10th February 2022

These are difficult times for the business. Production quality is well below that achieved in the late 1990s and 2000s. Indeed, the general trend over the last few years has been markedly downwards with occasional lifts which inevitably and predictably reverse back into the broader direction of travel.

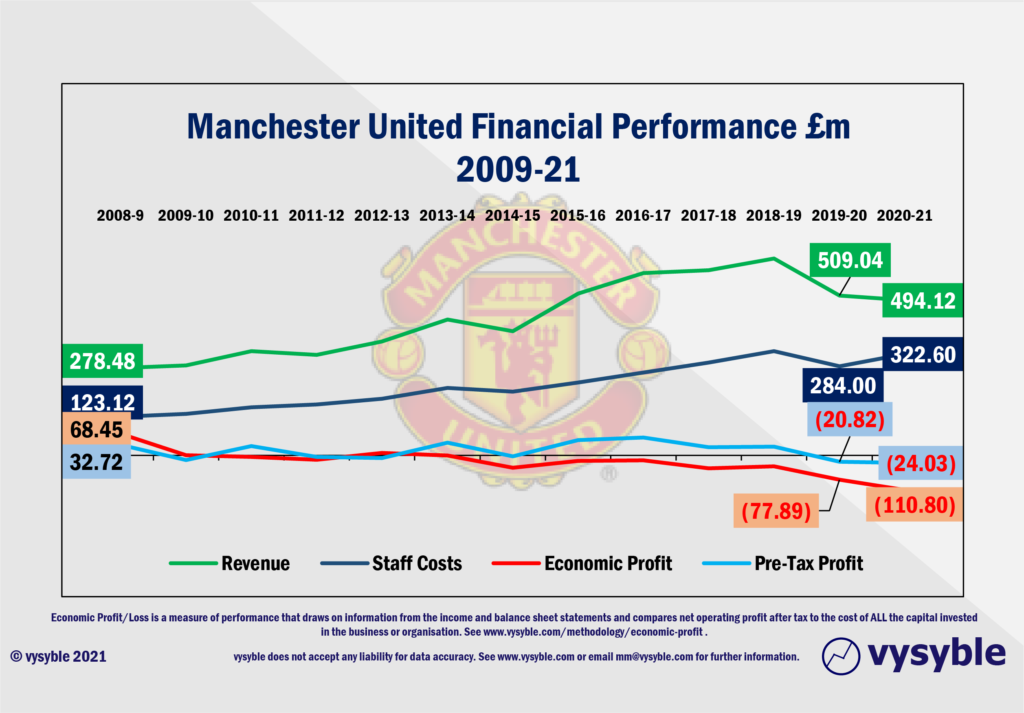

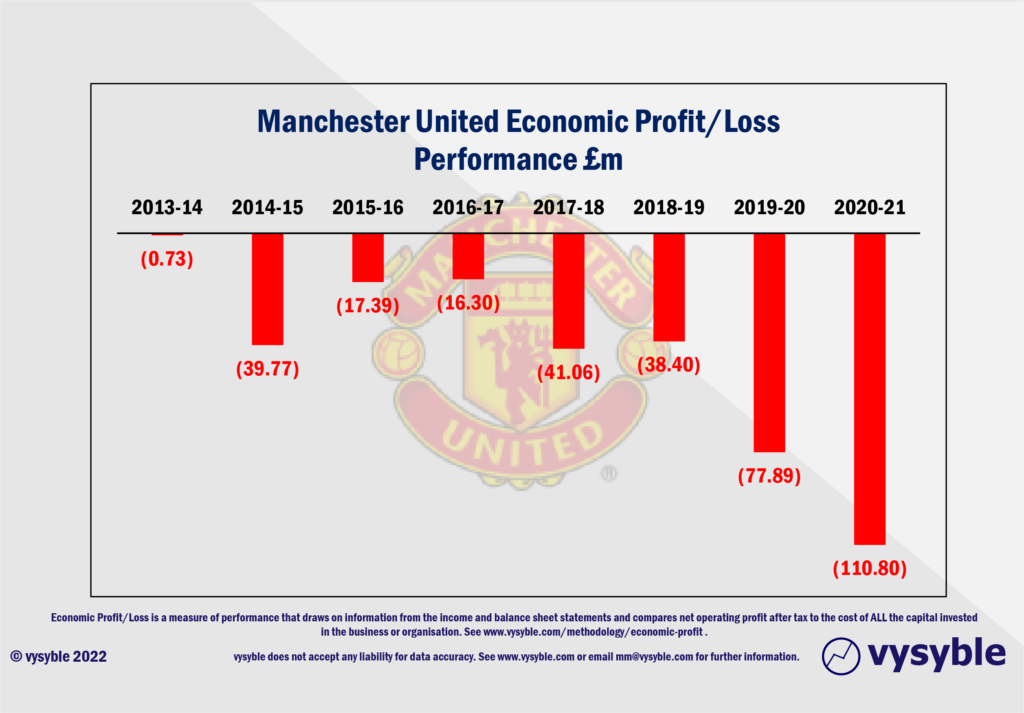

Production Directors have come and gone in recent years with the present incumbent viewed merely as a supposedly temporary measure ahead of an intended high-profile appointment later in the year. There is increasing pressure to alter production methods and energise personnel to reach what is to many the obvious potential on the factory floor, yet the overall business strategy has itself faltered in recent years with an increasing lack of economic profits. Indeed, the effects of higher labour costs and fees associated with procuring new workers and equipment has seen losses increase since the last economic profit which was achieved back in 2013.

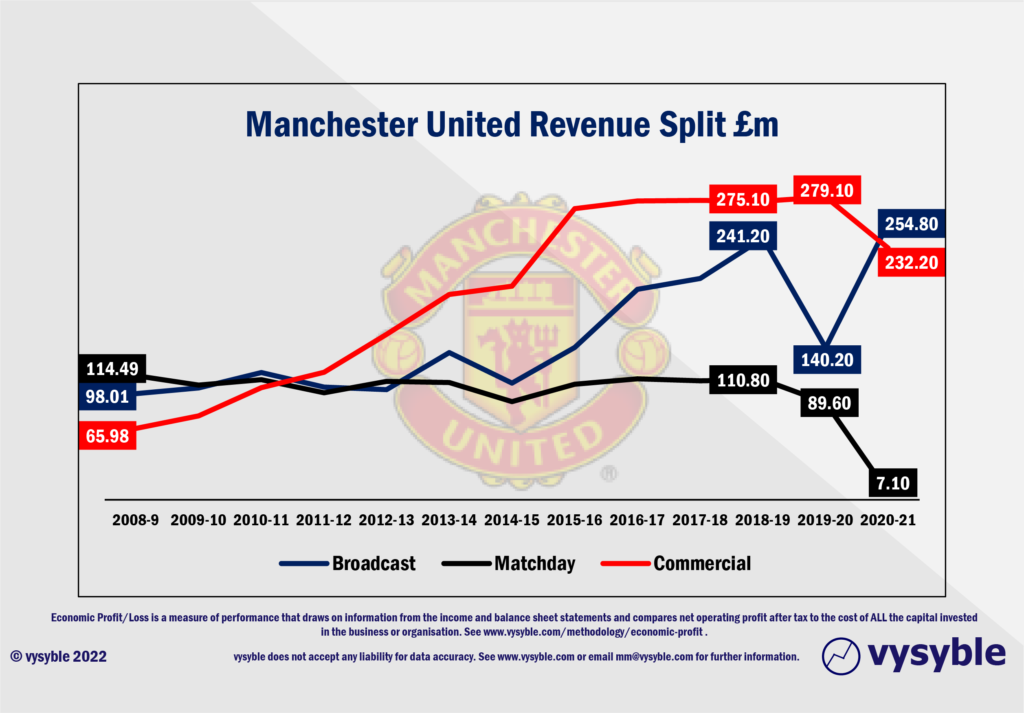

Covid has, of course, pushed the business into further economic losses with an increase in net debt and the extensive use of credit facilities in order to maintain operations. Restrictions imposed by Government badly affected customer interactions and sales, leaving the business exposed to lower revenue levels and a punitively fixed cost base given the nature of employee contracts. A forced shutdown did not help financially although production levels actually increased to lift the company into second place in in 2021 in terms of output quality among its domestic peer group.

The business remains highly active in procuring new equipment and personnel with recent purchases from Europe of over £140m in the last year. However, deployment has been somewhat haphazard with some of the new additions yet to be fully integrated into the production process. Indeed, some of this new and expensive equipment has been short-leased to smaller competitors. This has inevitably raised questions about procurement and deployment strategies given that plant and equipment to the value of £110m+ had been largely lying idle since purchase.

The share price has made little progress since the company undertook an IPO in 2012. The shares have decreased in value at the time of writing from the IPO strike price of $14.00 to $13.42. Over the same period, the S&P 500 index has increased by 253%.

Blue-coloured competitors have eaten into market share with increasingly better product development and quality. Investment in new plant has been more considered and effective. This has exerted considerable pressure on the business to return to previous levels of success given the competitive nature of the market.

In our view, the company appears to have a somewhat vague set of objective in being satisfied with continuing participation in European markets but apparently lacking the aim of being the most dominant or successful entity. The ability to compete abroad is somewhat restricted if performance in the domestic market is in itself inferior and the negative impact on the balance sheet without the international aspect can be, and has been, damaging. Yet the company continues to enjoy the support of a global customer/fan base with a highly responsive social media presence.

The current Executive Vice-Chairman who has presided over this period of apparent decline was replaced by a new Chief Executive on 1st February.

The company is, of course, Manchester United.

Bloomberg quotes Manchester United’s market capitalisation at around $2.2bn. However, the media continues to speculate over the exit price/value for the Glazer family in order to give up their prized soccer club with quotes as high as $4bn.

Unfortunately, and as described above, Manchester United has struggled to regain the status of England’s no. 1 club since Sir Alex Ferguson retired in 2013, both on and off the pitch. We have written about United’s financial travails previously and we remain sceptical that some form of financial recovery is imminent given that since Sir Alex’s departure, the club has enjoyed the managerial services of the Chosen One, the Dutch One, the Special One, the Likeable but Dispensable One and currently the Temporary One.

The club’s economic performance since 2009 has been defined by increasing costs, primarily in player wages, and increasing economic losses.

With a distinct lack of economic profits, the new Chief Executive has a considerable task list to work through. Indeed, recent events off the pitch concerning the running down of contracts give rise to the thought that forward planning capabilities and objectives need to be re-examined. The prospect of allowing Paul Pogba to go for nothing not just once but perhaps twice represents incredibly poor judgement. And the general malaise is beginning to have a wider effect.

The share price has been trading under the 2012 IPO price of $14.00 since 19th January 2022. Thus, investors with the appropriate class of share are now failing to see a return other than a 9 cents per share dividend (usually) payable every six months.

However, on the day the Ole Gunnar Solskjaer was sacked, the share price was $15.79. Manchester United shares have dropped by 15% since then. Is it the case that the capital markets are starting to wise-up to Manchester United’s economic performance?

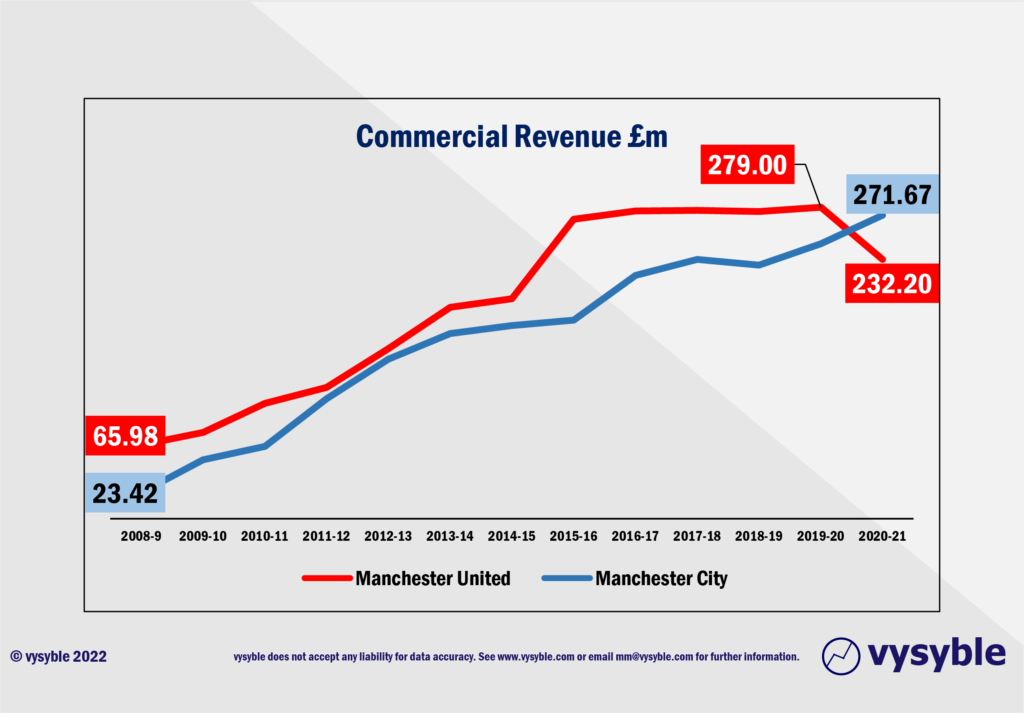

Certainly, the much-lauded commercial side of the business has been lacking in growth in recent years. Indeed, performance has been flat since 2015-16. Since then, the ‘noisy neighbours’ otherwise known as Manchester City have grown commercial revenues from £177.87m to £271.67m thus overtaking Manchester United as the most successful club in generating commercial revenue in the Premier League on an annual basis.

And since the acquisition of Manchester City by Abu Dhabi interests in 2008, the club has accumulated 58 more points than their red rivals. The balance of power would appear to have well and truly moved.

And if the latest UEFA club financial report is anything to go by, the European theatre of competition is facing increased, and in many cases, record operating losses (no cost of equity capital included so the real picture is going to be worse) along with rising labour costs. Of course, the report trumpets an increase in broadcast revenues but it is still hugely disappointing that this particular administration still hasn’t worked out the longer-term trend that regardless of the size of broadcast income coupled with a lack of effective operating regulations, clubs will still lose increasing amounts of money.

One of the methods that we employ in valuing a business is to work backwards from the proposed valuation number. In Manchester United’s case, we can go further and determine what the business needs to achieve in order to justify a particular share price.

Initially, we set out the recent economic performance over the last 10 years and also the assumed or forecast EP performance over the next 10 years to bring us back to the share price of $15.79 on the day of Solskjaer’s departure, using mathematical models.

Therefore, we have prepared a fundamental valuation. What combination of future economic profits can sustain a share price of $15.79?

As can be seen in the above graphic, the club/business has to radically alter its financial performance in the coming decade with the achievement of regular economic profits as opposed to regular economic losses.

Unfortunately, Manchester United is a publicly listed entity and as such is required to issue quarterly updates on its financial performance given its placing on the New York Stock Exchange. We are, therefore, able to get an almost real-time view of not only the business but also the potentially wider trends within the other Premier League clubs.

The club’s Q1 2022 results demonstrate the influence of bringing in those expensive and arguably under-utilised assets with a staff costs bill rising 23.1% year-on-year leading to a quarterly economic loss of £21.67m. Not the best start to a season whereby crowds returned and revenues reached a reasonably ‘normal’ £126.46m.

What is clear is that the current uncertainty enveloping the club on so many fronts will largely be resolved in time. What remains unclear is whether or not the business can recover share pricing levels well above the IPO price before the capital markets get wiser still.

This blog was composed on 4th February 2022. The share price on the date of publication (10th February 2022) was $14.05.

vysyble

1st December 2021 – Fantasy Football – The Fan-Led Review findings fall short of the necessary value-driven approach to regulatory reform.

23rd June 2021 – Road to Nowhere – Football stands at the crossroads ahead of the Fan-Led Review process. We examine the key questions that it must answer.

11th May 2021 – Prime Numbers – Football’s elite clubs seek a route to profit as fans yearn for sporting tradition. In between lies a gulf of mistrust and misapprehension.

26th April 2021 – A Bitter Pill – GSK’s new strategic direction fails to find riches in the middle of a pandemic when other pharma companies have prospered.

25th April 2021 – The Wrong Stuff – American-style football league won’t wash but the conditions that led to its launch are still present and are likely to get worse.

19th April 2021 – Super League Arrives – As we predicted, football’s elite breakaway emerges from the shadows.

30th March 2021 – $hooting B£ank$ – Arsenal’s commercial performance analysed.

22nd February 2021 – Measure for Measure – Take two financial measures, add pandemic and stir.

18th January 2021 – The Football Factory – If football was an industrial entity…

8th January 2021 – The Oil Majors – An Update – A shareholder return performance review of the 4 major oil companies in 2020.

10th December 2020 – Pump Up The Volume – ExxonMobil comes under fire from an agitated investor.

16th November 2020 – The Pain Game – Manchester United’s Q1 2021 financial release opens the lid on a Covid-19-affected financial can of worms.

11th November 2020 – A Tight Squeeze – Football’s Elephant in the Room leaving little space for financial relief.

29th October 2020 – Form and Function – Proposals-a-plenty for football’s structural reform.

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport.

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy.

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses.

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return.

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak.

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances.

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle.

12th December 2019 – The Cost of Chasing Gold– In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League.

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club.

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes.

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League.

5th July 2019 – Chopping Board – Knives out for former Tesco chief.

25th May 2019 –Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’– Why the Economic Profit metric is the most transparent measure of business performance.

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness.

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance.

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table.

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics.

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds.

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.