18th March 2022

From Super League to Frozen League in less than a year is impressive work. With HM Government making hasty strides into the bank balances and assets of some very wealthy Russians, Chelsea FC was always going to be in the firing line with few supporters of the club working within the confines of Whitehall (which, according to sources, is allegedly is comprised of Arsenal and Manchester United fans….).

We have previously written about football’s fragile financial position. Indeed, we have stated that in order to understand the economic dynamics of football, the starting point has to be a working knowledge of the economic dynamics of the Premier League and its constituent clubs. From here, all of football’s financial misfortune pervades.

In the case of Chelsea, it is/was arguably the engine room of economic unsustainability for the rest of English football. Not only did Mr. Abramovich change the financial complexion of the English game but he also plundered the talent from it and beyond with the establishment of player farming and extended loans. Indeed, the longest Chelsea-serving player loanee was Lucas Piazon with a 10-year stretch at 8 other clubs.

The trading of farm players became a nice little earner along with a smattering of loan fees here and there. Nevertheless, the other side of this golden coin is the ability to fund some of the most expensive and successful transfers in the modern game via an ever-increasing loan to the club. According to the latest accounts for Mr. Abramovich’s holding Company (Fordstam Ltd) for Chelsea FC, the amount owed is approx. £1.5bn. With an invested capital level just under £600m, the club has generated an operational deficit to Mr. Abramovich’s finances of around £900m.

From this, the tentacles of economic instability reach long into the fabric of the national game. Indeed, in previous missives, we surmised that he must have been incredibly disappointed when Manchester City was acquired by the pseudo-state ownership of Sheik Mansour. From 2003 up to 2008 when the City deal was completed, Mr. Abramovich more or less bought the Premier League title in 2005 and in 2006. Only the exceptional prowess of a revitalised Manchester United kept Chelsea at bay with three Premier League titles and a Champions League final victory in Moscow.

It had, of course, been done before with Jack Walker’s millions at Blackburn Rovers along with a near miss at Newcastle United with the Hall family fortune. But Chelsea from 2003 onwards was on a different scale. Unfortunately, once the new hierarchy was in place at Manchester City, Chelsea’s new foe could rely on near-unlimited financial resources. And how do you compete? You pay handsomely in wages and transfer fees, again and again and again.

By 2008-9, Chelsea’s staff costs to revenue ratio was 81.28%. However, the Premier League divisional ratio was just 62.34%, a differential of 18.94%. The gap widened further the following season before narrowing to a mere 16.75% differential in 2010-11. However, the damage was already festering in overall labour costs in football. Chelsea’s staff costs to revenue ratio eventually reached an eye-watering 84.89%. The Premier League divisional staff costs rose in tandem to 68.14%.

In the following season (2011-12), Financial Fair Play was introduced for those clubs participating in Europe. In the same season, the Premier League club staff costs to revenue ratio hit 69.10%, fuelled in part by the new financial dynamism at Manchester City. Chelsea had been the biggest payers in the division but the ambition of Manchester City’s owners had surpassed Chelsea’s generosity. Competition on the pitch was being fuelled by a balance sheet battle (and deficits) off it.

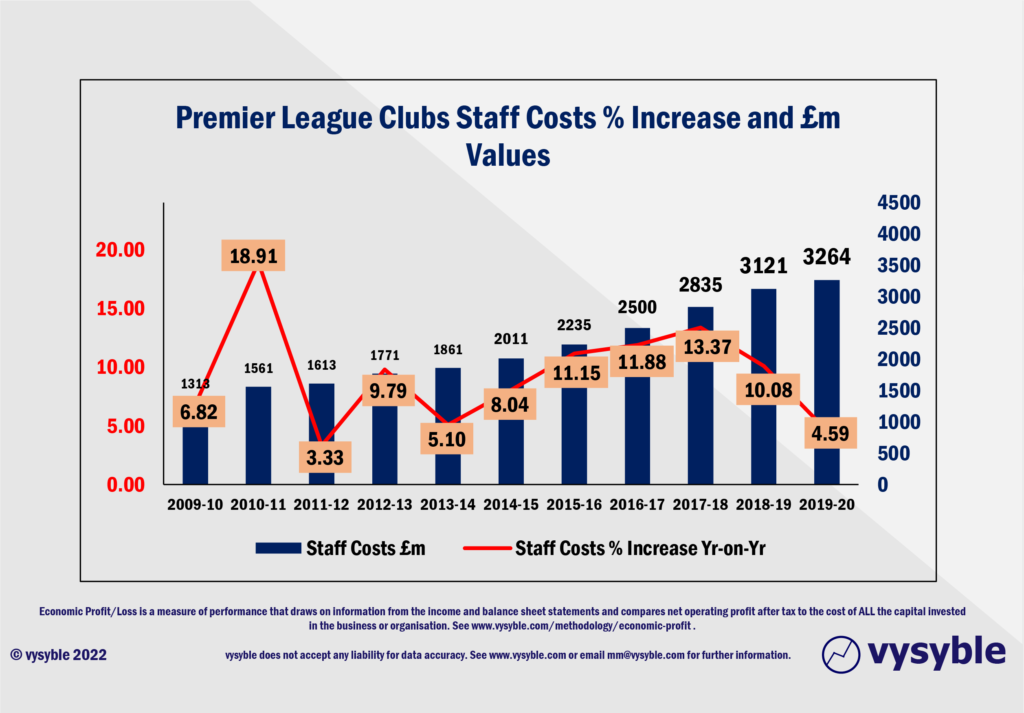

The then record-breaking TV deal for the 2013-16 cycle dampened the staff cost to revenue ratio from 69.25% to 57.20% in 2013-14 but arguably, the damage was already done. Pay inflation was well and truly established as the chart below illustrates.

The emergence of Project Big Picture and the predictable Super League in 2021 was a natural step for the Big 6 clubs given their colossal economic losses; the up-to-date number (2009-21) is £2.97bn.

Football is not the “profitable” value-creating enterprise that everyone would have you believe. But a large part of this dynamic is down to Mr. Abramovich inflating both wages and transfer fees to the detriment of the game itself. The tractor beam of wealth and dominance compels every other club to compete or wither. Unfortunately, today’s game is on its knees due in large part to these inflationary pressures. The effects of Covid have merely accelerated the inevitable. Never has the imperative to correctly monitor business performance been so critical to the future financial health of the game. Sadly, this has not and does not appear to be happening.

The future for Chelsea looks, in our opinion, very different indeed. A change in business model, funding infrastructure and operational procedures are all likely to occur. Unfortunately, the largesse of Chelsea may have already been replaced by that of Newcastle United. This near-polar role reversal of West London’s potential penury when compared with the expectation of free-spending Magpies following Mike Ashley’s financially stringent ownership is, perhaps, the greatest irony of all.

(Almost) A year, it would seem, is a very long time in football.

vysyble

10th February 2022 – Underwater – Manchester United’s share price fails to defy gravity and sinks below its IPO level. Has the market got wise to the club’s poor economic performance?

1st December 2021 – Fantasy Football – The Fan-Led Review findings fall short of the necessary value-driven approach to regulatory reform.

23rd June 2021 – Road to Nowhere – Football stands at the crossroads ahead of the Fan-Led Review process. We examine the key questions that it must answer.

11th May 2021 – Prime Numbers – Football’s elite clubs seek a route to profit as fans yearn for sporting tradition. In between lies a gulf of mistrust and misapprehension.

26th April 2021 – A Bitter Pill – GSK’s new strategic direction fails to find riches in the middle of a pandemic when other pharma companies have prospered.

25th April 2021 – The Wrong Stuff – American-style football league won’t wash but the conditions that led to its launch are still present and are likely to get worse.

19th April 2021 – Super League Arrives – As we predicted, football’s elite breakaway emerges from the shadows.

30th March 2021 – $hooting B£ank$ – Arsenal’s commercial performance analysed.

22nd February 2021 – Measure for Measure – Take two financial measures, add pandemic and stir.

18th January 2021 – The Football Factory – If football was an industrial entity…

8th January 2021 – The Oil Majors – An Update – A shareholder return performance review of the 4 major oil companies in 2020.

10th December 2020 – Pump Up The Volume – ExxonMobil comes under fire from an agitated investor.

16th November 2020 – The Pain Game – Manchester United’s Q1 2021 financial release opens the lid on a Covid-19-affected financial can of worms.

11th November 2020 – A Tight Squeeze – Football’s Elephant in the Room leaving little space for financial relief.

29th October 2020 – Form and Function – Proposals-a-plenty for football’s structural reform.

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport.

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy.

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses.

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return.

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak.

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances.

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle.

12th December 2019 – The Cost of Chasing Gold– In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League.

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club.

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes.

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League.

5th July 2019 – Chopping Board – Knives out for former Tesco chief.

25th May 2019 –Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’– Why the Economic Profit metric is the most transparent measure of business performance.

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness.

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance.

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table.

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics.

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds.

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.