13th October 2020

Well, that escalated quickly, didn’t it?

In our last blog – Game Aid – we discussed the influence of American investors and owners in English football and the likely changes that they would attempt to implement in moving towards a European Super League format. This has been a consistent theme for us since we first looked at football back in 2016.

So, a few days following the publication of our blog we were hit between the eyes with the big reveal of Project Big Picture (or should that be ‘Big Profit’?…) which frankly came as no surprise to us. In fact, many of the major points looked as though Liverpool and Manchester United had been taking notes from our work.

And one of the key aspects that commentators seem to have missed since then is that the owners of Liverpool and Manchester United (and Arsenal) also own sporting franchises in the US where risk is very much reduced and reward is very much more accessible than that found in the generally unprofitable world of English football.

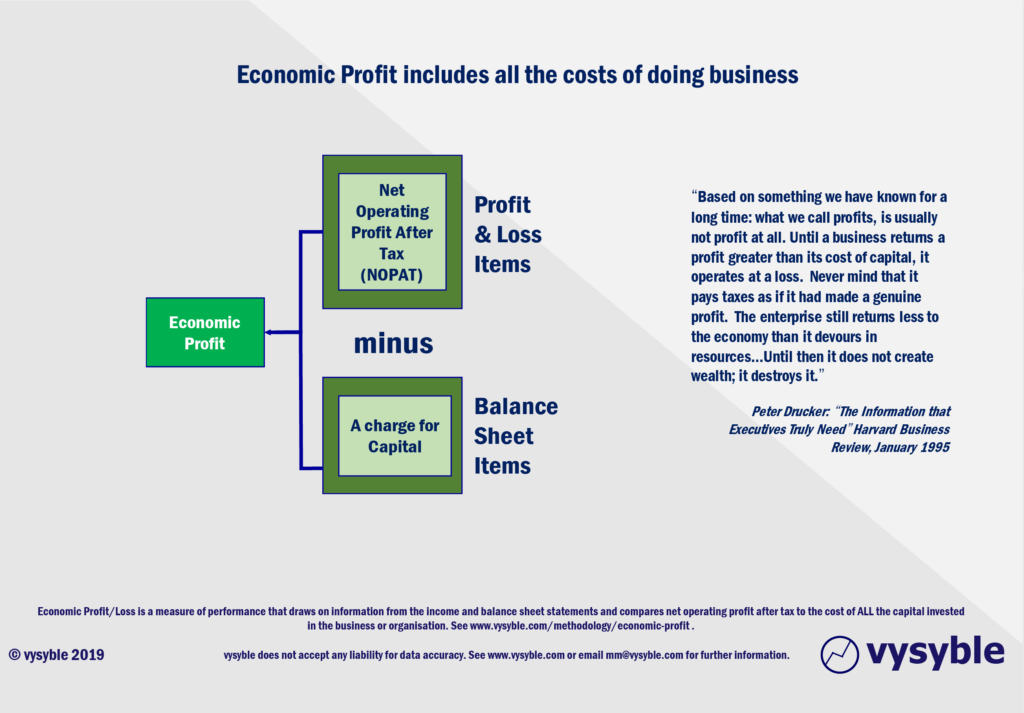

Our own thoughts have always been directed by the outputs from our economic profit calculations. It is significantly more revealing and insightful than the pre-tax data so commonly touted as a measure of accurate business performance.

The economic profit calculation considers the cost of the equity capital that is part-funding the business as well as all other business-related costs. For reasons dating back to the Industrial Revolution, the accounting profession takes the in-going perspective that equity capital is free, hence there is no accommodation or reflection of that obligation within modern day financial accounting statements. In many ways it is akin to determining the household budget but only including part of the mortgage repayment in your calculations.

Football clubs in particular have vast amounts of equity capital sitting within their financial make-up. Converting loans into equity is one of the most common ways of continually funding a club by owners and shareholders. Therefore, it seems both sensible and prudent at least to us to account for the ongoing cost of this equity.

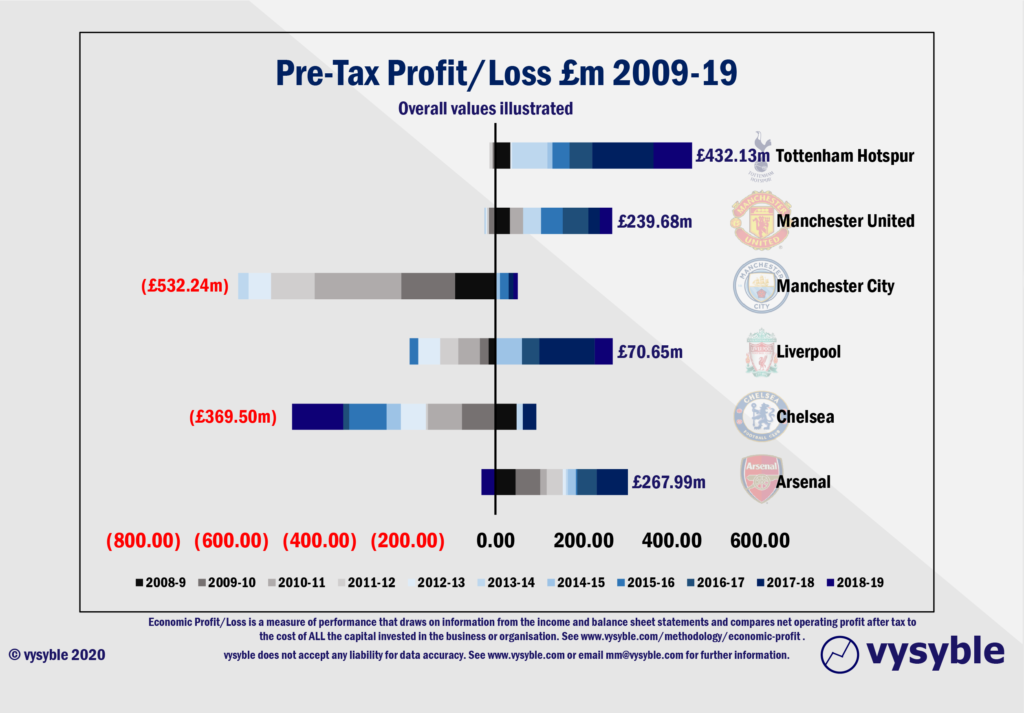

And when viewed through the economic profit and loss lens, the Big 6 come up noticeably short. Between 2009-19, the pre-tax performance of the Big 6 clubs is a marginal profit of £106.7m from a combined revenue of £20.8bn.

That’s a lot of effort to make a profit of half-of-one per cent over 11 years. Indeed, their vast revenues often confuse some commentators who conflate said revenues with value creation. Although revenue and indeed the growth in revenue has been nothing short of impressive, so has the growth in costs over the years.

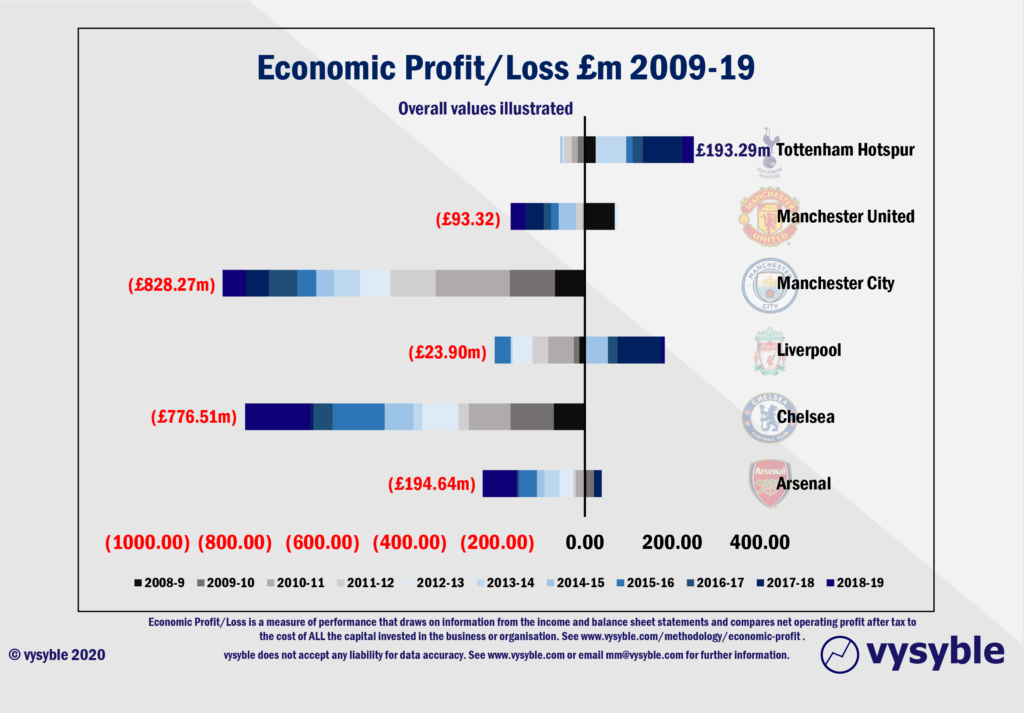

The economic profit and loss performance reveals a much more worrying picture of performance. With taxation and the cost of that all-important equity capital, the economic loss for the Big 6 clubs comes to £1.7bn over the same 11 year period.

The challenge for the Big 6 and indeed all clubs is how to move the business from an economically-challenged position to a positive given that the current Premier League, Champions League and EFL formats do not appear to be delivering returns above the cost of all the capital invested in the businesses.

The simple answer for the Big 6 at least is to change the formats and compete more often in a bigger, more lucrative market. An even better position would be to have greater influence and control over the market where the majority of your current business is conducted and also your future enlarged market. And that is what Project Big Picture is all about.

The other ‘theme’ within Project Big Picture is that it is a strategic plan for increased ‘product’ margins and increased commercial opportunities. Do not be fooled about the sporting aspect because that is way down the list of priorities. It is about business.

And it is a business strategy with an in-going governing objective of maximising profits from a previously unprofitable (or value-destroying) enterprise.

The EFL bailout, the increased share of declining domestic and (likely) international broadcast deals and other monies offered to save and promote the remnants of football are a relatively small price to pay for a reasonably quick exit. The change in voting rights is perhaps a ploy to ensure that the exit can be executed without legal or public recourse.

The future points strongly towards a vastly upgraded Champions League/European Super League format, dominated by US-owned interests (Arsenal, Liverpool, Manchester United, AC Milan, Roma etc). The remains of the Premier League will likely be merged into an EFL-administered local league framework and left to get on with it.

Local broadcast contracts will be much reduced as the media focus pivots towards the new international competition which will no doubt be underpinned by lucrative broadcast contracts from predominantly American companies e.g. Comcast (owners of Sky and NBC), the tech giants Amazon and Facebook, with perhaps Disney’s ESPN somewhere in the mix too.

Relegation will be much reduced or even eliminated (reduction of risk etc) but plenty of international promotion i.e. tours, pre-season mini-tournaments and ‘home’ games played in international locations. Salary caps and financial limits will abound, as will eventually the profits.

We did state that ‘the demise of the Premier League had already started’ back in 2018 as a direct result of the poor economic performance of the clubs and the increasing influence of US owners and their desire to earn regular returns from their investments. Project Big Picture is merely a reflection of this ambition and a stepping stone towards a (more) profitable position.

Again, we do repeat ourselves in saying that it should not come as a surprise that the Americans will attempt to shape the game into something that is more familiar to them than it is to us.

It is also clear to us that the American perspective regarding financial value in club football is not in local competitions against a backdrop of declining TV revenues but in international competition where the best club teams on the planet compete against each other on a regular basis with a global audience and global sponsorship appeal. Whilst this may be highly unpalatable for the many supporters of English football clubs, the world is unfortunately a much bigger and more lucrative place.

Even if this attempt by Liverpool and Manchester United fails or is vastly watered down, there will be others. It is inconceivable in our view that the Americans will countenance additional years of significant investment for little return. The prize, for what it is worth, is too great to ignore. What is certain is that the business of football has changed once again – as we said it would on numerous occasions over the last four years.

vysyble

Follow vysyble on Twitter

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle

12th December 2019 – The Cost of Chasing Gold – In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League

5th July 2019 – Chopping Board – Knives out for former Tesco chief

25th May 2019 – Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’ – Why the Economic Profit metric is the most transparent measure of business performance

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.