11th November 2020

The first part of yesterday’s DCMS Select Committee hearing chaired by Julian Knight MP with Richard Masters (CEO of Premier League) and Rick Parry (CEO of the English Football League) in their respective virtual hotseats laid bare the conflicting dynamics of football without fans is nothing vs the business imperatives of a sport constantly flirting with financial disaster and very challenged economics.

In the open spaces of the hearing room for those participants not located in the virtual world, the sizeable elephant in that room otherwise known as Project Big Picture (PBP) loomed large. Indeed, the genesis of PBP served as an introductory scene setter before the second part of the hearing with the now-former FA supremo Greg Clarke and for what turned into an almighty car-crash of an interview.

It is also evident that some form of restructure is in the pipeline. Richard Masters was clear when he said ‘change is coming’. As expected, Rick Parry supported the PBP financial transfer to the lower divisions as an immediate solution whereas Mr. Masters promoted the Premier League’s own ‘review’ with a conclusion seemingly set to arrive in March 2021.

In between the talk of plots, plans and perceptions, the committee rightly investigated the reasons why a deal had not been agreed between the Premier League and the EFL regarding financial help from one to the other given the Government’s insistence that football should be able to look after itself.

Mr. Masters, in his opening statement, cited the numerous payments and grants that the Premier League is already obligated to fund. However, to us as keenly interested observers, we still find it difficult to envisage how one group of economically loss-making clubs can further fund another group of economically loss-making clubs.

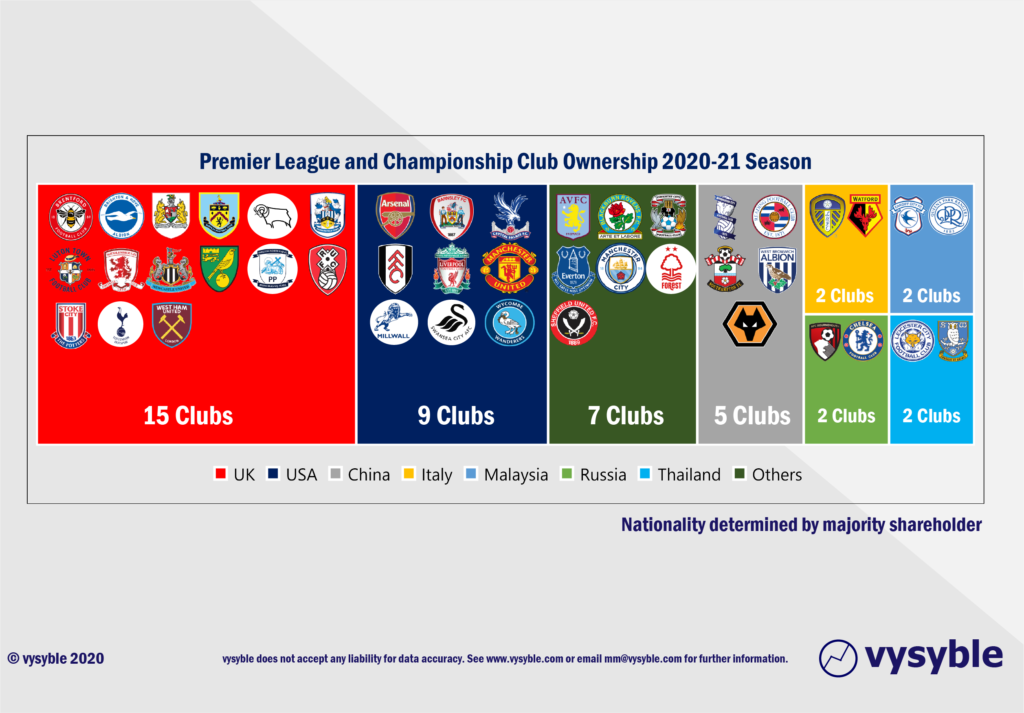

Indeed, the notion of the ‘football family’ is in our view a long-outmoded perception. Long gone are the local benefactors at the most senior levels of the game. Indeed, the graphic below illustrates the seismic change in English football’s internationalism over the last two decades with just 15 clubs now under the control of UK interests out of the 44 that make up the Premier League and Championship divisions.

And with international owners come international views and perspectives. Football is no longer a sport but a product to be consumed and paid for by willing pan-continental enthusiasts who in turn subscribe to their respective broadcast providers to watch their chosen club in action.

The emergence of US-based Private Equity investors into football in recent years is proof-positive that the romanticism associated with the game has been flattened by the largely unsuccessful but commecially-driven pursuit of value creation. What began as sporting excursions from local church, cricket and industrial clubs in the 19th century has turned into a heady mix of globally-known brands and publicly listed (for some) companies in the 21st century. The commoditisation of sports broadcast rights has also awoken professional investment entities to the fiscal possibilities from a poorly regulated enterprise that is increasingly ripe for reform. It should therefore come as no surprise that US owners are the second-largest group in English football’s two senior divisions and it is likely that the number of clubs under US control will only grow further.

Currently, three of the fifteen UK clubs are up for sale with Derby County’s prospective UAE owners seemingly close to completing the transaction whilst Burnley’s ongoing sale to either US or Egyptian interests has gone noticeably quiet in recent weeks. Of course, the aborted sale of Newcastle United has already created numerous chapters and will no doubt create more in the coming months.

Nevertheless, the emigration of UK interests away from the most senior levels of what is now not-so-English football points to the traditional values, as the Government currently sees them, withering out of existence. What degree of loyalty will an offshore-based international owner have when it has been almighty struggle to position his or her club on the right side of the financial line with numerous and costly equity capital injections to keep the club going when at the same time the Government expects a contribution to help further fund a competing club in a lower division, perhaps located just 20 miles away?

We’ve written before about the role of an independent regulator and the benefits that it could bring to the preservation and protection of clubs. If the Government is truly serious about the game, it could and should investigate this further. For now, the lack of a regulator or moderator in the face of an oversight regime that simply does not fit the operational reality of the game is a scandal in its own right. And one has to question the absence of FA involvement in this context.

The current situation of economic and financial unsustainability risks the emergence of perfectly normal dynamics associated with a struggling market i.e. closures, mergers and shrinkage. We’ve been saying as much since 2016 when we first looked at football’s precarious financial model and found a chasm bereft of financial common sense. Certainly, you don’t need to be an academic to realise that economic losses close to £1bn for the top two divisions of not-so-English football in the season before the emergence of Covid19 points to a deeper underlying issue.

Against these numbers, which have been shared with some members of the DCMS, we find it at best perplexing that the committee still appears to approach the current debate as though the Premier League was some haven of value creation. Yet again, we see the worrying (and plain wrong) conflation of revenue numbers with value creation from the committee – a rather basic error in business understanding; interested parties would do well to read the great Roberto Goizueta’s perspectives on this subject.

Just to be clear, the revenues accruing to clubs within the Premier League are indeed high but so are the costs of doing business and as we state above, the deficit (revenues less all of the costs of doing business) come in at just under £1bn for the season prior to the pandemic. How long before the penny drops? There isn’t a vast reservoir of wealth within the Premier League to distribute, even if we wish it were so.

It was also notable that references to the Premier League clubs’ £1.2bn (gross) spend on players over the summer were repeatedly made by MPs as a point of wonderment against the backdrop of claimed financial hardship by Mr. Masters, who subsequently defended his shareholders’ actions by claiming the 2nd largest net summer transfer spend ever (£834m) as ‘competitive investment’.

However, despite the headline number, the actual completion of these player transfers is not likely to happen until several years hence. In effect the transfer spend has been funded via the individual clubs’ exapnding lines of credit. Not so much a case of kicking the can further down the road but a Panenka into the hands of further financial calamity.

We also said in 2018 that the demise of the Premier League had already started and nothing we’ve seen in recent weeks and months has changed our view. If anything, the emergence of the predictable PBP and other initiatives merely reinforce the evidence from our economic profit/loss data which in itself points to inevitable change. The Big 6 clubs eye bigger broadcast revenues on a more substantial international stage, the other 14 clubs cling on to their invitations for the sideshow.

Returning to the events of yesterday, nobody wakes up in the morning expecting to end up in Accident and Emergency. In the case of football, the ambulance trip has been ongoing for many years with the attempts of the DCMS to persuade football to indulge in self-resuscitation proving to be less than adequate.

For all of Greg Clarke’s car crash interview, the PBP element proved to be illuminating in that he revealed his high degree of involvement in its early developmental stages. And for all his protestations about protecting the pyramid, the fact is that the very summit of that pyramid sees the world in a vastly different light, and with the FA’s encouragement.

The elephant, it would seem, is going to be in the room for quite some time yet.

vysyble

Follow vysyble on Twitter

29th October 2020 – Form and Function – Proposals-a-plenty for football’s structural reform.

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport.

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy.

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses.

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return.

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak.

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances.

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle.

12th December 2019 – The Cost of Chasing Gold– In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League.

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club.

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes.

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League.

5th July 2019 – Chopping Board – Knives out for former Tesco chief.

25th May 2019 –Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’– Why the Economic Profit metric is the most transparent measure of business performance.

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness.

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance.

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table.

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics.

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds.

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.