10th December 2020

You may be surprised to learn that company Board of Directors rarely reference their (obvious) role in creating value for their shareholders. In leafing through numerous company annual reports, we often despair at the lack of thought with regard to the very institutions and individuals that have invested in the enterprise with the intention of receiving a return. And when we do find reference to ‘shareholder value’ it is more often than not a misinterpreted and misleading statement, which in turn raises more challenging questions regarding the Directors’ understanding of the concept of ‘value’ and ‘value creation’.

So when an activist investor – the US hedge fund Engine No. 1 – hurls the phrase ‘shareholder value’ back at one of the biggest oil companies in the world by revenue ie ExxonMobil, then we are definitely going to take a look and see exactly what is going on.

Two things immediately come to mind when we read of an “activist approach”…

- For Anglo-Saxon Capitalism to function at optimal levels, the management teams of major companies need to be held to greater account by their predominantly institutional shareholders. Many have been passive to strategies which clearly destroy value over time. Indeed in the UK in recent months, there have been some high profile examples including Hammerson, Intu and Marks and Spencer. Unfortunately for shareholders, the respective management teams have been rewarded rather handsomely for poor performance.

- Secondly, there will be the “siren” response from management teams that it is the pandemic which has precipitated whatever strategic difficulties they currently face. For some, and our view is that it is a minority, there is undoubtedly a degree of truth to this but our work on English football’s troubled economics and other industrial sectors strongly suggests that the pandemic has accelerated or given additional emphasis to strategic errors that were in place long before the emergence of the virus commonly known as Covid-19.

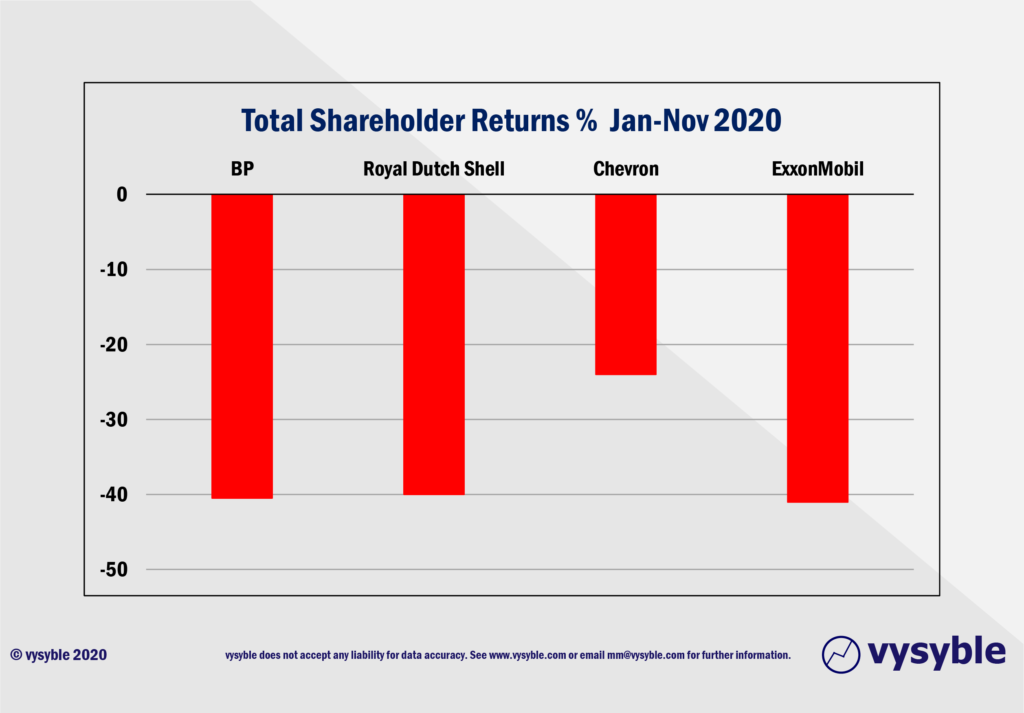

We believe that this is the case with ExxonMobil. 2020 has not been kind to the share price with a reduction of just over 40% in the 11 months ending 30th November 2020 and marginally higher than its most direct competitors.

Indeed, when considering a Total Shareholder Return (TSR) perspective during 2020, the company might be forgiven to some degree that oil in general has been the recipient of negative sentiment from the capital markets.

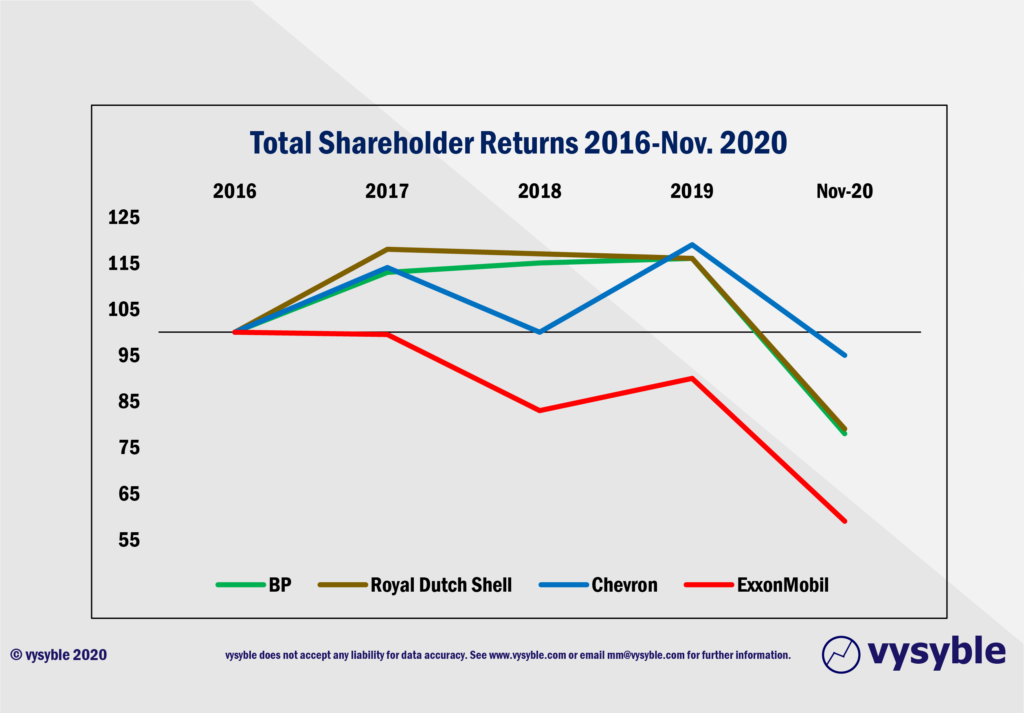

Of course, TSRs should ideally be viewed over a much longer time horizon. Set out below is the TSR performance rebased to 100 in December 2016, thus covering a period of 47 months to November 2020.

However, as the TSR graphic indicates, ExxonMobil has been in strategic difficulty long before 2020;

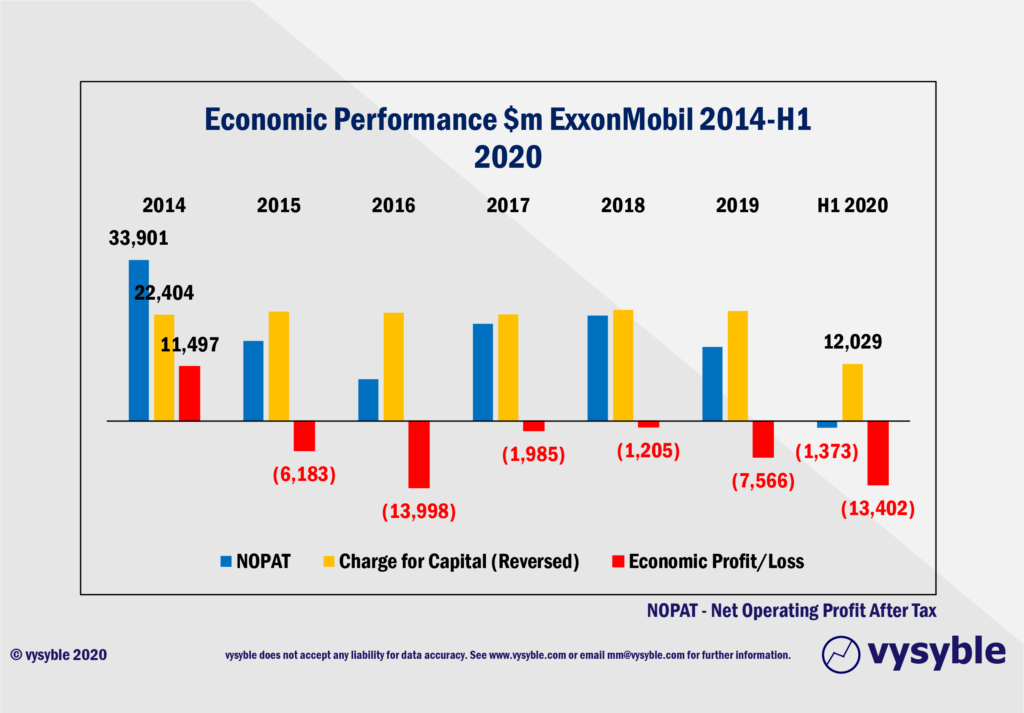

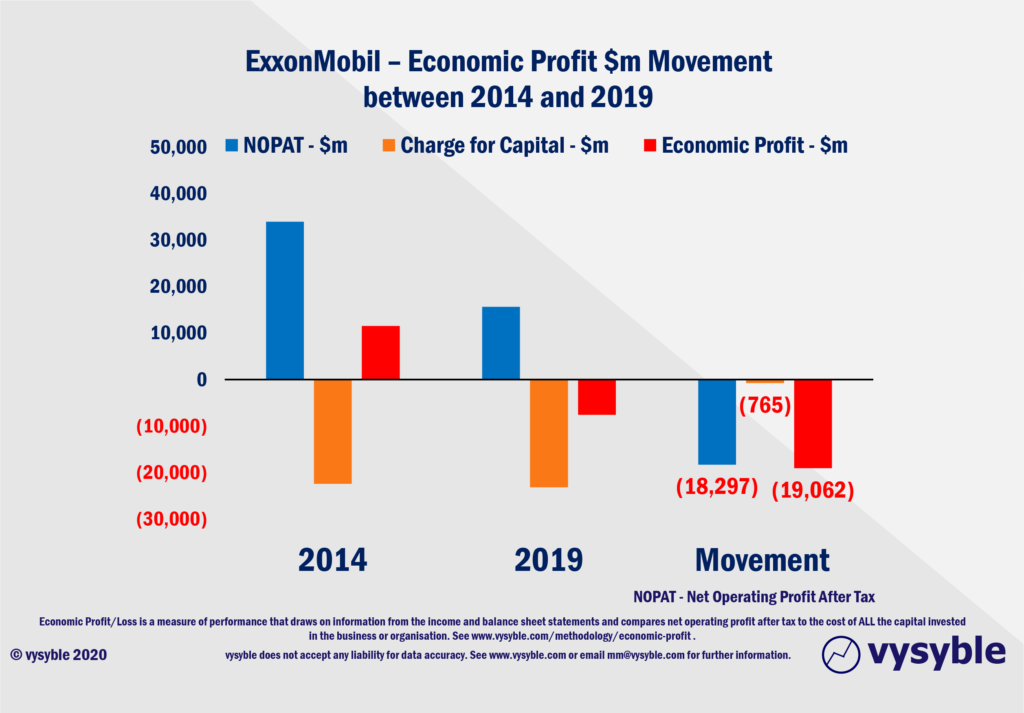

- Between 2014 and 2019, there is only one instance of an economic surplus (Net Operating Profit After Tax less a charge for ALL the capital used by the business) which was achieved in 2014 (see below). Despite this isolated triumph, the strategies adopted by ExxonMobil’s Executive Team during the period in question resulted in a quantum of value destruction (economic losses) totalling $19.4bn.

- When adding the $13.4bn economic loss achieved in the first six months of 2020 to the losses achieved between 2014-19, the total quantum of value destruction over the 6.5 year period since 2016 comes to $32.8bn. We need to be clear what this means; the Executive Team has adopted strategies that have transferred wealth to the tune of $32.8bn from their shareholders to other stakeholders.

To put this into context, ExxonMobil had 74,900 employees at the end of 2019. The degree of value destruction from 2014 equalled $473,917 for every one of those 74,900 employees.

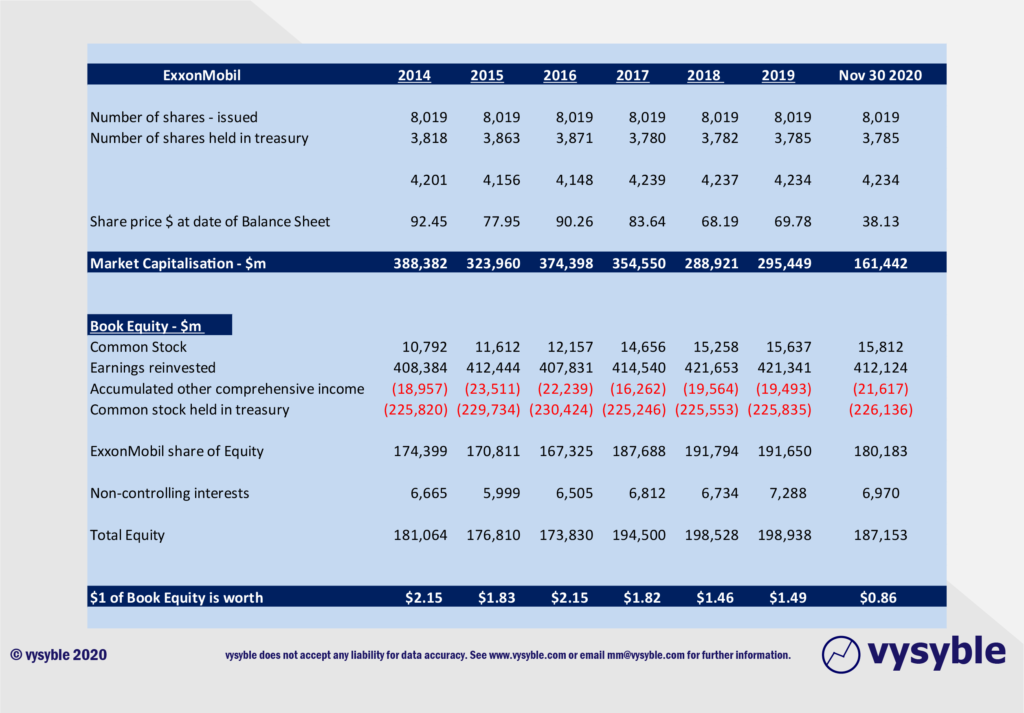

- At the end of 2014, $1 of book equity was worth $2.15 on the capital markets. By the end of 2019, $1 of book equity was worth $1.49, representing a fall of 30%.

- However, by November 2020 with a share price of $38.13, $1 of book equity was worth 86 cents on the capital markets ie the company’s market value has declined to less than that of book. (at the time of writing – 9th December 2020 – the share price has marginally recovered to $42.80 which in turn means that $1 of book equity is worth 97 cents). Seldom is it good news when the book equity value falls below the par value. What is certain is that the capital markets are not fans of, nor heartily endorsing, the company’s current strategy.

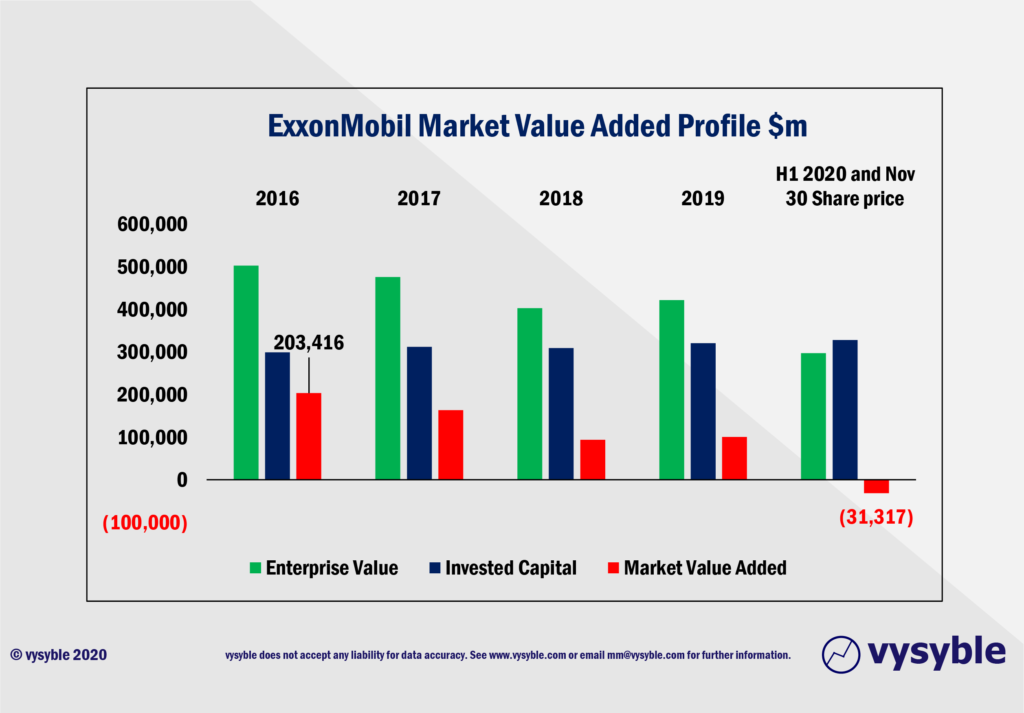

Market Value Added (MVA) defined as Enterprise Value less Invested Capital has fallen from $203.4bn at the end of 2016 to $100.7bn at the close of 2019. This is a fall of 50.5%. By the end of November 2020 and using the June 2020 balance sheet, MVA turned negative to the tune of $31.3bn. The fall in MVA from 2016 to November 2020 is a not inconsiderable $234.7bn.

Despite the above, the management team appear to be oblivious to the economic performance of the organisation under their responsibility. Here is an extract from the Chairman and CEO’s report from the 2019 Annual Report:

“Our strategy is supported by the strongest portfolio of opportunities we’ve seen since the Exxon and Mobil merger more than two decades ago. Our broad and diverse growth portfolio, which leads the industry, is capable of generating returns even at the bottom of the commodity price cycle, as we capture value in a favorable cost environment…

Our progress in the past year, our advantaged opportunity set, and our clear forward plan make us confident we can deliver on our commitments and create significant value for you, our shareholders.”

Darren Woods – Chairman and CEO. 2019 Annual Report

There is no mention of the quantum of economic losses, the decline in economic performance or the disturbing MVA position.

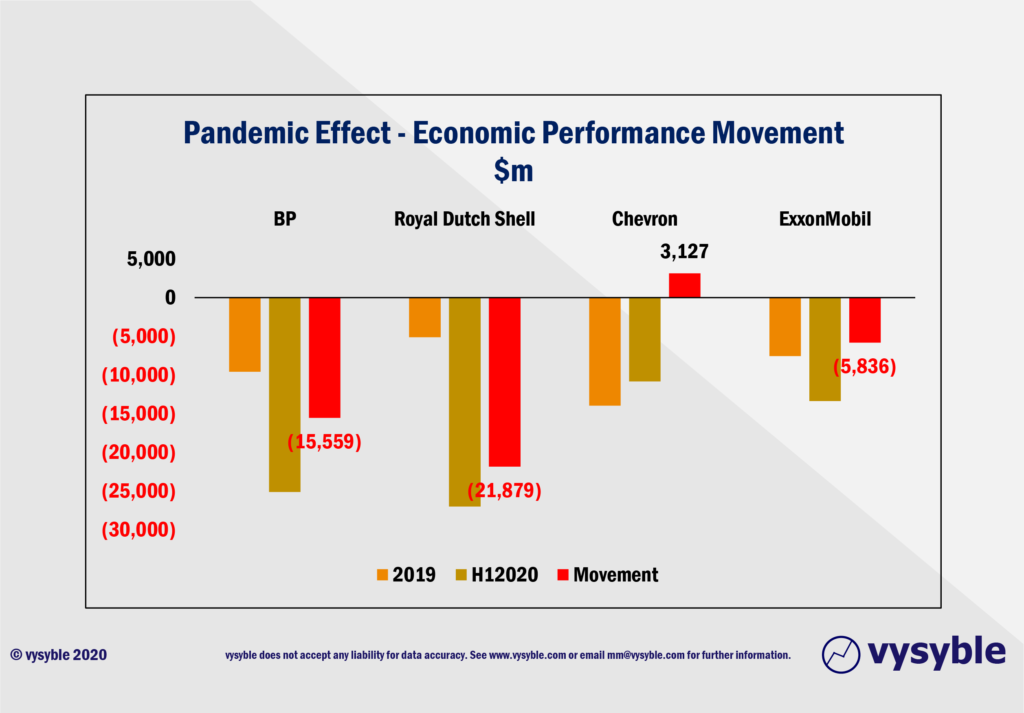

The management team will no doubt blame the pandemic. Accordingly, we set out below the economic profit performance for the full year of 2019 with the published half-year numbers from 2020 for BP, Royal Dutch Shell, Chevron and ExxonMobil. Only Chevron has managed to produce a lower half-year loss in 2020 than the full-year 2019 balance. Interestingly, it also has the ‘least-worst’ TSR performance of the cohort in 2020.

The approach from Engine No. 1.

It is against this background that Engine No. 1, a recently formed “activist” fund with a $40m stake (or 0.02%) in ExxonMobil, is calling for changes to the company’s management team and strategy.

With such a small stake, it will need wider investor support but given ExxonMobil’s track record of value destruction it seems highly likely to us that further support will materialise. Indeed, in its comprehensive and well-written ‘manifesto’, Engine No. 1 is calling for four new Independent Directors to be appointed to the Board. The individuals concerned (and named) within the document would appear to be highly experienced operators in the oil and gas industry.

However, we are not entirely convinced that the problems facing ExxonMobil are due to a lack of expertise in oil and gas at Board level. Let us stress and for the avoidance of doubt we have not met with the Executive Team of ExxonMobil, but from our experience there are countless companies from many sectors and industries with deep knowledge of their industry or market segment. Unfortunately, many fail to leverage this valuable ‘know how’ into strategies that are value creating, not only for the shareholders in the first instance but also for other stakeholders in a broader context.

Frankly, the use of metrics which fail to include all of the costs of doing business, particularly the cost of equity capital, frequently provide management teams with a misleading picture of the economic or value-driving ‘engine room’ of the business. Consequently, the defined priorities and subsequent strategy are in danger of being severely misaligned with the true value creation dynamic of the business. And thus, the new strategy is doomed to fail even before it has managed to pass the starting gate.

Indeed, when the strategy fails to produce the anticipated returns, the common reaction of company leaders is to blame the execution rather than the content in the belief that they can’t be wrong. This frequent doubling-down on the initial strategy locks the enterprise into a destructive spiral of value destruction. Sadly, this is also often reinforced by equity analysts who still believe that earnings per share drives the share price.

Our work on the MVA position of ExxonMobil strongly suggests that there is too much capital on the Balance Sheet which is not producing returns greater than the cost of that capital and in the first instance we would be seeking to find where or in what activity said capital relates to.

The most common errors that we see when we put company strategies under the spotlight are;

The strategy has the wrong objective or unclear and confused objectives

It is viewed as a periodic event rather than on ongoing process

It is not fact-based but is clouded with too much judgement and ‘experience‘

It has an inadequate economic underpinning

It is more of a presentation than a debate

It is too internally focussed

It does not consider alternatives in the correct manner

It does not drive management priorities and actions

It is delegated to outsiders…

…or even worse, it is delegated to the Finance Dept.

And finally, it really is all over when hubris creeps in.

It is highly unlikely that ExxonMobil is underperforming its competitors because it has a lack of expertise in oil and gas exploration. More probably, it is a combination of the issues concerning strategy as outlined above.

Within Engine No. 1’s open letter to the Board of ExxonMobil there is an excellent section entitled ‘Failure to align Management Compensation with Value Creation for Shareholders’. It is clear to us that there is a disconnect here between performance and reward. Of course, we would also advocate a more explicit value or governing objective for the ExxonMobil business. This is something that is not entirely clear from reading the Annual Report. Furthermore, we would encourage a more explicit link between senior executive remuneration and the achievement of a value-based objective.

It is a pity that we do not see this type of action more often. We find that the recognition of the dynamics associated with value creation are generally ignored for near-meaningless KPIs and statements of intent despite the incredible and well-documented successes achieved by Roberto Goizueta at Coca-Cola and Sir Brian Pitman at Lloyds Bank who, along with others, pursued value-based strategies with outstanding results for both shareholders and other stakeholders.

It is, therefore, good to see Engine No. 1 providing some considered lubrication and volume in this regard.

vysyble

Follow vysyble on Twitter

16th November 2020 – The Pain Game – Manchester United’s Q1 2021 financial release opens the lid on a Covid-19-affected financial can of worms

11th November 2020 – A Tight Squeeze – Football’s Elephant in the Room leaving little space for financial relief.

29th October 2020 – Form and Function – Proposals-a-plenty for football’s structural reform.

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport.

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy.

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses.

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return.

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak.

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances.

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle.

12th December 2019 – The Cost of Chasing Gold– In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League.

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club.

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes.

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League.

5th July 2019 – Chopping Board – Knives out for former Tesco chief.

25th May 2019 –Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’– Why the Economic Profit metric is the most transparent measure of business performance.

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness.

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance.

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table.

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics.

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds.

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.