29th October 2020

Project Big Picture:

‘A sugar-coated cynaide pill’

‘…would be a disaster…’

‘A warning shot…’

‘…offers nothing but danger…’

‘…will destroy the game in this country…’

European Premier League:

‘Fans would soon be sick…’

‘could happen and spell doom…’

‘Owners out of control…’

Saving The Beautiful Game:

‘English football needs reshaping…’

‘Worthy of debate…’

Outgoing Barcelona President Josep Bartomeu:

‘I can announce that we approved the requirements to be part of a European Super League.’

Abraham Maslow, the eminent psychologist; In any given moment we have two options; to step forward into growth or step back into safety.

As fans of the beautiful game we take no pleasure in stating “we said this would happen.” Football in its current structure and form is not some value-creating economic engine room. Indeed, where we have seen similar dynamics and economic losses in other industries, we also see mergers, acquisitions and regrettably, closures. Business models adapt as market conditions change. Football, quite simply, has failed to adapt and a business model primarily based on an assumption that “TV money” was only going to increase has left the game exposed. The pandemic has merely accelerated the imbalance that was already brewing.

Now, the danger is that it is almost too late. What could have been a well thought out and prescient transition to a more sustainable business model ahead of time (as we outlined back in 2016) is now a melange of ideas and half-truths that conflict and confuse the current debate. What we are seeing is a level of turmoil driven by the failure to recognise the obvious problem in time.

The emotional romanticism and the obvious ‘protect at all costs’ ethos associated with football clubs comes from their roots in local churches, cricket clubs and industrial sports. Unfortunately, in the hard-edged modern economy, this emotional benevolence does not extend to the Profit & Loss account on club balance sheets.

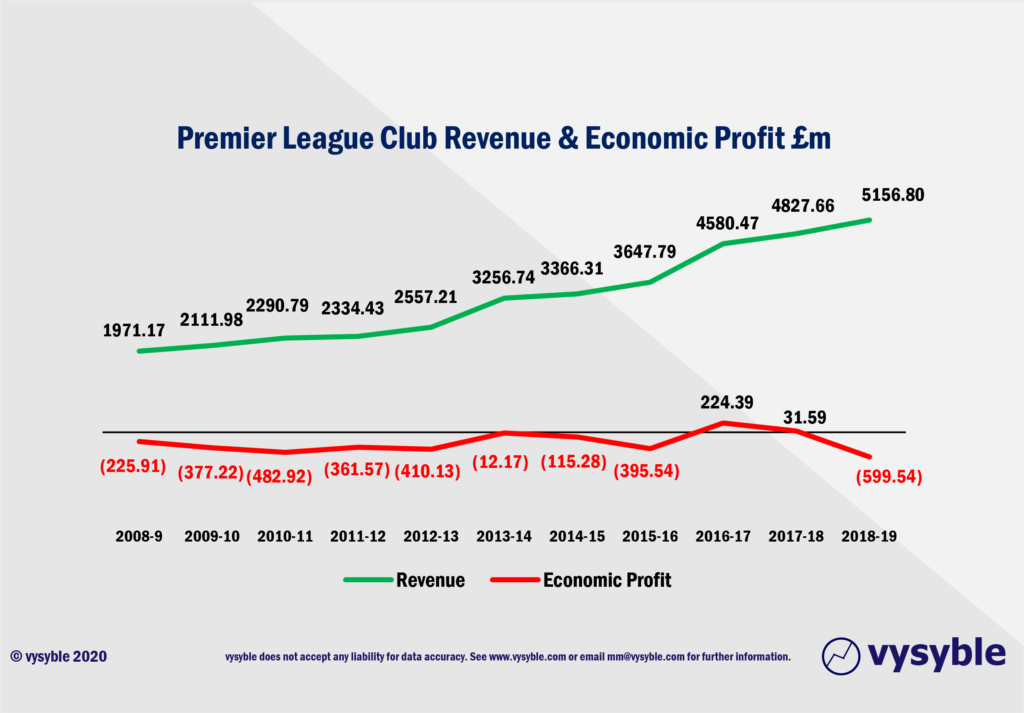

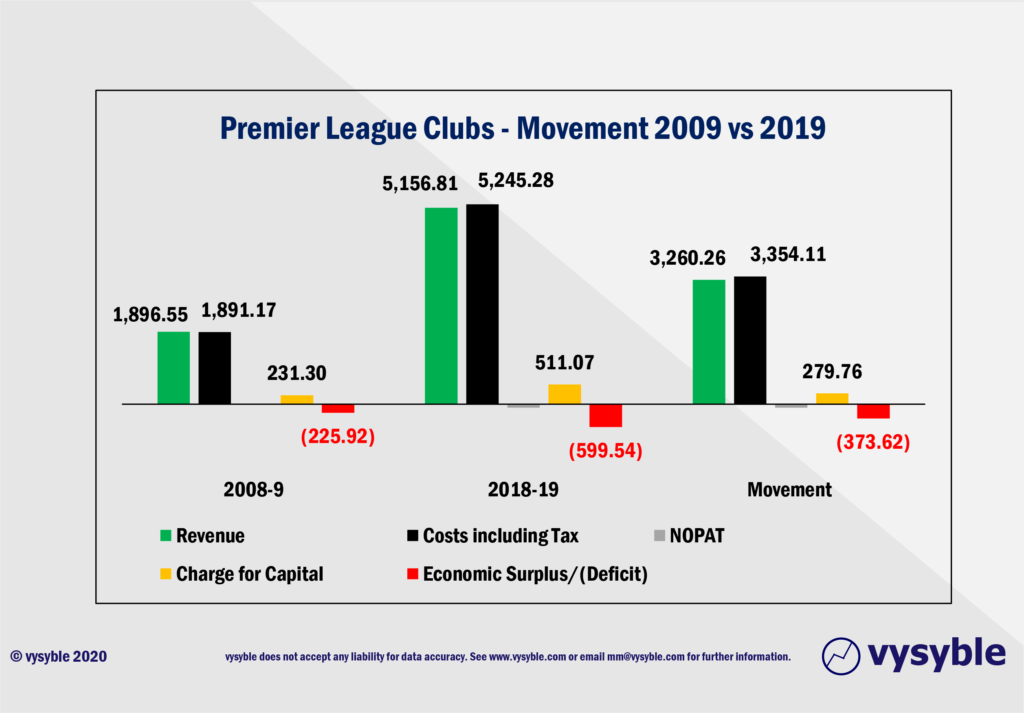

Despite revenues over the above period of £36.1bn, Premier League clubs have produced economic losses of £2.7bn. By the 2018-19 season, Premier League clubs were achieving economic losses of £11.63 for every £100 of revenue with a record-breaking collective economic loss of £599.54m from a record-breaking revenue £5.156bn. As the Americans would have you do, go figure.

These precious community assets (and there have been many clubs that have stepped up to help their local communities during the current health crisis) can only function for so long before the realities of finance take hold. The not-for-profit argument really does not compute when cash flows and money is at the heart of the problem. As we have often asked, if a not-for-profit ethos were to exist then what is an acceptable loss? Hitting that break-even point is exceedingly difficult no matter what business you are in.

Over the last few weeks we have listened to numerous podcasts in which pundits, observers and commentators opine for some form of divine and mystical intervention to save the nation’s favourite game. Common themes emerging include;

- Greedy Big 6 clubs

- It’s a power grab by the greedy Big 6 clubs

- The greedy big 6 clubs do not care for the English ‘game’

- The greedy Big 6 clubs are disingenuous in their offer to bailout the rest of football

Whatever your own opinion is of the behaviour of the Big 6 clubs – and the opening quotes of this blog are just a few – there is a very real, stark and uncomfortable truth here. When all of the costs of doing business are included, the game is unprofitable and has been for some time.

American owners and private equity/investment fund managers sense an opportunity for profit and growth. The price to be paid for this is the reform and restructure of the game in order to create the conditions and to lay down the foundations for this future growth and the creation of value. Fans, journalists, interested parties and even Parliamentary Committees need to get up to speed and understand the economic dynamic behind this very quickly.

Arguably football’s ‘wealth’ narrative is driven by the clubs, by suppliers to those clubs and possibly the administrative bodies. “Money Leagues” whilst initially interesting, merely portray a listing of clubs by way of a revenue ranking masquerading as “analysis” – the intellectual equivalent of fool’s gold. They are not in any way, shape or form a barometer of economic health yet revenue is somehow seen as THE performance indicator – perhaps a reflection of the author’s business naivety rather than their sophistication?

But further this point, given the use of equity capital as a means of funding football clubs, why the ongoing cost of this capital is never considered when trying to establish football’s economic position is frankly astonishing.

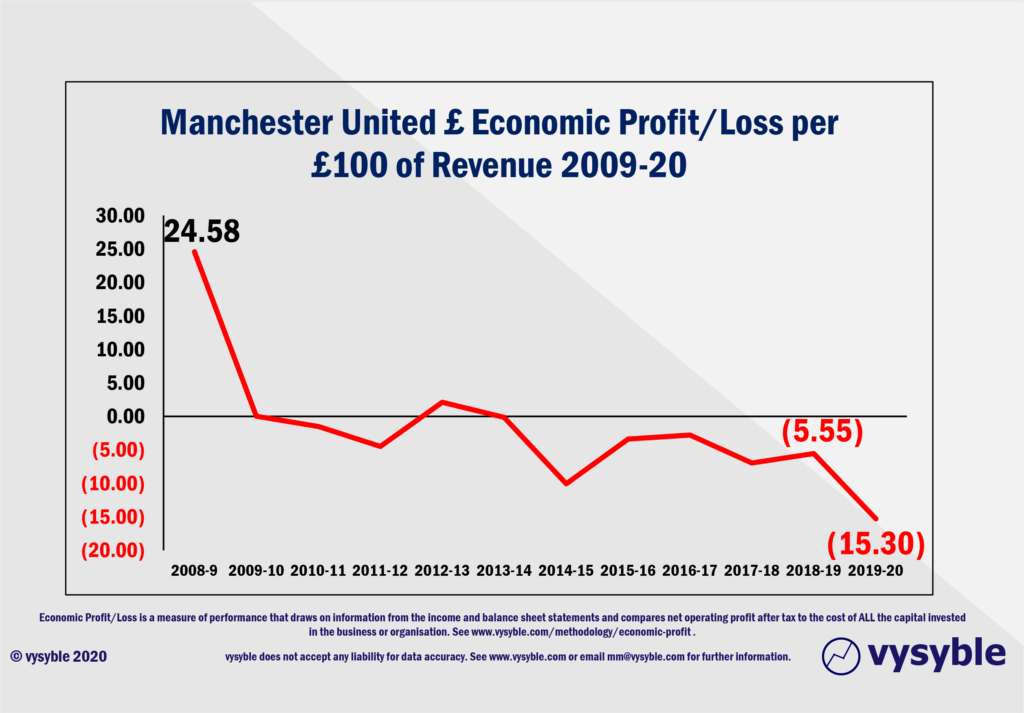

And a good example of this misinformation are Manchester United’s latest results.

The failure of the highest revenue earning club in the land to qualify for lucrative Champions League football plus the effects of Covid plunged the club into its first pre-tax accounting loss since 2014-15. Ok, one might argue that the result is unfortunate and that there are mitigating circumstances. However, as the Americans are also fond of saying, ‘you need to look under the hood.’

As you do so, the true decline of the club since the retirement of Sir Alex Ferguson becomes increasingly evident as indicated by the economic profit metric. The club’s costs are rising much faster than revenue and the reliance on new capital is increasing every year. Covid is not a cause of the club’s deteriorating position. Poor strategic planning and execution alongside an emphasis on EBITDA almost certainly is.

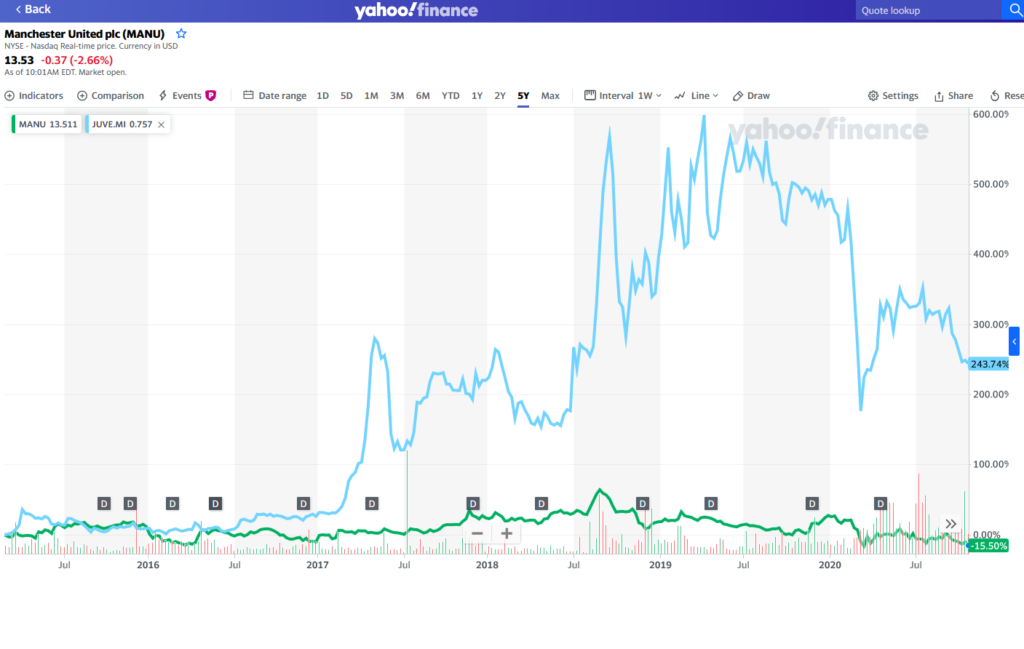

In Manchester United’s case at least, the combined wisdom of the capital markets have seemingly “wised-up” to the value-destroying wasteland of football, hence the lamentable performance of the share price which at the time of writing is below the IPO price of 2012. That’s 8 years of no equity value growth.

Juventus, the other major publicly listed European football club, has enjoyed a more successful run in terms of its share price, largely on the back of signing of Cristiano Ronaldo in 2018. Even so, the initial enthusiasm surrounding the signing has waned with the share price currently sitting some 45% lower than in September 2018. With a combined economic loss close to £180m for 2019-20, even allowing for Covid-19, neither club should be sitting in anyone’s pension plan.

Sadly, much of what we surmised about football’s future has happened or is in the process of happening. The data, particularly over such a long period (11 years) does not lie. The inescapable conclusion is, as it is currently constituted, that it is exceptionally challenging for a football club to consistently create value. Our only regret is that all the people in positions of authority who we approached and who had the ability to do something ahead of time did not do so.

Whatever the flavour of reform, the obvious but somewhat distasteful end-game of a European Super League is getting ever closer. Not because of the ‘greed’ of certain clubs but as a result of the essential elements coming together into a near-perfect alignment. The technology for clubs to control their own broadcasting output is in place as is their ability to charge a fee to the discerning fan for doing so. Indeed, why bother with a UEFA when a FIFA can deliver the whole planet…

It seems unlikely to us that the Americans and their backers will let this go. At the moment, it is a PR war but that will change when positions become entrenched and clubs start to squeal under the pressure of reduced TV revenues and increasingly insurmountable costs. Sadly, it is likely to be ugly and painful. But that is exactly what happens in business when the leap forward is taken. Growth is a way forward, safety (if it ever existed in football in a financial sense) is an increasingly limiting and limited fallback.

It has been 228 days since the last Premier League game was played in front of a crowd. And still no sign of an agreement within football to assist EFL clubs.

vysyble

Follow vysyble on Twitter

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle

12th December 2019 – The Cost of Chasing Gold – In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League

5th July 2019 – Chopping Board – Knives out for former Tesco chief

25th May 2019 – Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’ – Why the Economic Profit metric is the most transparent measure of business performance

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.