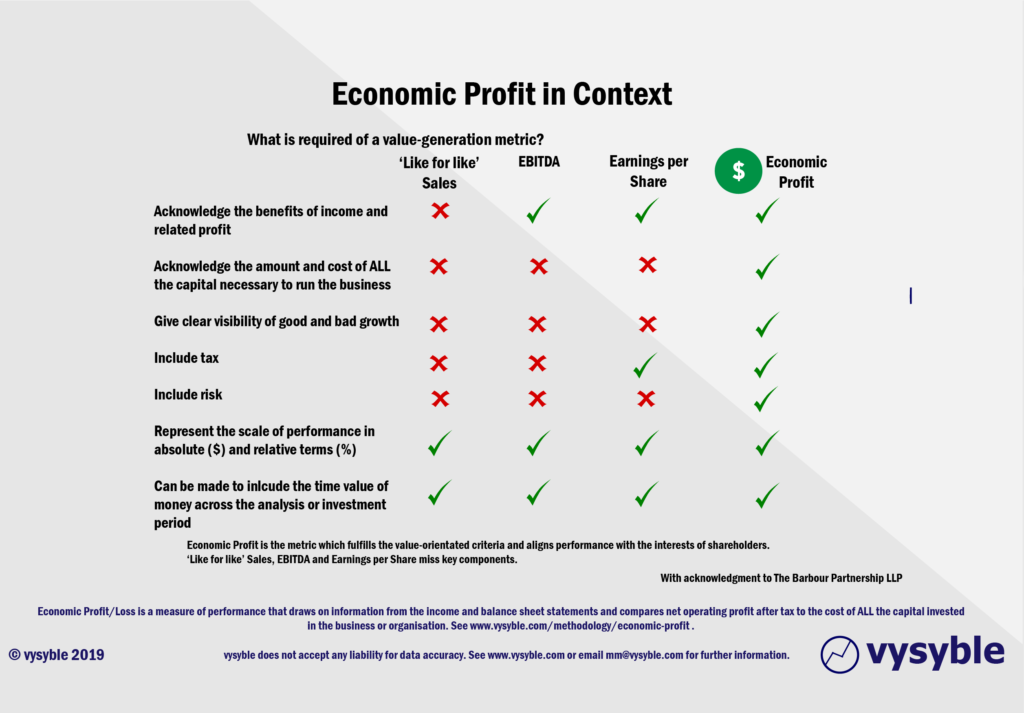

In today’s world, many managers are taught to use accounting earnings or some variant thereof eg EBIT (Earnings before Interest and Tax), in order to measure business performance. Marshall’s great and simple tenet tends to get lost in this subset of benchmarking where the parts are more important than the whole. Why? Because earnings metrics suffer from the following deficiencies:

- Earnings / earnings per share is an “incomplete” measure of performance – it does not include any element for the amount and cost of all of the capital needed to run and grow the business

- It is not a measure of cash flow. Earnings last year or next year tells us very little indeed about the cash flows that the business will deliver or needs to deliver in the future

- It contains nothing about how risky earnings are, either now or in the future

- It says nothing about the need for or role of intangible assets which are an increasingly important ingredient in many companies

- It is easily manipulated or distorted using perfectly legal accounting conventions

- It gives a poor signal between good growth, which advances the wealth of the organisation and bad growth, which despite producing a positive outcome is nevertheless lower than the (“unaccounted”) cost of equity capital and hence destroys value.

Marshall and execution

Thus “accounting” earnings metrics do not comply with Alfred Marshall’s definition of value creation and hence decisions made using such metrics are in grave danger of giving managers the wrong signal when considering strategic alternatives and trade-offs. All too often, once their strategies fail to produce the returns anticipated, Boards and Management teams quickly turn to the cult of execution – “our strategy is right it is just that we need greater focus on execution” is a frequently heard mantra.

Recognising the importance of strategy delivery and the need for executives with the “skill and will” for strategic execution, we remain firmly of the view that an incorrect assessment of the organisation’s competitive / economic position is the most likely cause of the subsequent strategy failing to deliver.

Essentially the basic issue or problem with using accounting data for complex strategic decision-making is that the information is incomplete (see above) and is commonly not in sufficient detail in the right areas from which to build out value-creating strategies. Consequently it tends to lead managers towards the belief that “ALL GROWTH IS GOOD” which, if applied to the wrong area of the business, might actually accelerate value destruction.

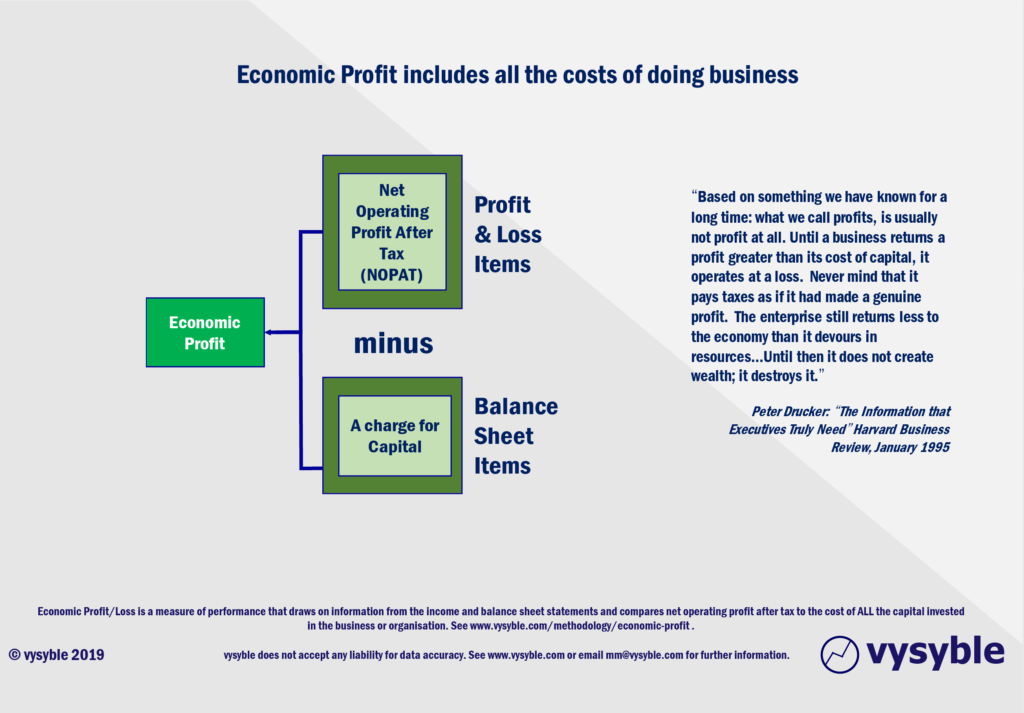

An economic return

In considering this backdrop and also realising the need for a firmer grip on value creation and destruction, many organisations have adopted a value-based perspective for their strategy deliberations – central to which is the use of economic profit defined as net operating profit after tax less a charge for all of the capital used by the business. Many companies have produced staggering returns for shareholders including Coca-Cola under Roberto Goizueta and Lloyds Bank under Brian Pitman.

“When you start charging people for their cost of capital, all sorts of good things happen.”

Roberto Goizueta – CEO of Coca-Cola between 1980 and 1997

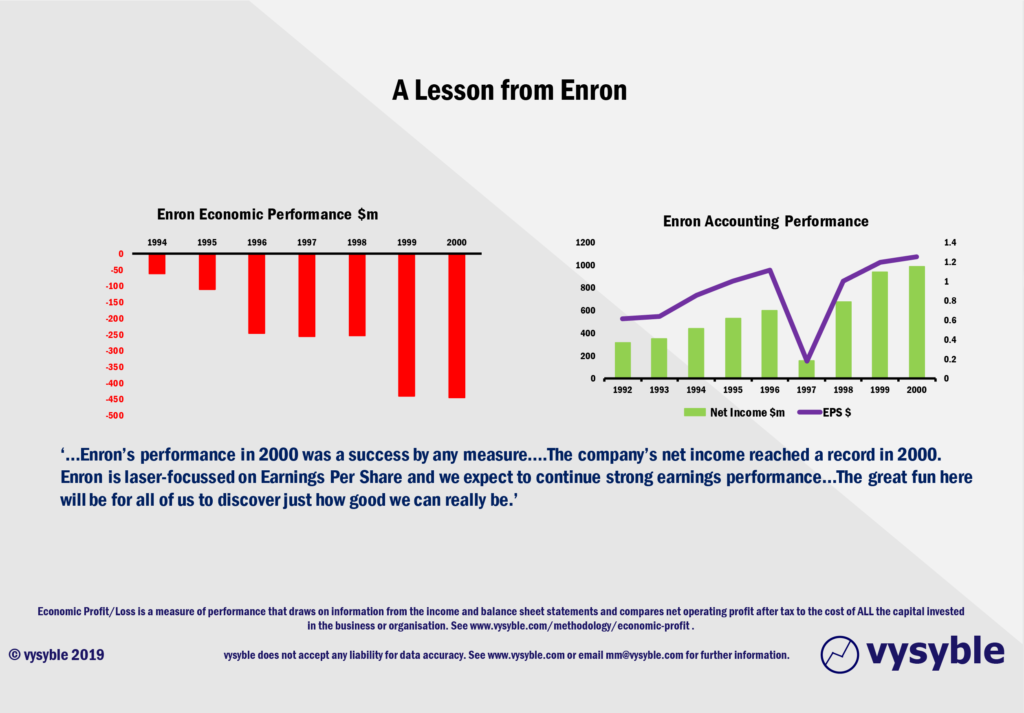

Unlike any other business metric, economic profit combines three things; the profit and loss account (NOPAT), the balance sheet (to calculate Invested Capital and from that the capital charge) and an external capital market measure, all in one number. It differs from accounting profit because it includes an expense for the required return of shareholder’s capital and consequently has a superior strategy signalling attribute – see below the example from Enron…

Numerous factors were behind Enron’s eventual collapse, although having a governing objective (earnings per share) so misaligned with value creation was undoubtedly a major factor.

The left-hand diagram highlighted above includes all of the costs of doing business – the right-hand diagram does not. The evidence and differences between them is easy to see.

Perhaps Enron’s board of directors would have adopted a different set of strategic decisions if it had seen the left-hand diagram rather than the right-hand version which in turn might lead one to believe that all growth is good which is not the case.

From a comparative standpoint, the attributes of the various measures are listed below;

It is clear to see that the economic profit concept is founded on sound and quite grounded principles. It also draws upon the work of two Nobel prize-winning economists – Mondigliani and Miller – and their extensive deliberations cocerning corporate capital structures. So, to have the economic profit concept dismissed as ‘nonsense’ on Twitter by a football finance academic and ‘expert’ did raise our eyebrows by a few millimetres.

Indeed, our expert went on to state that we appear to have something of an obsession with the economic profit measure. We’ll take that as a compliment.

We are firmly of the view that British business would be significantly more competitive in world markets if other captains of industry, not to mention advisors, consultants and educators took a similar perspective to that of our own. There is only one business school in the UK at the University of Strathclyde (led by Professor John Barbour) that has a value-based strategy course firmly established within its syllabus (and which is frequently over-subscribed). From a ‘UK PLC’ perspective this cannot be the value-maximising way forward.

Indeed, it is not uncommon for CEO and Finance Directors to fall into an initial state of denial and disbelief followed by apoplexy when first confronted by their own economic profit numbers – particularly when divisional and geographic perspectives are included. Eventually the good ones come around to our way of thinking and want to understand more as they increasingly appreciate the power of the insights from taking an economic perspective and the potential future impact to their respective businesses.

Industry dynamics

So when it comes to looking into industry-level dynamics we usually find that our observations and insights turn out to be both prescient and correct.

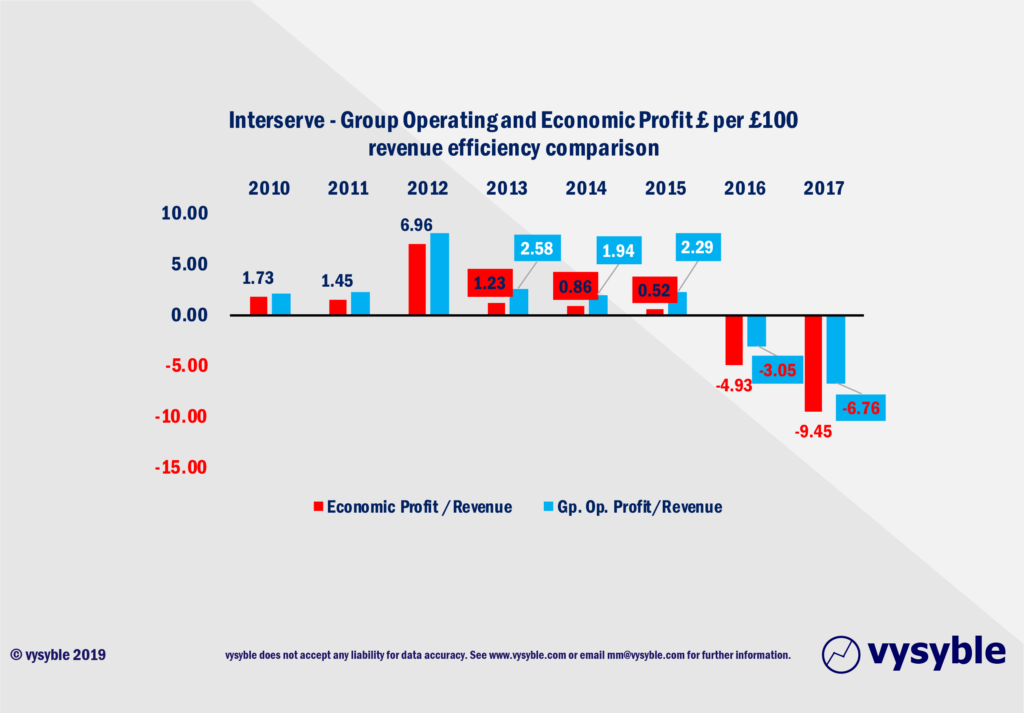

For example, the demise of Carillion and the exceptionally challenging position of Interserve might have been identified by management some 5-7 years prior if the economic profit measure signal had been both appreciated and used as a basis for strategy development. Indeed our own indexing capabilities clearly show a decline in the ability to convert revenue into economic profits with an ongoing downward signal for both companies between 2012-15 and beyond. The “incomplete” earnings-based measures such as Operating Profit, EBIT etc incline us to the view that everything was fine. As time has gone on to prove, this was a grossly incorrect perspective.

Group Operating Profit measures between 2013 -15 remained relatively stable as the economic profit measures clearly highlight the decline in underlying performance.

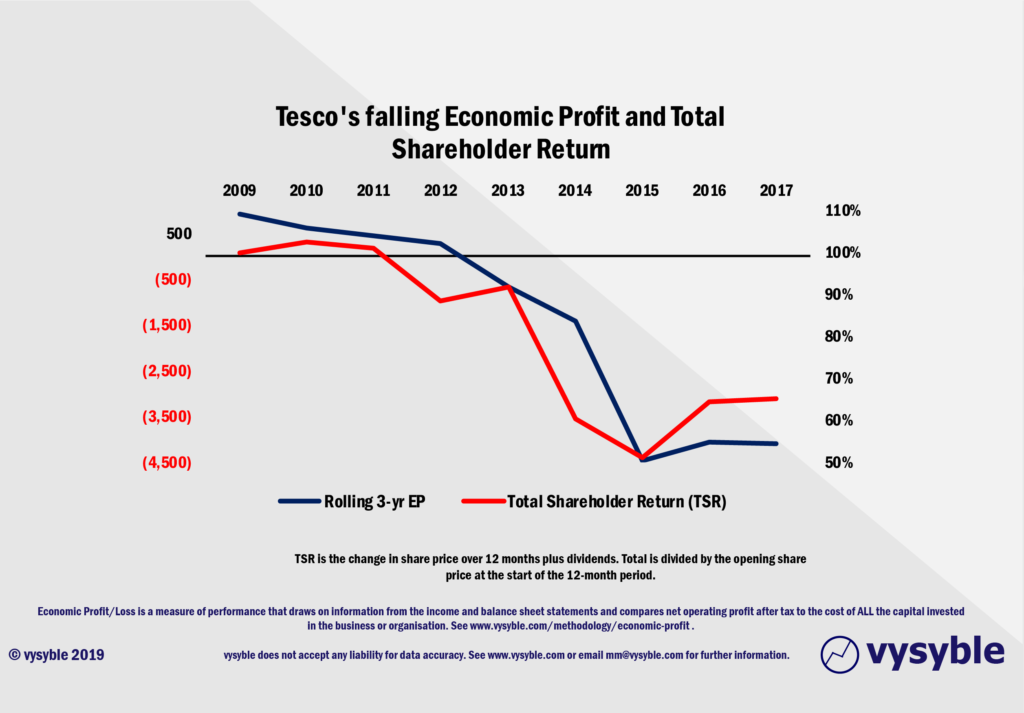

Both companies are not isolated cases. We frequently see the economic profit trend highlighting difficulties in corporate health well before the earnings-based measures pick it up, which is usually too late to prevent a serious reversal in performance or share price, as was the case with Tesco.

The above diagram shows Tesco’s economic performance in decine from 2009. Interestingly, the share price trajectory and the economic performance of the company are not exactly strange bedfellows. The prevailing media narrative in 2014 held that Tesco’s position was directly threatened by the UK expansion of both Aldi and Lidl. Our own work strongly suggests that Tesco’s non-UK and non-supermarket activities were acting as a significant break on the company’s economic output and that the decline in performance started at least 5 years prior to the emergence in earnest of the German retailing giants within the UK.

The price of energy

Have you ever wondered why your energy bills are increasing at a faster rate than the cost throughput from the wholesale energy markets? It is due to the massive erosion in value as a result of an insatiable demand for capital as the energy companies try to decommission and replace ageing power plants.

The 2015-16 combined economic losses run to over £72m per day – that’s approx. £26bn per year – for the Big 6 energy companies. Indeed, our efforts in highlighting just how bad the situation was resulted in the presentation of our economic profit data to a Parliamentary select committee by Dr Philip Lee MP in 2013 and used to directly question the economic performance of the Big 6 energy companies.

We forewarned the industry that things were going to get a lot worse unless it and the Government took remedial action. Once again, as we all cope with our increasingly costly energy bills a few years down the line, we have sadly been proven to be correct with shareholders of the “Big Six” having suffered appalling returns (since 2013) on their investments.

A video of the select committee session can be found here.

Therefore, at this point we can confidently conclude that economic profit is hardly the stuff of ‘nonsense’.

Football

And so we come to football. The beautiful game that does not create value and yet people wonder why?

By way of background, we first examined the world of football in late 2016 simply because as fans of the game we wanted to see exactly what was going on from an economic profit perspective. Yes, there are a number of experts that will report the balance sheet performance on a club-by-club basis, discuss the effects of increasing/decreasing amortisation and highlight the cash-generative capabilities of certain clubs using EBITDA and other measures.

However, in a general sense that is as far as it goes. In our consultative work we take a much more investigative role in proceedings. We look for outliers and imbalances in financial operations and we seek trends and signals using indices that enable a fair benchmarking of performance. From our observations we are able to develop insight and commentary using the most transparent and demanding of financial measures i.e. economic profit.

As with the Enron example outlined above (although not as catastrophic – just yet), we have found a number of underlying trends conveniently masked by pre-tax and other earnings-based measures. We have got closer to the true cost and investment by some very rich individuals (and countries…) into their respective football clubs and we believe we have established a direct relationship between “economic profit efficiency” and relegation from the Premier League. We have demonstrated the increasing usage and cost of capital in promotion out of the Championship and we have clearly demonstrated the failings of Financial Fair Play schemes.

Short of ideas?

The European Super League is often quoted as a concept based on greed. However the reality that we observe is that it is one of necessity given the losses of the Premier League Top 5 (Spurs are generally economically neutral). This has escaped many a commentator, pundit and ‘expert’.

So our investigative process usually brings us towards developing ideas and solutions. Our previous blog (Financial Fair Play – Guilty as Charged?) looked at the failings of such schemes and offered up a number of ideas in terms of an alternative ruleset to ensure the future financial security of football.

We do keep a reasonably close eye on media content within our areas of interest. We do not see that many articles suggesting a new way forward or offering an alternative pathway to prosperity for the footballing community. Of course, we do miss a lot of the academic output, but on the other hand, papers of note tend to get good coverage in the wider media. But perhaps that’s our point. It is as if the status quo, as bad as it is, is almost universally accepted.

Seemingly, one of the more contentious ideas put forward by us is the notion that clubs should be economically profitable. ‘Not so’, says the expert. ‘Clubs exist not to make money…’ Ah, this is not the first time that we’ve been subjected to this particular viewpoint. What, then, is an acceptable loss and how is that loss going to be defined? On this our “critics” offer no credible perspective or way forward.

We are sure that the supporters of Aston Villa, Blackburn Rovers, Bolton Wanderers, Charlton Athletic, Oldham, Notts County, Sunderland and many other clubs that have been on the wrong end of the balance sheet will have an opinion. Sadly losses in football, however you may want to define them, are all too common.

It is unavoidably evident that the EFL Championship is a financial basket case but are we the only entity to track the financial carnage of promotion into the Premier League and the effects of a relatively quick relegation (one-third of promoted clubs are relegated after one season, two-thirds after three) on the balance sheet and subsequent club performance? Perhaps we are, but we don’t see anyone else offering ideas or potential solutions to this clearly unsustainable situation.

Indeed, given that clubs are run as limited companies, they are subject to the same legal requirements and financial obligations as any other type of business and as such they are compelled to be run in the same way. So, as it stands there is no special treatment to be found here, yet we advocate for new and specific legislation to be applied to football clubs along with the appointment of an independent Football Regulator who ought to be sufficiently empowered to ensure widespread profitability throughout the game.

Such an arrangement would not create barriers, as the expert infers, but would ensure that clubs survive as they are put on a path towards a firmer financial footing along with the additional aim of eradicating poor and often questionable owner behaviour via regulatory limits.

Frequently, we have written that there is a storm coming in the shape of an alternative pan-regional club competition. It may be a European Super League, a club world cup format or even a revamped Champions League. The big clubs will do well out of it, whatever the outcome. They will do even better if owners can eventually agree on a range of cost control measures and limits as exemplified by that other big $$ sport, American Football. As we have often said, it will be the American influence both at club level and within the media that will dictate the future direction of football – not the local entrepreneur made good – given that a small but influential number have a foot in both sporting camps.

What will be left behind once the European circus has elevated itself away from the national leagues is of more concern. Without lucrative TV deals and robust revenue streams, the lower reaches of the game will suffer until balance sheets (and their respective benefactors) can take no more. This is why simply doing nothing and merely observing is in itself unsustainable.

We have seen too many examples in other industries where leaders and stakeholders have chosen to ignore the true position of their respective businesses with alarming and definite consequences. We see the same trends and the same thread of denial within football. Something needs to happen. The debate needs to start now before it is too late.

Finally, there is Roberto Goizueta, undoubtedly a candidate for the greatest leader of an American company (Coca-Cola), who said;

“Creating economic profit is the single most important driver of the stock price (and hence valuation) of the Coca-Cola company.”

Now that is a worthy obsession.

vysyble