1st December 2021

Football’s wishlist in the form of Tracey Crouch’s report arising from the Fan-Led Review was released last week. We are logged in the report as one of the contributors. Unfortunately, we are listed as ‘Vysble’ rather than Vysyble. But the missing ‘y’ is not the only element that is absent from the report. Perhaps the real question which the report fails to solve is why did football end up in this mess in the first place?

The review starts by outlining three drivers indicating a crisis in the game. The actual quote is set out below:

The Fan-Led Review of Football Governance (‘the Review’) was the result of three points of crisis in our national game. The first … was the collapse of Bury. A club founded in 1885, which had existed through countless economic cycles, several wars and 26 different Prime Ministers, ceased to exist in 2018-1919 with a devastating impact on the local economy and leaving behind a devastated fan base and community. This led to the commitment in the 2019 Conservative Party manifesto to ‘set up a fan-led review of football governance…’

The next crisis was COVID-19. For the first time since the Second World War, club football was brought to a complete halt, threatening the continued existence of many professional football clubs. Fortunately, the clubs survived due to a combination of government support and commitment from many football stakeholders, including fans, club owners, and – eventually and after a delay of 6 months – the leagues and Football Association (FA). However, the pandemic and its effects laid bare the fragile nature of the finances of many clubs, as well as the structural challenges of the existing domestic football authorities.

The final crisis was the attempt to set up a European Super League (ESL) in April 2021. This new competition would have involved six English clubs as founding members, protected from relegation. It was a threat to the entire English football pyramid and led to an unprecedented outpouring of protests from fans, commentators, clubs and Government. As a result, the Secretary of State for Digital, Culture, Media and Sport (DCMS) announced to Parliament on 19 April 2021…

We are firmly of the view that before the game can move forward, a greater consensus regarding the drivers of the above needs to be established and communicated before alternatives can be assessed and agreed upon.

Initially, it might seem that the three issues in question are distinct and separate. However, whilst we acknowledge that the Covid Pandemic could not have been predicted, it is our firm conviction that all of the above are symptoms of a much bigger and worrying issue which is the inability of football at ALL levels of the pyramid to generate an economic return, or in other words, to cover all of the costs of doing business coupled with an ineffective and largely obsolete regulatory oversight.

And just to be explicitly clear at this point, we rely solely on the empirical evidence derived from individual club balance sheets and apply our own calculations to determine the degree of value creation or destruction achieved by the clubs ie economic profit or loss. Indeed, we give a very clear and defined determination of value which was ably expressed by the leading economist Alfred Marshall in 1890;

“Value is created by investing capital and generating a return greater than the cost of that capital.”

When we see phases such as ‘value-driven’ or ‘financial stability value engagement’ espoused by well-meaning groups, we do wonder if the promoters really do have a grasp in understanding the financial realities of the modern sport. It is, however, vital that the concept of value creation is correctly understood and adopted.

The collective failure of both the club hierarchy and the regulatory overseers highlights why Bury FC was eventually forced, after 133 years, into liquidation with Bolton Wanderers not that far behind at the time on the path to oblivion.

Indeed, it was widely reported in the media that we had warned the EFL in the winter of 2017-18 that numerous clubs under its jurisdiction were vulnerable given both the poor economic performance of individual clubs but also the destructive financial trend dynamics in terms of promotion and relegation between the major divisions.

As for the Super League, we could clearly see the economic imperative for such an entity directly from the deteriorating economic performance seen in individual club balance sheets. Indeed, we were pilloried in the media for daring to suggest such a thing back in 2016 such was the blinkered confidence of those decision-makers in the game who really should have known better. Yet here we are…

We have to acknowledge that the nation’s senior football clubs have so far managed to weather the Covid-19 storm but as the latest financials numbers are rolled out and published for the 2020-21 season, we are beginning to see and to understand the worrying scale of economic carnage wrought by lockdowns and fanless fixtures.

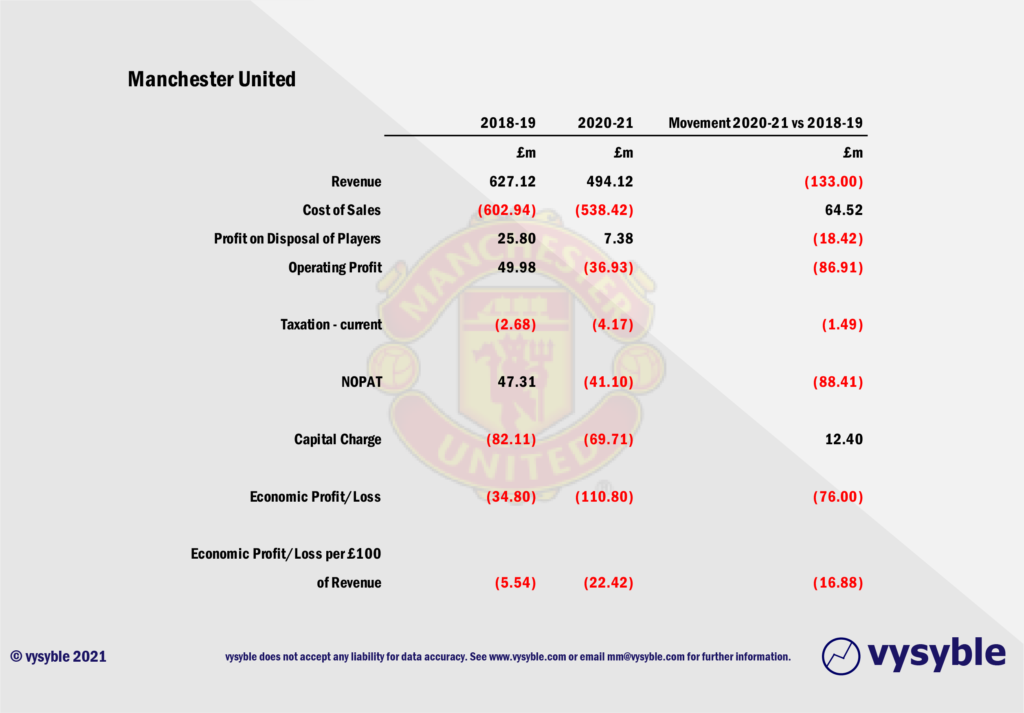

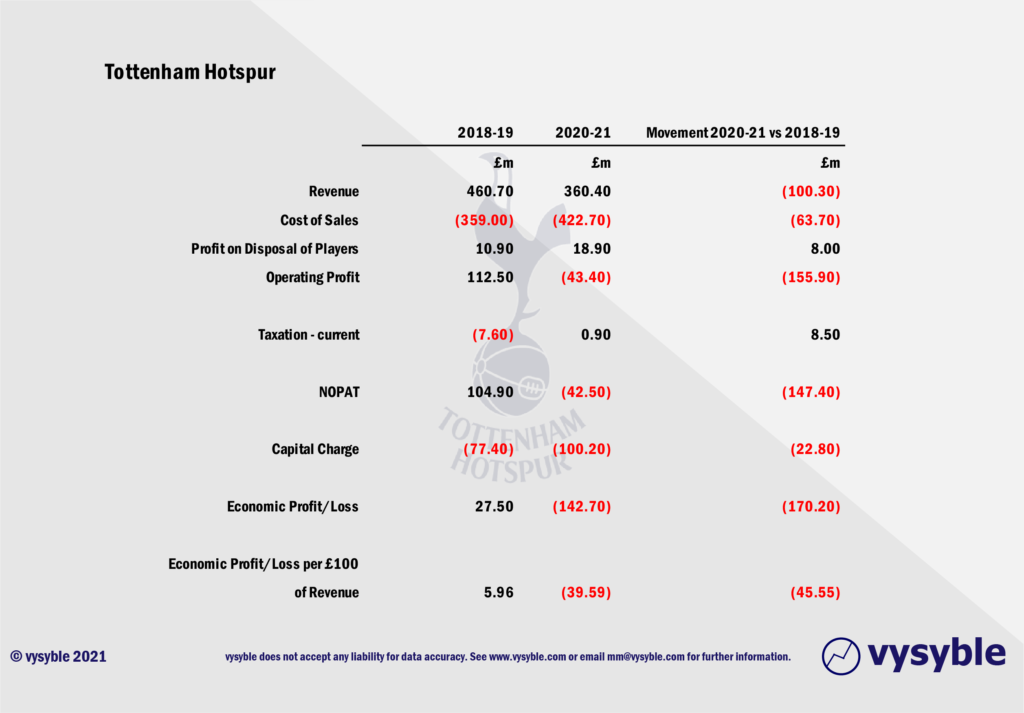

To date, both Manchester United and Tottenham Hotspur have released accounts for the 2020-21 season. In the tables below we compare their performance with a pre-Covid 2018-19 season.

In 2018-19, the economic position for both clubs was a small combined economic loss of -£7.2m (Tottenham +£27.6m less Manchester United – £34.8m). By 2020-21, this loss had increased by £246.2m (negative movements for Tottenham – £170.2m and Manchester United – £76.0m) to -£253.4m.

Clearly, the pandemic has affected financial performance but here we have two of the nation’s biggest football clubs struggling to maintain operations without incurring huge losses, in part derived by the increasing deployment of capital within both businesses. Super League offered an alternative route to profit and it is not so difficult to see the rationale given the above economic numbers as to why it was an attractive alternative.

Why is there so much confusion regarding the fundamental economics of the beautiful game?

As we stated in our submission of evidence to the Review Committee, football is hampered by several widely held in-going myths which prevent an honest and robust assessment of its economic reality. These include:

- Revenue (and growth thereof) is in all circumstances a good surrogate for value creation and strategic progress. This ridiculous notion is given further credence by the annual publication of a list of European club revenue numbers which in turn is given additional and bogus credibility from certain sections of the media who really ought to know better…

“FC Barcelona has become the world’s richest football club for the first time, thanks to recent changes to the Catalan team’s merchandising business that has provided a financial edge over its peers.” – FT Jan 14, 2020

“World’s richest football clubs 2021: Barcelona top Deloitte Football Money League ahead of Real Madrid while Bayern Munich overtake Manchester United” – City AM

“Which are the world’s richest football clubs in 2021?” – Goal.com

Reality =FC Barcelona has been widely reported as being in financial trouble with a suggested debt of 900m+ euros. Lionel Messi left the club because it allegedly could not afford to fund a new contract. The lesson here is that revenue does not equal wealth.

- That “earnings-based” accounting metrics are a sound indicator of wealth creation. They are not and never have been. There is no credible evidence supporting this particular ‘myth.’ The earnings metric is an incomplete measure of performance and therefore unreliable in establishing the scale of value creation and destruction for any organization, including a football club.

Reality = Manchester United’s share price has moved from U$14 at IPO in 2014 to US$15.12 as of 30/11/2021. EBITDA is proudly touted as a measure of cash-generation yet share price growth is near-stagnant. If the elite Premier League clubs are so ‘lucrative’ and ‘profitable’, we wonder why that has NOT translated into a more encouraging share price trajectory?

- A belief that the revenues from TV would both increase and continue indefinitely notwithstanding the very challenged economics of the TV companies. Even before Comcast acquired Sky in 2018, the economic performance of Sky plc was arguably challenged. At the time of writing, BT is believed to be trying to reduce its interest and financial exposure in all things football.

Reality = the 2016-2019 domestic TV deal reduced the revenue received per game from £10.14m to £7.72m, a decrease of 26% as a result of the Premier League increasing the number of live games from 168 to 200 to maintain the headline contract values. This particular ‘deal’ has been extended to 2025. Interestingly, the review seems to assume that TV revenues will continue to rise ad infinitum – a stance which we think is best described as “bold.”

- A belief that football clubs are a “social asset”. Apparently, football clubs do not need the outputs and visibility that high-end, economically-based metrics can provide because football clubs are ‘not for profit’ entities. Curiously, advocates of this perspective seem unable to credibly articulate what would therefore be an ‘acceptable loss.’

Reality = Football clubs are currently subject to the same business rules, laws, financial and economic dynamics as any other industry in England & Wales.

- Allied to the above point, a belief that the ‘economic gravity’ for football clubs is somehow different or even immune to the general economic cycle. Experience demonstrates that they are anything but immune. Indeed, it is a belief which has the potential to be hugely damaging.

Reality = As in other lines of business, football clubs are subject to the economic realities of the day with flexible asset values and (highly) variable cash flows.

- That increasing popularity or potential popularity is an automatic guarantee that value creation, as night follows day, will somehow accrue.

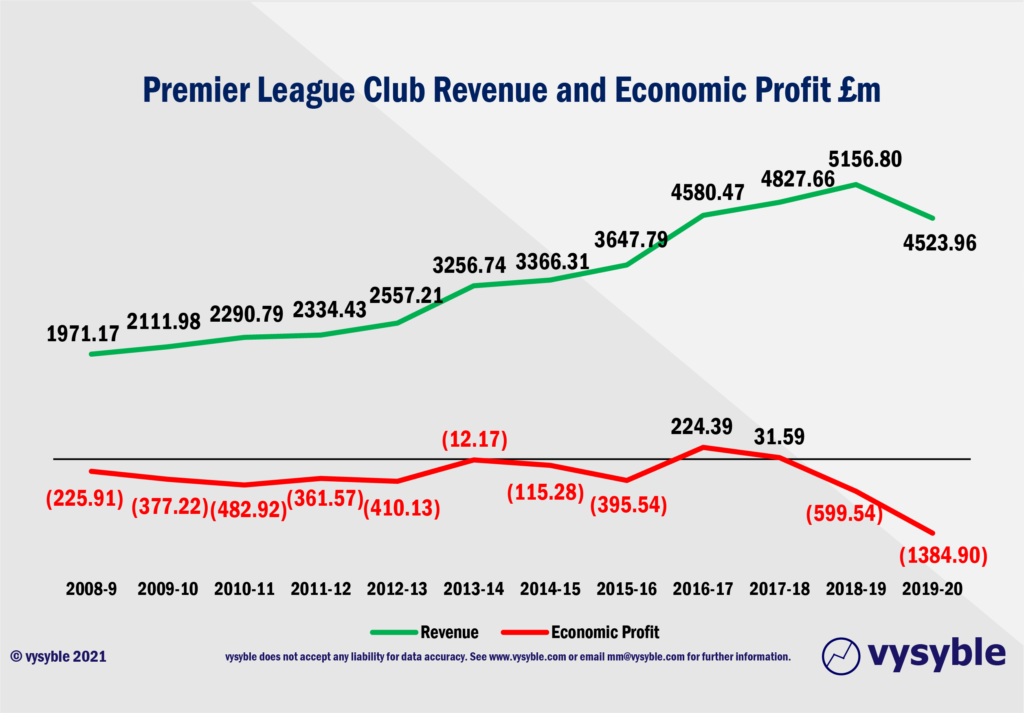

Reality = The popularity of the Premier League is without precedent. However, in pre-Covid 2018-19, record club revenues of £5.1bn were matched by record economic losses of £599.54m. The mistake is to confuse popularity and ‘marketing reach’ with the ability to create value.

- That relative valuations (Forbes list etc.) are somehow a reliable indicator of the economic value and potential of the clubs. For example, “football clubs are valued at 5 times revenue” was mentioned several times by participants during one (excellent) recent seminar on football finance attended by various industry luminaries.

Reality = Why not 6x or 4x revenue? An absurd notion that deserves an absence of oxygen; revenue has been increasing steadily for Premier League clubs yet economic profits and hence value creation remains largely elusive. In other words, rises in revenue have simply flowed into a higher cost base and not into building a sustainable ‘value-creating business.

So what?

The prudent use of the Economic Profit (EP) metric answers or addresses the myths outlined above.

It has enabled us to predict with a high level of accuracy the failing financial dynamic in football since 2016 and the various manifestations of attempted structural change and disturbance. Indeed, if the powers that be had divested themselves of their own interests and actually read our letters, submissions, comments etc, a lot of time and effort and, dare we say it, clubs, could and would have been saved.

There are numerous real-life examples where organisations have used EP as a cornerstone of their strategy development discussions to generate value, in the broadest sense of the word, for shareholders and other stakeholders. Key to this is an understanding of the fundamental economics of the organisation and the industry or peer set that it is competing against. In part, this is to answer the question how much of the performance is driven by industry or market forces and how much is due to the organisation’s business model.

Often, the balance between these two dynamics varies widely across industries. For instance, the American company Southwest Airlines typically produces strong economic profit numbers but competes in an industry where the average airline participant is economically negative or value destroying.

Arguably, this is why some business people, who have been highly successful in other industries with more favourable economics, often struggle to leverage their expertise in a football setting. We believe that understanding the interplay between market forces and business model is fundamental to the strategy formulation and dialogue phase whether that is football, pharmaceuticals, real-estate development or just about every other economic endeavour. Even ‘regulators’ can use it to both understand and gain sight of the underlying forces at play within the marketplace.

Furthermore, we are firmly of the view that it is only by understanding the economic dynamics of the Premier League can we understand the following:

- The strategic forces at play including the balance of power between the clubs, the players and their agents

- The capacity of the Premier League to subsidise the football pyramid

- The ripple effect of relegation and promotion in the EFL Championship and beyond

- Football’s overall financial and economic dynamic

Set out below is the total annual Revenue and Economic Profit performance for those clubs competing in the Premier League over the period 2008-9 through to 2019-20.

Despite revenues of £40.625bn over the period, economic losses amount to £4.109bn. In taking a top-down view, we might reasonably conclude that this is a difficult industry to generate or achieve an economic surplus/create value. The vast increases in revenue, which many other industries can only dream of, are all too often swallowed up by even larger costs increases.

This lack of attention or inability to manage the cost base is not, in our view, because of a skills deficit but is more likely to point to where the power base finds itself within the game. Undoubtedly, it is with the players and their agents. It should therefore come as no surprise that salary caps were a key component of the Super League model.

More fundamentally, given the economic profit performance set out above, where are the vast pools of ‘wealth’ required to increase subsidies to the rest of the football pyramid?

And here is the problem for the Premier League clubs. For many years, the annual review of football finance published by Deloitte (Auditor to The Football Association Premier League Ltd) has been telling us that the Premier League has been eminently profitable, with ‘a continuation of club profitability’ (2016), ‘strengthening balance sheets’ (2018) and ‘…recent trend towards profitability at the highest level of football in England appears set to continue for the near future’ (2019).

Anyone who is familiar with our work will immediately see through the naivety of these quotes. In summary, the Premier League clubs are in the main collectively value-destructive. That is not to say that club owners would like their operations to be profitable. Of course they would. However, the lack of regulation and responsibility from the FA in particular prompts us to think of the parallels in the deregulation process of the US and European banking systems from the 1980s onwards. And look where that got us to…

Nevertheless, the recent PR drive by various Premier League-related luminaries to counteract the thrust of the Fan-Led Review has been entertaining if nothing else. The ‘radical’ topic of financial distribution is one that we suspect will provide many more hours of interest. Is it only a matter of time before they start to quote our numbers in order to plead poverty? We shall see.

An Independent Regulator

Several high-profile commentators have at various points in time called for the introduction of an Independent Regulator. Indeed, it is arguably the key recommendation of the Review Committee.

In part, this is almost certainly a reaction to the negative perception of those currently charged with running the game, namely the Premier League, The Football Association (FA), and The English Football League (EFL) (note the order…). Given our own experiences with the EFL and the FA, we have a degree of sympathy for the Review Committee’s perspective.

However, as far as an Independent Regulator is concerned, our view is that the devil is in the detail and such an appointment does not and may not change the fundamental economics of the industry even though in principle it is a good idea (see blog: 13th March 2019).

One particular example to illustrate the point is the energy supply industry, something which affects each and every homeowner or renting tenant in the land.

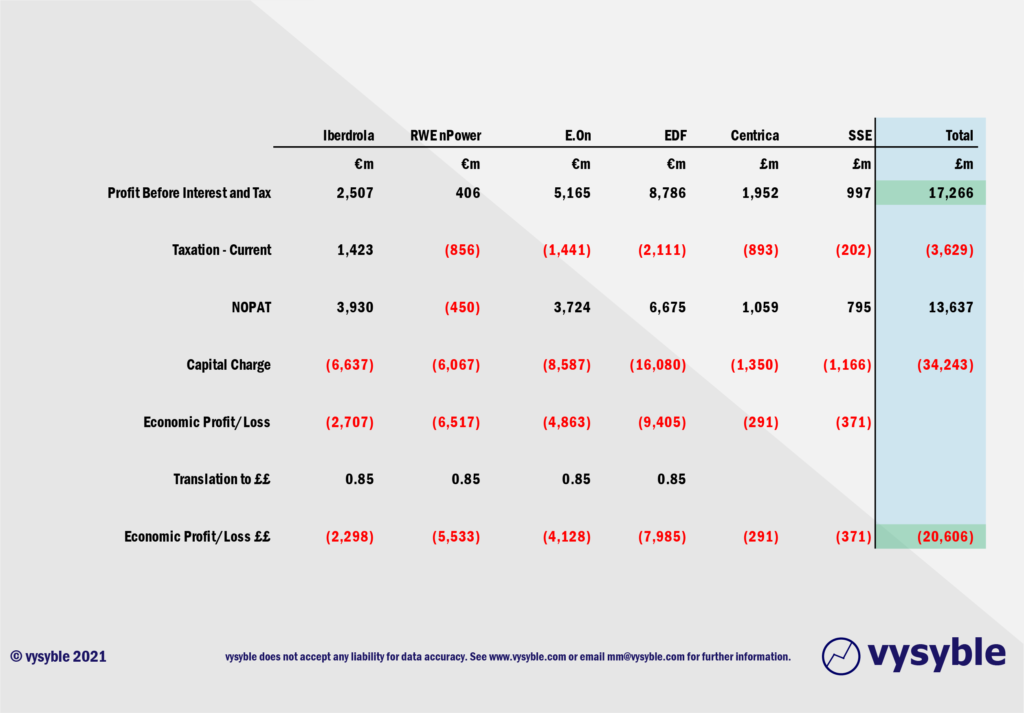

Set out below is a slide from a presentation to Ofgem in October 2014 based on 2013 financials. This work across the “Big Six” European Energy Generation companies highlights the difference between the accounting perspective and the economic profit/loss perspective.

The accounting perspective shows a Profit Before Interest and Tax (PBIT) of £17.266bn and hence an understandable but incorrect perception that the industry at that time was highly profitable. In fact, there was considerable press comment that the industry was ‘profiteering’.

However, when we deduct tax and a charge for all of the capital used by these businesses, we see that the PBIT of £17.266bn becomes an economic loss of £20.606bn.

Today, there are numerous forces driving the crisis within UK and international energy supply markets but we argue that adding a large number of poorly capitalised new domestic entrants to an industry already destroying value in the belief that it could be made ‘more efficient’ was a fundamental error of judgement.

Our broader point is that any regulator/regulatory body, whether within energy generation or football, cannot manage what it cannot see. The use of accounting metrics can and most likely will give a misleading indicator of an industry’s economics. So much of football’s own commentary is focused on revenue (remember those ‘richest’ clubs ranked by revenue alone?) and/or accounting PBIT rather than taking the economic profit perspective. This has led football clubs down some dangerous paths to the point of administration and insolvency.

Furthermore, the energy market has demonstrated that a regulator cannot prevent insolvencies under current company law. Whether HM Government is minded to amend the statute to provide football with exceptional financial provisions as indicated in the Review remains to be seen. We suspect that there will be many a HMRC inspector questioning the Government’s thinking given that it’s status as a primary creditor in football administration cases has only been recently restored. Indeed, as the main petitioner of administration cases in football, the Government’s future position on this aspect is one that fosters a high degree of curiosity.

In returning to our opening paragraph, the question of ‘why did football end up in this mess in the first place?’ is, as we have described, down to a lack of understanding of the value creation/destruction dynamic together with a weak regulatory oversight which in turn fails to impose a workable and effective financial framework which ought to achieve a neutral economic position as a bare minimum.

We know with some certainty that if these key elements are not resolved, then football’s recurring financial mistakes will return once again with even more upheaval than last time.

Vysyble

Follow vysyble on Twitter

23rd June 2021 – Road to Nowhere – Football stands at the crossroads ahead of the Fan-Led Review process. We examine the key questions that it must answer.

11th May 2021 – Prime Numbers – Football’s elite clubs seek a route to profit as fans yearn for sporting tradition. In between lies a gulf of mistrust and misapprehension.

26th April 2021 – A Bitter Pill – GSK’s new strategic direction fails to find riches in the middle of a pandemic when other pharma companies have prospered.

25th April 2021 – The Wrong Stuff – American-style football league won’t wash but the conditions that led to its launch are still present and are likely to get worse.

19th April 2021 – Super League Arrives – As we predicted, football’s elite breakaway emerges from the shadows.

30th March 2021 – $hooting B£ank$ – Arsenal’s commercial performance analysed.

22nd February 2021 – Measure for Measure – Take two financial measures, add pandemic and stir.

18th January 2021 – The Football Factory – If football was an industrial entity…

8th January 2021 – The Oil Majors – An Update – A shareholder return performance review of the 4 major oil companies in 2020.

10th December 2020 – Pump Up The Volume – ExxonMobil comes under fire from an agitated investor.

16th November 2020 – The Pain Game – Manchester United’s Q1 2021 financial release opens the lid on a Covid-19-affected financial can of worms.

11th November 2020 – A Tight Squeeze – Football’s Elephant in the Room leaving little space for financial relief.

29th October 2020 – Form and Function – Proposals-a-plenty for football’s structural reform.

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport.

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy.

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses.

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return.

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak.

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances.

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle.

12th December 2019 – The Cost of Chasing Gold– In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League.

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club.

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes.

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League.

5th July 2019 – Chopping Board – Knives out for former Tesco chief.

25th May 2019 –Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’– Why the Economic Profit metric is the most transparent measure of business performance.

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness.

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance.

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table.

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics.

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds.

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.