23rd June 2021

Introduction

Football’s constituency covers a broad church of interests ranging from the Sunday-morning pub teams playing in the lower reaches of football’s oft-quoted ‘pyramid’ all the way up to the elite group in the Premier League which eventually caused so much turmoil in recent months with the European Super League concept.

Somewhere in between lies a multi-layered, multi-aged and multi-talented melange of clubs, leagues, associations and patrons. Charles De Gaulle was once quoted as saying that it was a near-impossible task to govern France given that it had 264 different types of cheese. Football in England may not be so different.

The announcement that six clubs from the EPL were to join a European Super League and the resulting outcry, largely but not exclusively from fans, appears to have been the catalyst to this review. That said, whilst we welcome Ms. Crouch’s undoubted enthusiasm and passion for the beautiful game, we do have deep and profound concerns regarding both the substance and the membership of the review.

As fans of the game, we hope that the review does make good progress. For too long, ‘football’ in its broadest context has been reluctant to take a good, long hard look at both itself and economic realities therein. From experience, and having offered our research to a number of key stakeholders including Ms. Crouch, we are well aware of the game’s inherent tendency to push challenging issues into the long grass or even to deny their existence.

Indeed, Ms. Crouch, as quoted in “The Athletic” on 27th May 2021, offers her own thoughts on the issues at hand:

“The question is actually not about an independent regulator. It’s about what it regulates. And I think that’s going to be the sticking point. I think the Premier League and the FA and co have become a lot more open-minded and perhaps recognise now that this is the future of what it looks like.

“It is about what it will regulate and also where does it sit? Is it a separate regulator, like an Ofcom? Or is it a beefed up but entirely independent football regulatory authority that still sits within the FA family? Those sorts of questions are what the lawyers and the experts on the panel are going to be able to help with.”

The starting point for the review is the brief or terms of reference, as highlighted by the following listing on the www.gov.uk website:

- Consider the multiple Owners’ and Directors’ Tests and whether they are fit for purpose, including the addition of further criteria;

- Assess calls for the creation of a single, independent football regulator to oversee the sport’s regulations and compliance, and its relationship with the regulatory powers of The FA and other football bodies;

- Examine the effectiveness of measures to improve club engagement with supporters, such as structured dialogue, that were introduced on the back of the Expert Working Group;

- Investigate ways league administrators could better scrutinise clubs’ finances on a regular basis;

- Examine the flow of money through the football pyramid, including solidarity and parachute payments, and broadcasting revenue;

- Explore governance structures in other countries, including ownership models, and whether any aspects could be beneficially translated to the English league system;

- Look at interventions to protect club identity, including geographical location and historical features (e.g. club badges);

- Examine the relationship between club interests, league systems and their place within the overall football pyramid.

On the face of it, it is all very interesting but our concern is that (sadly) the entire initiative is in danger of missing the point and will face yet another wasted opportunity to address the important and worrying issues facing the game. In essence, the above questions are in total and in effect seeking to establish or find the value-maximising (in the broadest sense of the phrase) strategy for football.

However, given the outputs from several Committee members and also much of the commentary across the media since the European Super league announcement, we are firmly of the view that there is a fundamental misunderstanding of the underlying economics of the game, particularly those associated with the English Premier League (EPL).

Thus, even before the review has kicked off, we believe that there are a number of in-going perceptions, including the notion that football is value-creating, which are both confusing and grossly misleading. In addition, we question why the level of payments to players and agents is not being explicitly addressed?

At this initial stage, the capacity for mistakes in strategy formulation is significant and in our experience usually consists of one or more of the following:

- Strategy has the wrong objective (or unclear / confused objectives)

- Strategy discussion dominated by ‘visions & missions’

- Strategy is viewed as a periodic event rather than an on-going process

- Strategy is not fact-based – too much reliance on ‘judgement and experience”’

- Strategy has an inadequate economic underpinning

- Strategy is more a presentation or a ritual than a debate

- Strategy is too internally focused

- Strategy does not drive management priorities and actions

- Strategy is delegated to outsiders

- Strategy is delegated to Finance Dept.

- Hubris creeps in….

Here are the tests that we would apply to evaluate a ‘strategy’ for any given organisation:

- The Governing Objective test.

- Does the strategy set out to maximise the value of the business by maximising the growth of future Economic Profit (see later) whilst taking into account the wants and expectations of all Stakeholders?

- The Economic Framework test.

- Is the strategy based on a robust understanding of the economics of markets, customers, and competitors?

- The Factbases test.

- Is the strategy based (to a significant degree) on facts rather than opinions?

- The Alternatives test.

- Does the strategy process identify and evaluate alternative proposals in order to develop the value-maximising strategy?

- The Continuous test.

- Is the strategy process on-going and continuous in order to cope with and exploit threats/opportunities as they appear so that we always have the value-maximising strategy?

- The Execution test.

- Is the effective execution and the adjustment of selected strategies monitored and managed robustly?

At this point, we return to remind ourselves that there is a misunderstanding of the economics of the game by those in positions of authority and elsewhere.

Therefore, we argue at this incredibly early point in our assessment that the review does not have the necessary expertise to prepare the relevant information necessary to understand the Economic Framework test.

Additionally, football is hampered by a number of widely held in-going beliefs and myths which prevent an honest and robust assessment of its economic reality. These include;

- Revenue (and growth thereof) is in all circumstances a good surrogate for value creation and strategic progress. This ridiculous notion is given further credence by the annual publication of a list of European club revenue numbers which in turn is given additional and bogus credibility from journalists who really ought to know better…

“FC Barcelona has become the world’s richest football club for the first time, thanks to recent changes to the Catalan team’s merchandising business that has provided a financial edge over its peers.” – FT Jan 14, 2020

“World’s richest football clubs 2021: Barcelona top Deloitte Football Money League ahead of Real Madrid while Bayern Munich overtake Manchester United” – City AM

“Which are the world’s richest football clubs in 2021?” – Goal.com

Reality = FC Barcelona is believed to be 900m euros in debt with numerous media outlets reporting significant financial difficulty at the club. Revenue does not equal wealth.

2. That “earnings-based” accounting metrics are a sound indicator of wealth creation. They are not and never have been. There is no credible evidence supporting this ‘myth’. The earnings metric is an incomplete measure of performance and therefore unreliable in establishing the scale of value creation and destruction for any organization, including a football club.

Reality = Man.Utd’s share price has moved from U$14 at IPO in 2014 to US$15.40 as of 15/6/2021. EBITDA is proudly touted as a measure of cash-generation yet share price growth is near-stagnant – see later for further quotes from both Goldman Sachs and McKinsey.

3. A belief that the revenues from TV would both increase and continue indefinitely notwithstanding the very challenged economics of the TV companies. Even before Comcast acquired Sky in 2018, the economic performance of Sky plc was arguably challenged. At the time of writing, BT is believed to be trying to reduce their interest and financial exposure in all things football.

Reality = the 2016-2019 domestic TV deal reduced the revenue received per game from £10.14m to £7.72m, a decrease of 26% as a result of the Premier League increasing the number of live games from 168 to 200 to maintain contract values.

4. A belief that football clubs are a “social asset”. Apparently, they do not need the outputs and visibility that high-end, economically-based metrics can provide because football clubs are not for profit’ entities. Curiously, advocates of this perspective seem unable to credibly articulate what would therefore be an ‘acceptable loss’.

Reality = Football clubs are subject to the same business rules, laws and financial dynamics as any other limited company in England & Wales.

5. Allied to the above point, a belief that the ‘economic gravity’ for football clubs is somehow different or even immune to the general economic cycle. Experience demonstrates that they are anything but immune. Indeed, it is a belief which has the potential to be hugely damaging.

Reality = As in other lines of business, football clubs are subject to the economic realities of the day with flexible asset values and variable cash flows.

6. That increasing popularity or potential popularity is a surefire guarantee that value creation, as night follows day, will somehow accrue.

Reality = The popularity of the Premier League is without precedent. However, in pre-Covid 2018-19, record club revenues of £5.1bn were matched by record economic losses of £599.54m.

7. That relative valuations (Forbes list etc.) are somehow a reliable indicator of the economic value and potential of the clubs. For example, ‘football clubs are valued at 5 times revenue‘ was mentioned several times by participants during a recent and excellent seminar on football finance hosted by Pinsent Mason.

Reality = Why not 6x or 4x revenue? An absurd notion that deserves an absence of oxygen and as we shall see later on, revenue has been increasing steadily for Premier League clubs yet economic profits remain largely elusive.

The net effect of all this is a commentary that is largely ill-informed about the true economics of the game and consequently politicians, the public, the fans and other key stakeholders have a misleading and, at times, a wholly incorrect understanding of the game’s fundamental economics. As they are not seeing the business, or football club, as it truly from a financial standpoint, the owner/board of directors will focus on the wrong priorities and hence have a strategy misaligned with longer-term success and survival.

In 2020, we observed a Parliamentary committee interrogation of Mr Rick Parry who, in our view, demonstrated extreme patience when every second question from MPs seemed to be based on the notion that the Premier League should find additional resources to fund clubs within the Championship and further down the ‘football pyramid’. As we shall demonstrate later, the Premier League clubs have achieved regular and large-scale economic losses for some time and do not have the assumed wealth (notwithstanding huge revenues) to fund clubs further down the football pyramid over and above current commitments.

This is not to say that there isn’t a moral or ethical case that a given percentage of the revenues accruing to clubs in the Premier League should be allocated to clubs further down the league(s) but for the moment there are enough factors in play. Thus, we will persevere with what is rather than what should be…

What do we mean by value creation?

This is often challenging for a number of commentators so at this stage, we will endeavour to keep this as simple as possible.

Firstly, we will start with a basic principle. In 1890, the great economist Alfred Marshall published “Principles of Economics” (New York MacMillan) in which he stated the following:

“Value is created by investing capital and generating a return greater than the cost of that capital”

So, it seems opportune to ask the reader, in the same way as one often does when presenting this to a live audience – do you understand and agree with that statement?

If your answer is no, then please stop reading this blog. However, if your answer is yes, then the next question is as follows;

“Is this the picture presented by modern day financial accounting statements?”

(Answer – no, it is not.)

For perfectly legal reasons, together with a principle rooted in ‘stewardship control’ around the time of the Industrial Revolution, financial accounting statements do not comply with Marshall’s definition of value creation. The cost of ALL the capital is NOT reflected within the accounting perspective with the result that value destruction tends to be under-stated whilst value creation is over-stated.

Broadly speaking, companies and organisations are funded by debt to some degree, the cost of which is reflected in the annual accounting statements. However, the cost of equity capital (share capital and accumulated reserves) is not reflected in the accounting approach.

Therefore;

- Value is created by investing capital and generating a return greater than the cost of that capital.

- Value is destroyed by investing capital and generating a return lower than the cost of that capital

At the end of the 1950s, Modigliani and Miller won the Nobel Prize in economics by proving that:

- There is a cost to equity capital,

- The cost of equity capital can be calculated with their Capital Asset Pricing Model (CAPM) which can be considered to be an algebraic representation of risk and return.

Frequently, when the cost of equity capital is included within the overall calculation of value, one observes a vastly different picture of the organisation’s economic performance and hence its value. Indeed, it can frequently unlock a management’s team understanding as to why the company share price is under-performing even though their strategy is producing ‘accounting profits’.

To put it simply, this is why some of the genuinely great businessmen of the modern age, including Roberto Goizueta at Coca-Cola, Sir Brian Pitman at Lloyds Bank and Jim Kilts at Gillette, alongside many others adopted economic profit as their principal compass in their strategy discussions and deliberations. The result was staggering returns for shareholders, customers and other stakeholders.

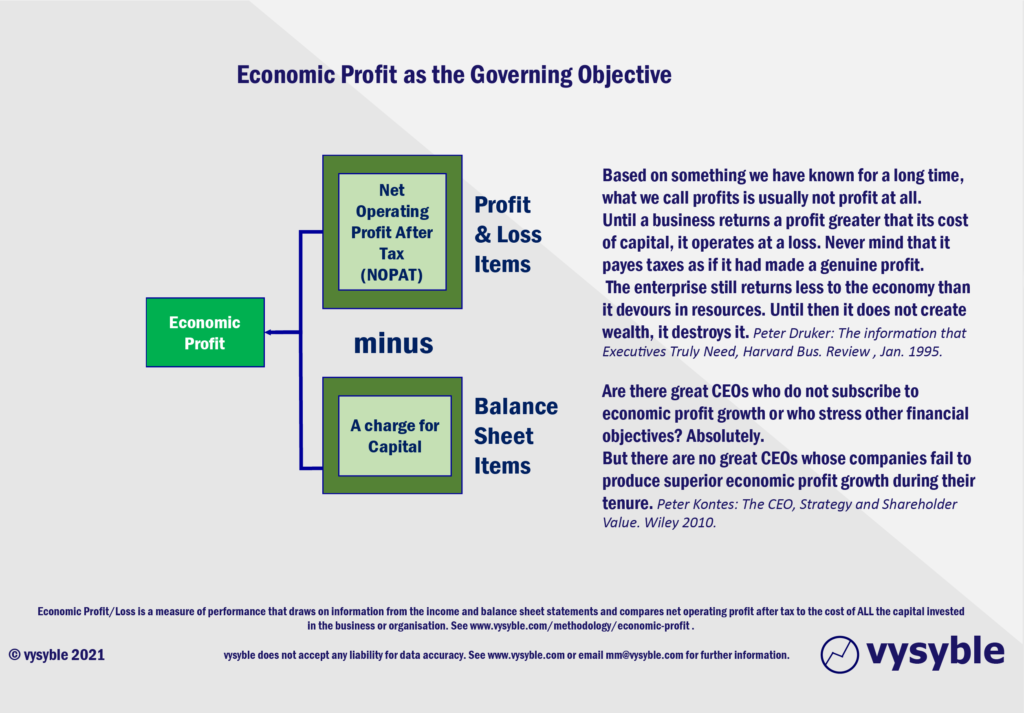

Note that the economic profit metric (see illustration) includes a charge for all the capital used by the organisation.

“Creating economic profit is the single most important driver of the stock price of the Coca-Cola company” – Roberto Goizueta, former Chairman and CEO of the Coca-Cola Company

“The EVA (i.e., Economic Profit) approach to equity analysis has become increasingly popular because it more accurately reflects economic reality (as opposed to accounting reality) when compared with many traditional valuation measures such as earnings per share (EPS), return on equity (ROE), and free cash flow; those accounting-based measures can be distorted by accounting practices. They also include the cost of debt and exclude the cost of equity…

Focusing on the variables that drive the underlying economics of the business, rather than on accounting-based benchmarks, should result in improved management, financial analysis, and ultimately, enhanced shareholder value” – Goldman Sachs

‘While there are many indicators of market-beating strategies, in our experience Economic Profit is highly revealing.’– McKinsey: The Strategic Yardstick You Can’t Afford to Ignore – 2013

“As an illustration of how executives get caught up in a short-term EPS (earnings per share) focus, consider our experience with companies analyzing a prospective acquisition. The most frequent question managers ask is whether the transaction will dilute EPS over the first year or two.

Given the popularity of EPS as a yardstick for company decisions, you might think that a predicted improvement in EPS would be an important indication of an acquisition’s potential to create value. However, there is no empirical evidence linking increased EPS with the value created by a transaction. Deals that strengthen EPS and deals that dilute EPS are equally likely to create or destroy value…

If such fallacies have no impact on value, why do they prevail?

The impetus for short-termism varies. Some executives argue that investors do not let them focus on the long term; others fault the rise of shareholder activists in particular.

Yet our research shows that even if short-term investors cause day-to-day fluctuations in a company’s share price and dominate quarterly earnings calls, longer-term investors are the ones who align market prices with intrinsic value”

McKinsey, first published in ‘The Real Business of Business, March 2015

How does this all work in practice? We have included a small number of examples whereby the accounting viewpoint delivered a very different picture to that of the economic perspective but with catastrophic consequences.

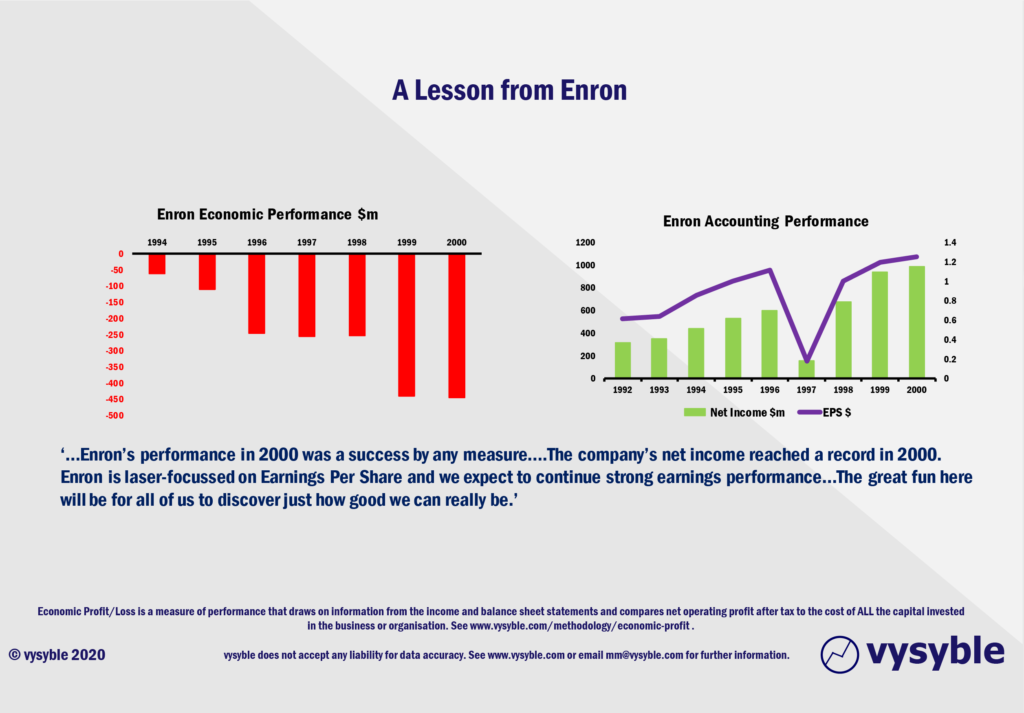

Enron

Set out below is the data for Enron. For those of you who are too young to remember, this was the largest corporate collapse in history before the 2007-8 banking crisis. The left-hand chart reveals that in the several years leading up to its demise, the company was posting significant and increasing economic losses i.e., it was failing to generate returns greater than the cost of its capital. The right-hand chart shows accounting net income and earnings per share which reveals a more ‘optimistic yet incomplete perspective.

There were a multiplicity of factors driving Enron’s collapse but can we at least agree that a management team using the left-hand chart would have a different set of priorities than one reviewing the right. The accounting perspective does suggest that all was well. The worrying aspect for us with this very pertinent example is that there are clear parallels with football and how it sees its own financial position.

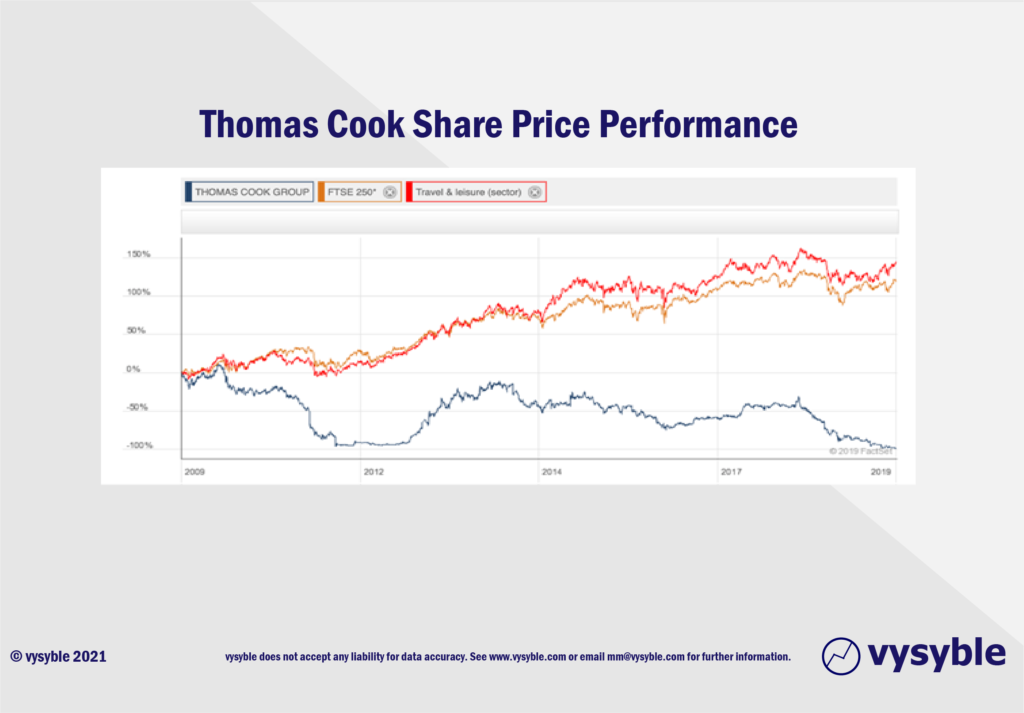

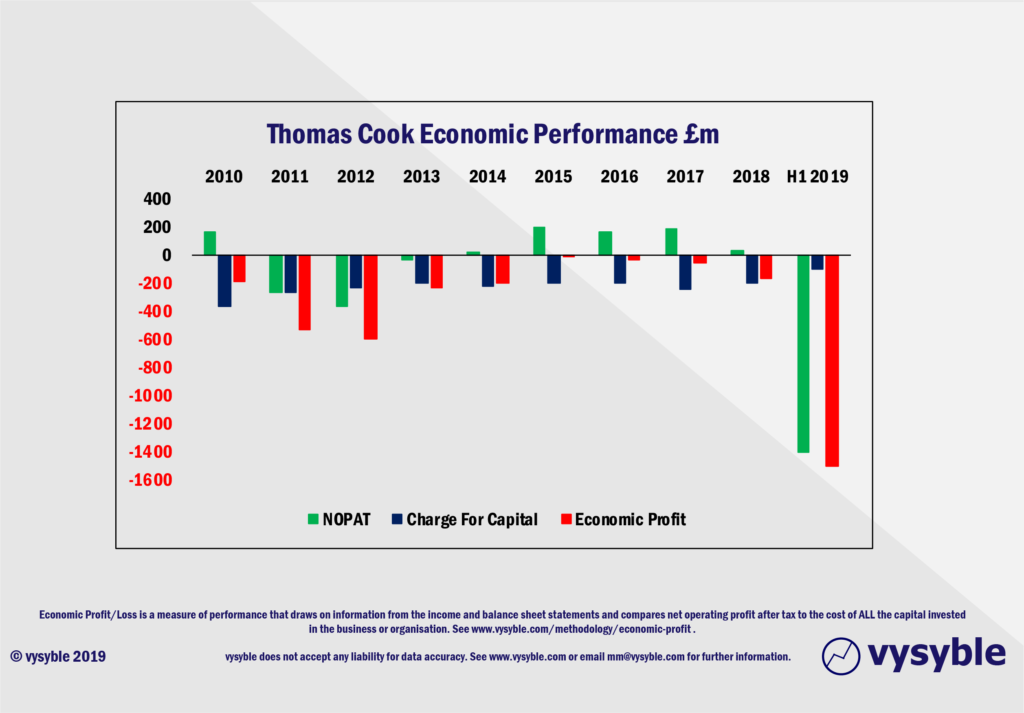

Thomas Cook

Thomas Cook shares consistently underperformed the wider equity market along with the travel and leisure sector indexes, principally due to its poor economic performance resulting from the strategies adopted by the senior management team.

Indeed, in the nine and a half years leading up to its collapse, Thomas Cook failed to produce a single positive economic surplus or, in other words, create value. All this, despite the Board rewarding the CEOs over that period with bonuses that might be described by a man on a London omnibus as ‘generous’.

Given the widespread surprise at the fate of Thomas Cook and the long record of value destruction, we are reminded of the Hemmingway quote from the 1926 novel The Sun Also Rises which includes the following snippet of dialogue:

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said, “gradually and then suddenly.”

Similarly, Rudiger Dornbusch, discussing Mexico’s economic crisis in the 1990s said:

“The crisis takes a much longer time coming than you think, and then it happens much faster than you would have thought.”

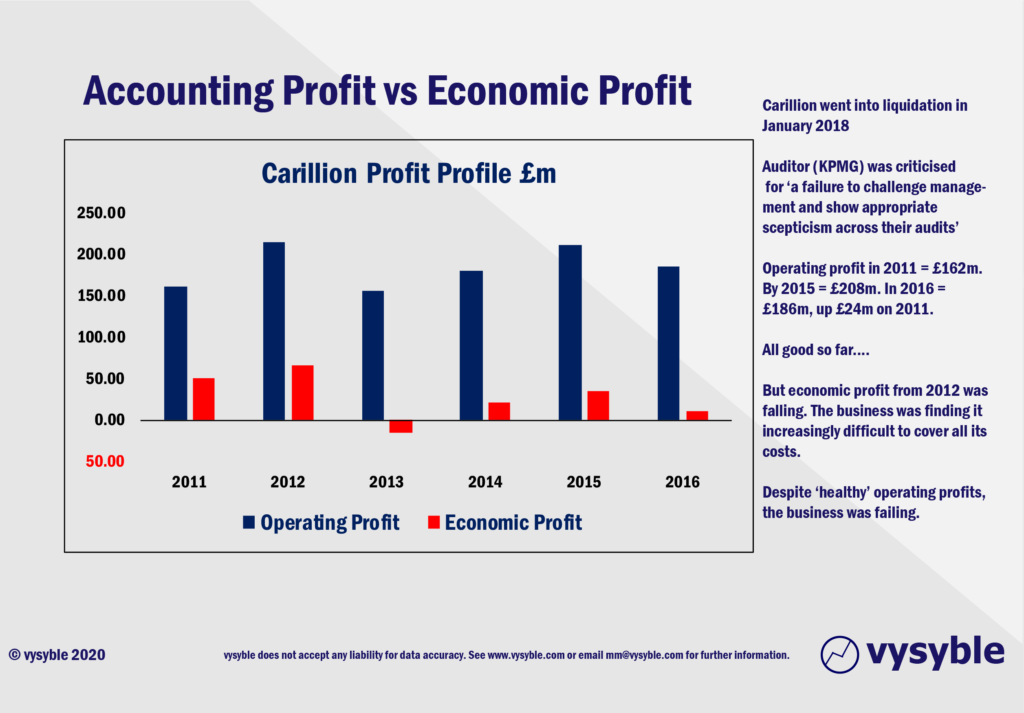

Carillion

In 2011, the company reported an operating profit of £162m which later peaked at £208m in 2015. By 2016, it had slipped back to £186m, but still represented an increase of £24m or 14.5% of the 2011 balance.

However, the underlying economic numbers reveal a more worrying position. In 2011, economic profit totalled £51m but by 2016 it had fallen to £12m; a decrease of £39m or 76%.

In January 2018 Carillion went into liquidation.

The point we are making with all of the above examples is this – you cannot manage what you cannot see.

This level of insight into the strategic performance of any business or organisation is extremely difficult, if not impossible, to achieve via accounting metrics alone which simply do not include all of the costs of doing business.

“As a managerial metric, economic profit (EP) has important advantages over earnings, return on investment, or even cash flow. Uniquely, it contains an income statement measure, a related balance sheet measure and an external capital market measure all in one number. This combination gives EP a signalling attribute that is superior to other financial metrics…It is not too strong a statement to say that without EP measures, a proper managerial understanding of the strategic position of the business and the strategic options it faces would be nearly impossible.”

The CEO, Strategy and Shareholder Value – Peter Kontes; Wiley 2010

Economic Profit and Football

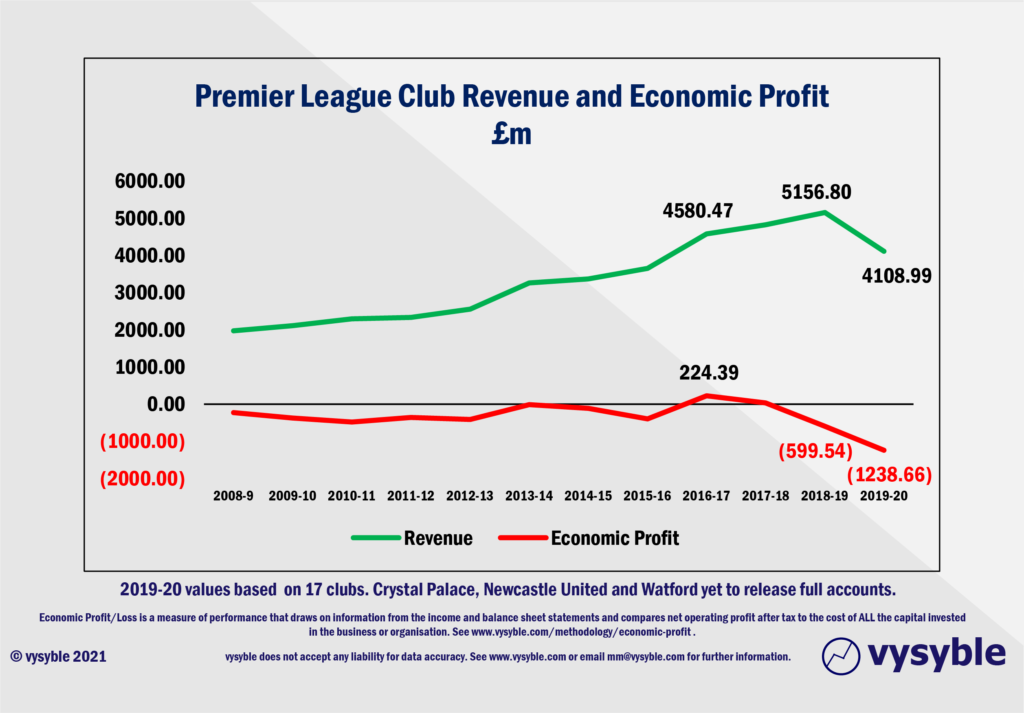

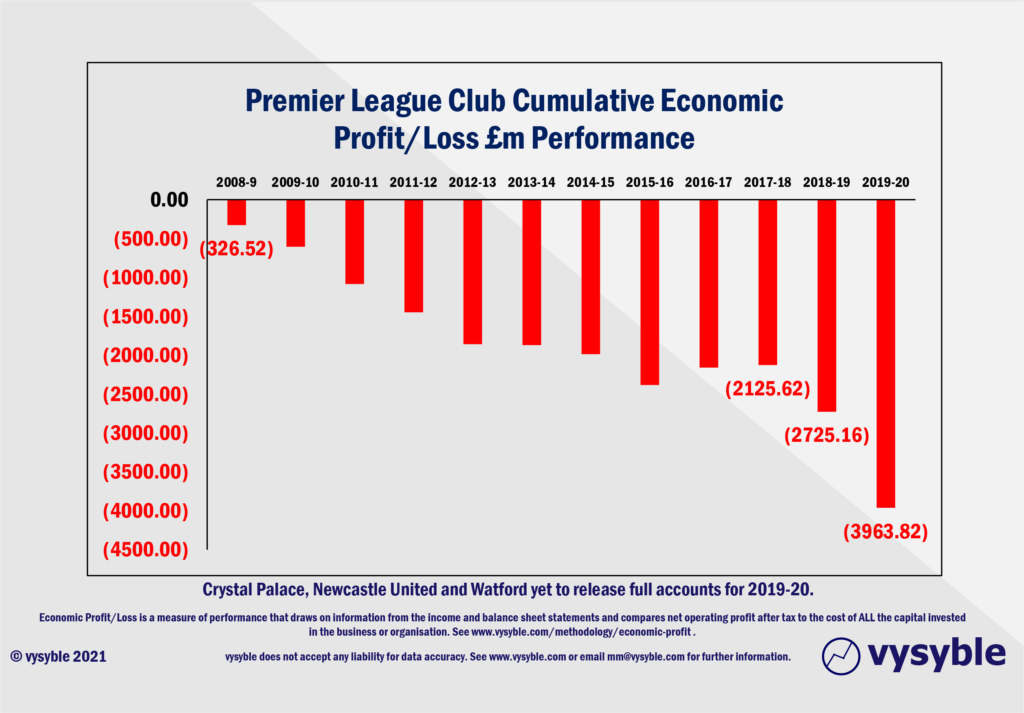

When we apply the economic profit metric to every club that has participated in the Premier League since 2008-9, what do we discover?

- Annual revenue for clubs competing in the EPL has grown from £1.9bn in 2008-9 to £5.16bn in 2018-19 – a staggering increase of £3.26bn or 171.5%

- Revenues over the period 2008-9 to 2018-19 totalled £36.0bn

- In the 11 seasons between 2008-9 and 2018-19, there are only two instances economic profits; in 2016-17 (£224.4m) and in 2017-18 (£31.6m)

- The total economic deficit over the 11 seasons to 2018-19 amounts to £2.7bn (despite revenues of £36.0bn)

- In the 2018-19 season and before the pandemic, the EPL produced both a record revenue number (£5.16bn) AND a record economic loss (£599.5m) – yet somehow the conflation/confusion between revenue and value or wealth creation persists.

With economic losses over an 11-year period totalling £2.7bn (and with more to come as a result of the pandemic), we struggle to understand statements like this;

‘…profitable performance and strengthening balance sheets, that looked so impossible a decade ago, are now the norm.’

Deloitte – extract from the 2018 Annual Review of Football Finance

There is a view, frequently expressed at conferences, that the popularity of the game in the emerging middles classes of India and China will produce revenues on a such a scale that the game’s economics will be restored to full health and beyond. We refrain from extreme fortune telling but in the 11 years since 2008-9, the 171.5% increase in revenue has certainly not been matched by economic surpluses which remain largely elusive.

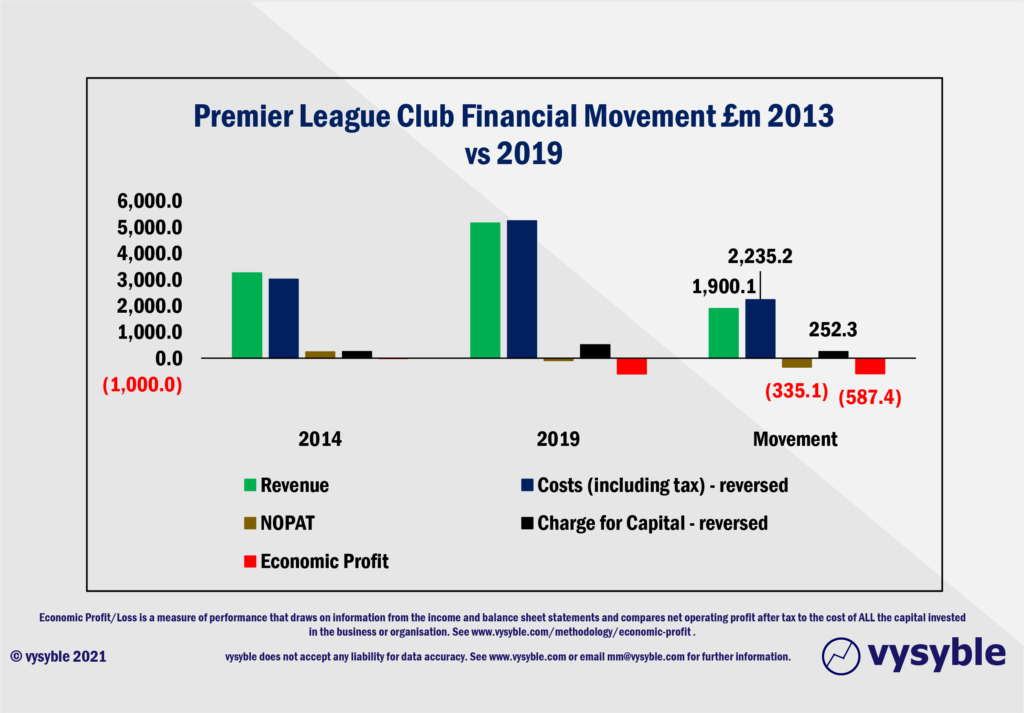

It seems to us, as independent observers, that increased revenues are in effect ‘soaked up’ by cost increments as illustrated by the graphic below.

As the diagram above reveals, in the 5-year period from 2013-14 to 2018-19, total revenues for clubs competing in the EPL rose by £1.9bn. Unfortunately, the cost base increased by £2.2bn; even before we address the charge for capital, the substantial revenue gains have been swallowed by the new and increasing cost base. In addition, the charge for capital has risen by £252m pa. The net effect is a £587.4m increase in economic losses.

Evidently, there are those who still believe that the Premier League is a form of cash-generative ‘money tree’….

‘The Premier League leads the football world in all three key revenue categories…What we are seeing is a continuation of club profitability, it is certainly not a one-off. We feel Premier League clubs have turned the corner and are entering a new era of sustained profitability.’

Deloitte, quoted on BBC News website, June 2016

Unfortunately, our continuing analyses confirms that the Premier League does not lead the world in cost control. This may be more a function of industry structure rather than lack of will or expertise.

Manchester United

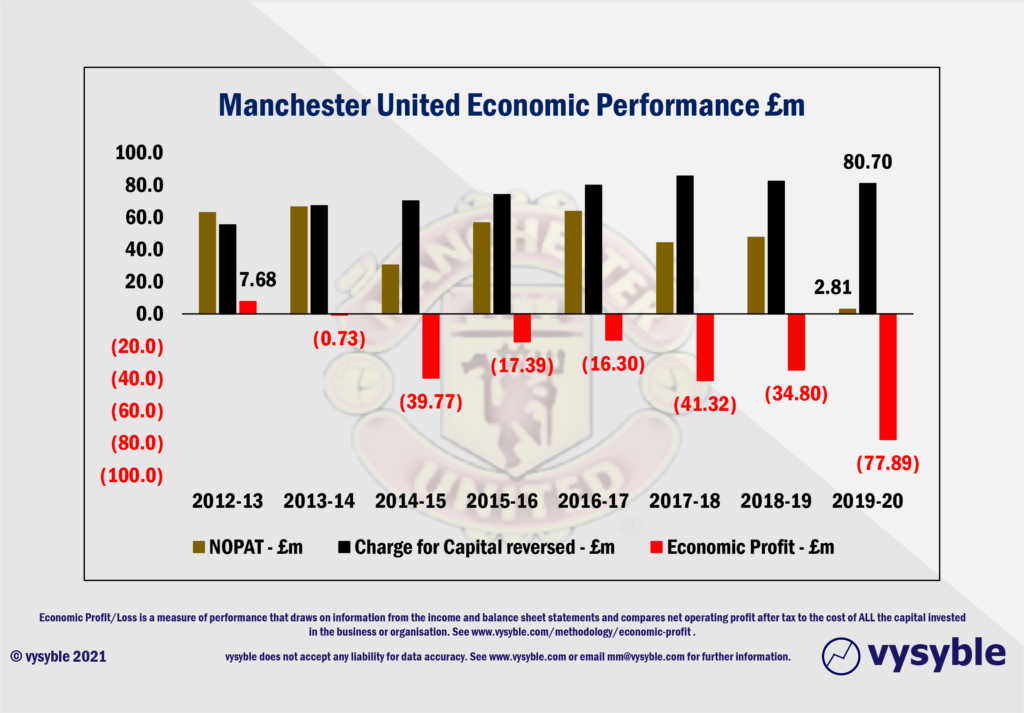

From 2013-2020, Manchester United achieved economic losses of £220.5m. The cumulative effects of the club’s strategy has produced a situation where it has taken revenue from TV along with the money earned from their commercial activities and the fans via matchday revenue and given it and £220.5m to other stakeholders, presumably to the players and their agents.

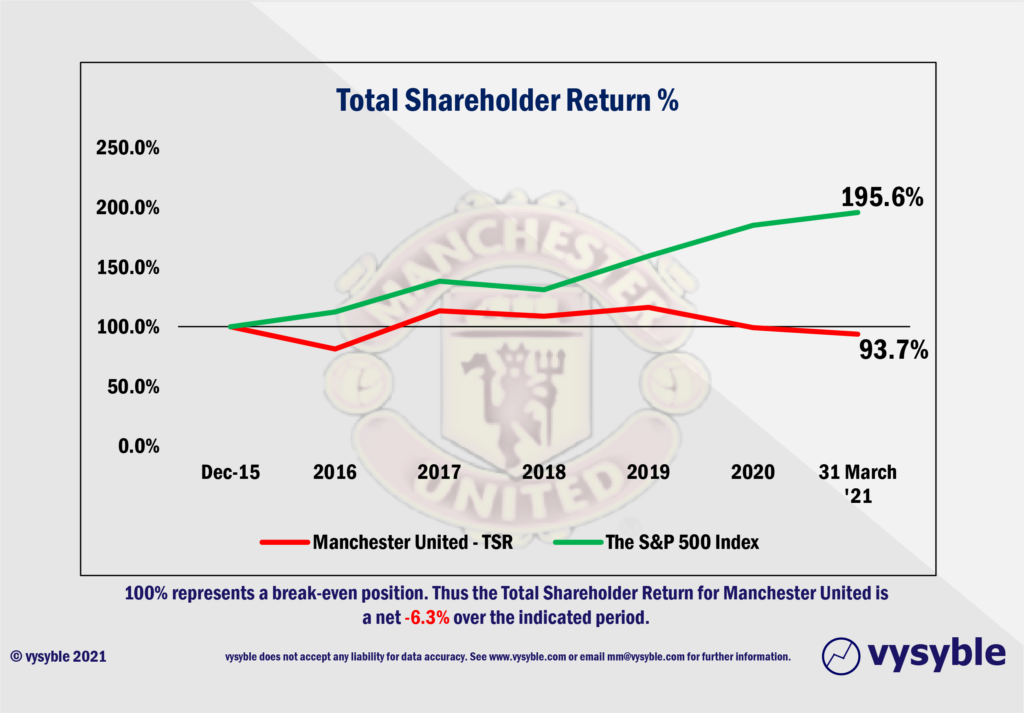

Thus, millions of investors who review the capital markets each day have collectively reached the conclusion that Manchester United is not the economic behemoth that some would have you believe, as indicated above by the negative net total shareholder return.

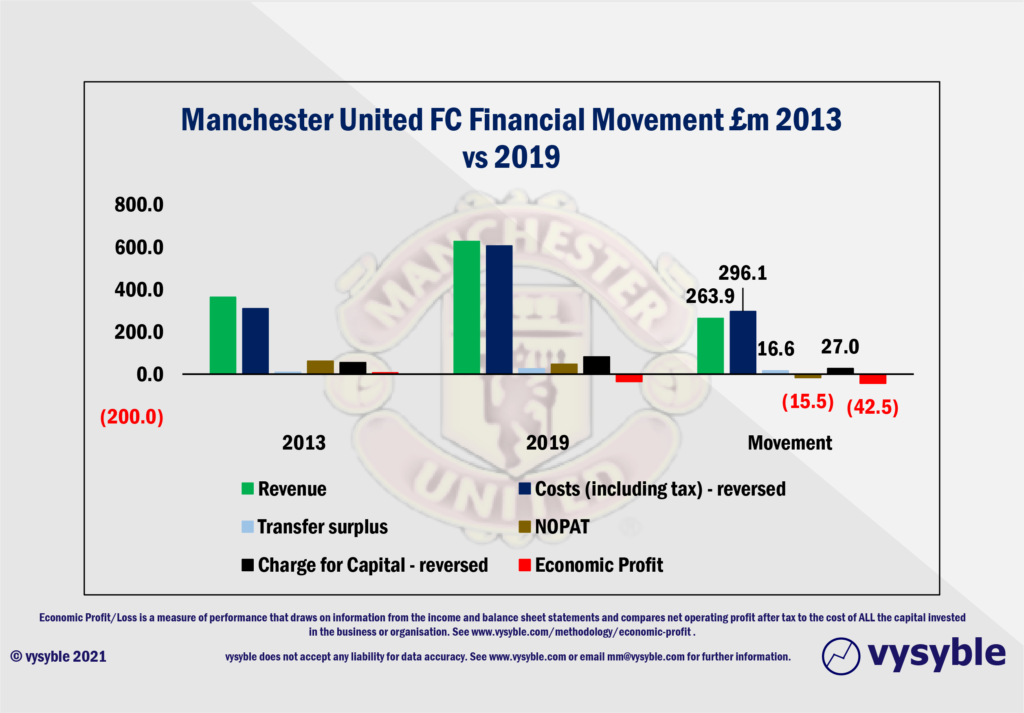

The above ‘Movement’ note goes some way to shedding further light on the lack of share price appreciation. Between 2013-2019, Manchester United’s revenue increased by £263.9m per annum (we are using 2019 as the benchmark, as 2020 is partially pandemic-affected). This is an impressive increase and a reflection of the club’s powerful commercial strategy.

However, the issue is the cost base which has risen by £296.1m per annum over the same period. In other words, the impressive rises in revenue have been swallowed by larger increases in the cost base, even before we get to add capital charges et al. The club’s rudimentary economics over time really do not stack up.

And so to be crystal clear on this point at this juncture, despite revenue gains that most clubs can only dream of, the most well-known and highest revenue-earning club in England is consistently destroying value over an extended period of time. It is, we suggest, a poor candidate for consideration if you are looking to bolster your pension fund.

It should come as no surprise, then, that Man United’s owners and executives were fully behind both Project Big Picture and Super League.

Everton

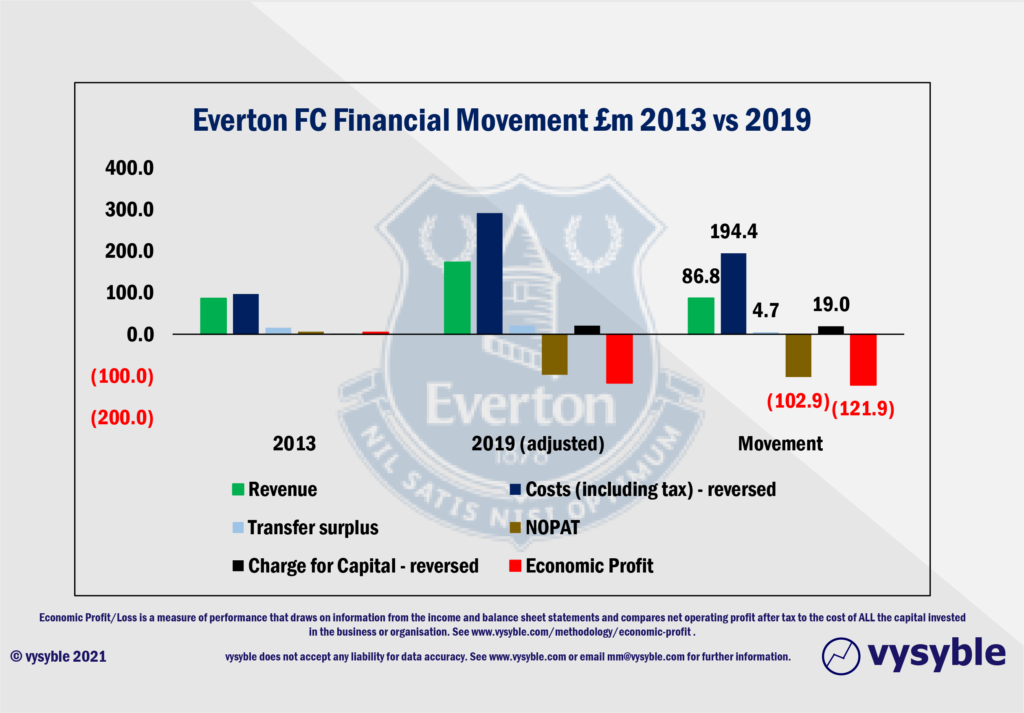

The CEO of Everton FC is a member of the ‘Fan-led’ Review committee. Set out below is a movement note between 2013-2019. As 2019 was a 13-month period, we have adjusted the numbers so that there is a meaningful comparison with 2013. The graphic reveals a more extreme version of the Manchester United example. In this case, revenue has risen by £86.8m between 2013-2019. Unfortunately, the cost base (prior to adding charges for capital etc) has risen by £194.4m resulting in an eye-watering £121.9m economic deficit increase;

In the most recent three accounting periods, Everton FC has destroyed over £300m in value as well as achieving two of the five largest-ever economic losses in English football history (-£156.31m in 2019-20 and -£128.85m in 2018-19).

So where are we?

We could debate the morality or indeed the integrity of the European Super League (ESL) for evermore but the widespread backlash to the concept tells its own story. What is of greater value is to understand how we all got here, which we do. In fact, we stated the following in a press release back in July 2018

‘The EPL retains the gambler’s main enemy – risk. The top six clubs are dominating proceedings in a way that points towards a desire to further reduce their risk, to the point of dispensing with the current EPL altogether. Clubs hope they will be able to recover the shortfall in domestic TV money from international media revenues and it is the top six clubs, who have not made a collective economic profit in years, that just negotiated to receive a bigger share. It is the increasing ambition of the Top 6 and their different fiscal approach that leads us to believe that the EPL is already on the road towards an end-game that will result in its ultimate demise and replacement by an NFL-style European Super League.’

All businesses should endeavour to listen to their stakeholders and, of course, football is no exception. If the review leads to greater fan representation, then all-in-all, we cautiously support such a development although clarity on what exactly is meant by ‘fan representation’ would be welcome. Currently, we feel it is nothing more than a soundbite.

However, greater fan participation or even the appointment of an independent regulator does not alter the fundamental economics of the game which remain challenging at all levels. Long before the emergence of Covid-19, the game destroyed value with alarming regularity and indeed we firmly believe that this is one of the principal drivers behind the ESL initiative.

Our concern is that in seeking to establish football’s capital flows, or what we would refer to as understanding the game’s economic engine room, the use of the wrong approach and metrics risks repeating the same mistakes experienced at Enron, Thomas Cook, and Carillion. We have many other examples in our research locker.

We do recognise that some people can struggle with the economic profit approach and we can think of several high-profile CEOs who have initially wrestled with more than a few of the uncomfortable messages that the analysis facilitates. In one particular case, following a very long and challenging weekend, a CEO eventually understood the calculation and the power of the associated insights. He wholeheartedly embraced the concept and for several years afterwards his company moved from industry laggard to a consistent membership of the ‘most admired companies in Europe’ listing. The company also became a high-performing, upper quartile stock market performer.

We challenge the Committee to make a similar leap, which given support for the economic profit concept from Alfred Marshall, Goldman Sachs, McKinsey, Peter Drucker, Roberto Goizueta, Sir Brian Pitman, Peter Kontes and many more, should not be too far a jump for people who are really committed to the cause.

Finally, our own work has revealed a number of trends and dynamics withi football’s fragile financial ecosystem, namely:

- The game is over-reliant on revenues from TV and more particularly a belief that said revenues will continue to rise by circa 30% every 3 years.

- Championship clubs are economically challenged with numerous failed financial gambles designed to achieve Premier League status which then lack the means to survive once the inevitable relegation ensues. Bolton Wanderers is a good example of this.

- Numerous clubs have faced financial difficulties. The EFL boasted to us back in 2017 that it had solved the problem of financial hardship as no club had experienced an insolvency event in the previous 7 years. Sadly, Bury FC became that club in 2019.

- The economics of the Premier League would sooner or later become unsustainable with little incentive to compete with billionaires and City/ Super States.

- Poor economic returns from the Big Six clubs and the increasing influence of American ownership would drive them towards the formation of a European Super League.

- That for every increase in revenues, there is a larger consequence to the costbase suggesting that the power within the game currently rests with the players and their agents rather than the clubs themselves.

Whilst our work has received extensive coverage across the globe, we have been struck by a lack of engagement from football’s governing bodies and numerous politicians. Indeed, in the past we have written to several members of this committee and have yet to enjoy the courtesy of a reply. Yet the game believes that it can resolve its problems with the existing toolkit.

Nevertheless, the danger of protectionism may be the hidden culprit if the eventual outcome is a neutered set of regulatory tweaks as the make-up of the committee appears to us to be heavily weighted towards Premier League interests.

In conclusion, deeply flawed analysis, poor leadership, a number of evidence-free myths, over-confidence and not a little hubris have in total conspired to give birth to the need for the review. The game is producing levels of value destruction that in just about any other industry would induce profound structural change. The European Super League is a predictable route in this regard. However, there are many within the game who are making a very good living and one wonders whether they have the wisdom and appetite to think above their own narrow interests and save the game from itself.

Over to you, Committee. Football is firmly in extra time and we hope it doesn’t come to penalties.

vysyble

Follow vysyble on Twitter

11th May 2021 – Prime Numbers – Football’s elite clubs seek a route to profit as fans yearn for sporting tradition. In between lies a gulf of mistrust and misapprehension.

26th April 2021 – A Bitter Pill – GSK’s new strategic direction fails to find riches in the middle of a pandemic when other pharma companies have prospered.

25th April 2021 – The Wrong Stuff – American-style football league won’t wash but the conditions that led to its launch are still present and are likely to get worse.

19th April 2021 – Super League Arrives – As we predicted, football’s elite breakaway emerges from the shadows.

30th March 2021 – $hooting B£ank$ – Arsenal’s commercial performance analysed.

22nd February 2021 – Measure for Measure – Take two financial measures, add pandemic and stir.

18th January 2021 – The Football Factory – If football was an industrial entity…

8th January 2021 – The Oil Majors – An Update – A shareholder return performance review of the 4 major oil companies in 2020.

10th December 2020 – Pump Up The Volume – ExxonMobil comes under fire from an agitated investor.

16th November 2020 – The Pain Game – Manchester United’s Q1 2021 financial release opens the lid on a Covid-19-affected financial can of worms.

11th November 2020 – A Tight Squeeze – Football’s Elephant in the Room leaving little space for financial relief.

29th October 2020 – Form and Function – Proposals-a-plenty for football’s structural reform.

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport.

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy.

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses.

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return.

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak.

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances.

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle.

12th December 2019 – The Cost of Chasing Gold– In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League.

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club.

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes.

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League.

5th July 2019 – Chopping Board – Knives out for former Tesco chief.

25th May 2019 –Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’– Why the Economic Profit metric is the most transparent measure of business performance.

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness.

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance.

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table.

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics.

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds.

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.