17th May 2022

One of the less predictable events of this sporting year so far is the forced sale of Chelsea FC. Across the sports pages over the last few weeks, there has been widespread coverage that Todd Boehly, owner of 20% of the LA Dodgers, has agreed to buy the club for a reported £4.25bn.

Whilst we are not aware of the contractual detail of the agreement, the arrangement has been reported as consisting of £2.5bn to acquire the full share complement plus an additional commitment to invest £1.75bn in club operations. Thus, for the purposes of this exercise, we will use £4.25bn as the full acquisition price/Enterprise Value of the business.

The purpose of this blog is not to offer, at this stage, our own valuation but to try and establish the assumptions and performance required to underpin an enterprise value of £4.25bn.

By way of context, the current Enterprise Value of Manchester United, a club with a challenged but significantly better economic performance (see later graphic) than Chelsea is currently, £2.2bn (based on a $13.12 share price).

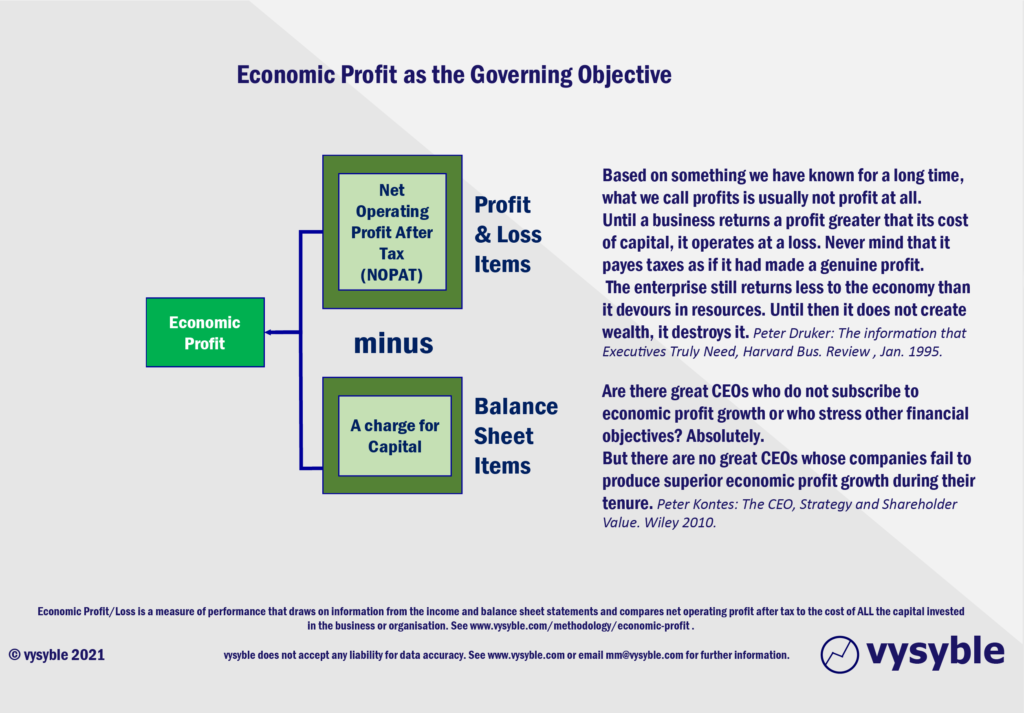

What is Economic Profit?

In essence, it is a more demanding performance and valuation metric that has been used by some of the world’s truly great CEOs to formulate strategy and to drive the performance and priorities of their respective organisations. These CEOs include Roberto Goizueta at Coca-Cola, Sir Brian Pitman at Lloyds Bank, Sir John Sunderland at Cadbury Schweppes and Jim Kilts at Gillette alongside many others. Unlike accounting profit, it incorporates ALL of the costs of doing business including the cost of equity capital. When used by executives with both the skill and the will to embrace and understand the theory, it enables the senior management team to see things about their business that they weren’t seeing before, which in some cases can be a very uncomfortable experience.

“Creating economic profit is the single most important driver of the stock price of the Coca-Cola company”

Roberto Goizueta, former Chairman and CEO of the Coca-Cola Company

“The EVA (i.e., Economic Profit) approach to equity analysis has become increasingly popular because it more accurately reflects economic reality (as opposed to accounting reality) when compared with many traditional valuation measures such as earnings per share (EPS), return on equity (ROE), and free cash flow; those accounting-based measures can be distorted by accounting practices. They also include the cost of debt and exclude the cost of equity…

Focusing on the variables that drive the underlying economics of the business, rather than on accounting-based benchmarks, should result in improved management, financial analysis, and ultimately, enhanced shareholder value”

Goldman Sachs

“As an illustration of how executives get caught up in a short-term EPS (earnings per share) focus, consider our experience with companies analyzing a prospective acquisition. The most frequent question managers ask is whether the transaction will dilute EPS over the first year or two.

Given the popularity of EPS as a yardstick for company decisions, you might think that a predicted improvement in EPS would be an important indication of an acquisition’s potential to create value. However, there is no empirical evidence linking increased EPS with the value created by a transaction. Deals that strengthen EPS and deals that dilute EPS are equally likely to create or destroy value…

If such fallacies have no impact on value, why do they prevail?

The impetus for short-termism varies. Some executives argue that investors do not let them focus on the long term; others fault the rise of shareholder activists in particular.

Yet our research shows that even if short-term investors cause day-to-day fluctuations in a company’s share price and dominate quarterly earnings calls, longer-term investors are the ones who align market prices with intrinsic value”

McKinsey, first published in ‘The Real Business of Business’, March 2015

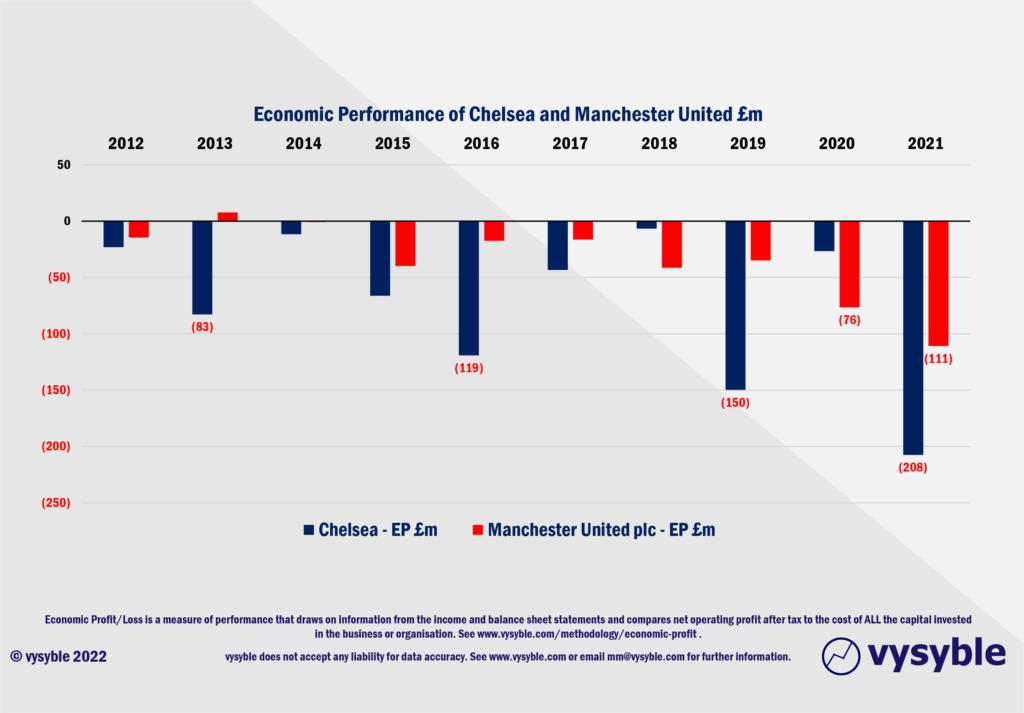

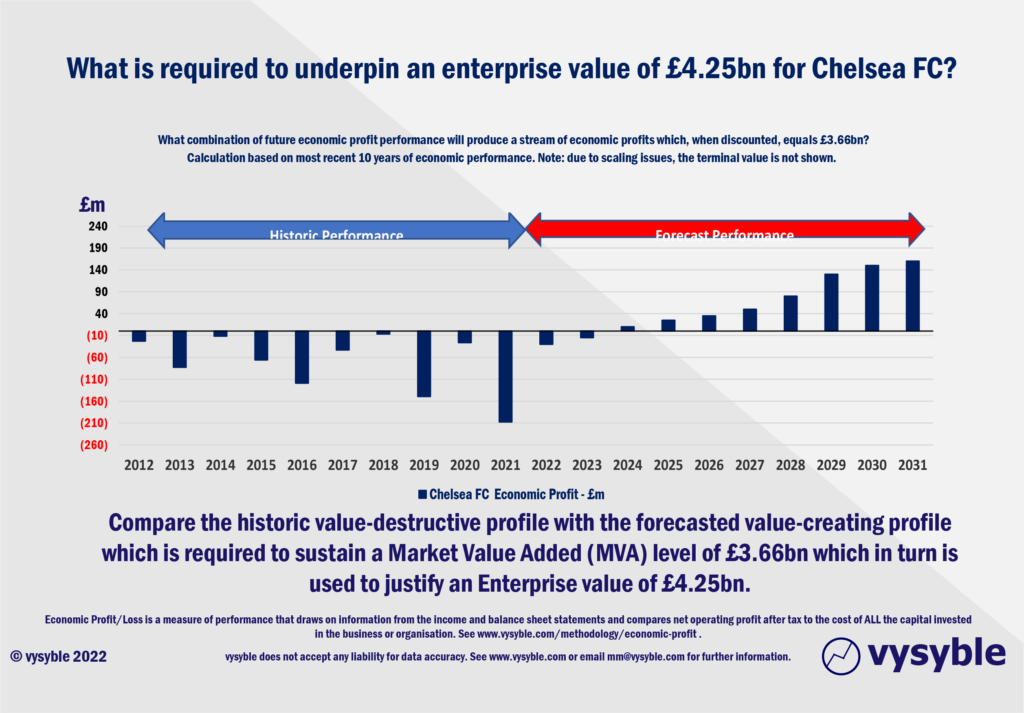

In the 10 years between 2012-2021, Chelsea achieved total economic losses of £736m. In the same period, Manchester United achieved economic losses of £344m. There is only one instance of an economic surplus from both clubs as illustrated in the above graphic. It was achieved by Manchester United in 2013 with an economic profit of £7.68m. This was also the last year of the Sir Alex Ferguson era.

2020-21 was seriously affected by the Covid pandemic and can be considered as an outlier. Therefore, we will take a 9-year view ie 2012-2020. In this revised period, Chelsea achieved a total economic loss of £529m or, to put it another way, an average annual economic loss of £58m. This is the base or opening position that we will use later in our fundamental valuation and from which improvements in performance will be drawn against.

What is the Enterprise Value?

Investopedia defines it thus:

“Enterprise value (EV) is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization. EV includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company’s balance sheet. Enterprise value is a popular metric used to value a company for a potential takeover.

Formula and Calculation for Enterprise Value (EV)

EV=MC + Total Debt−C

where:

MC=Market capitalization; equal to the current stock price multiplied by the number of outstanding shares.

Total Debt=Equal to the sum of short-term and long-term debt

C=Cash and cash equivalents; the liquid assets of a company – but may not include marketable securities.

To calculate the market capitalization if not readily available, you multiply the number of outstanding shares by the current stock price. Next, total all debt on the company’s balance sheet including both short-term and long-term debt. Finally, add the market capitalization to the total debt and subtract any cash and cash equivalents from the result.”

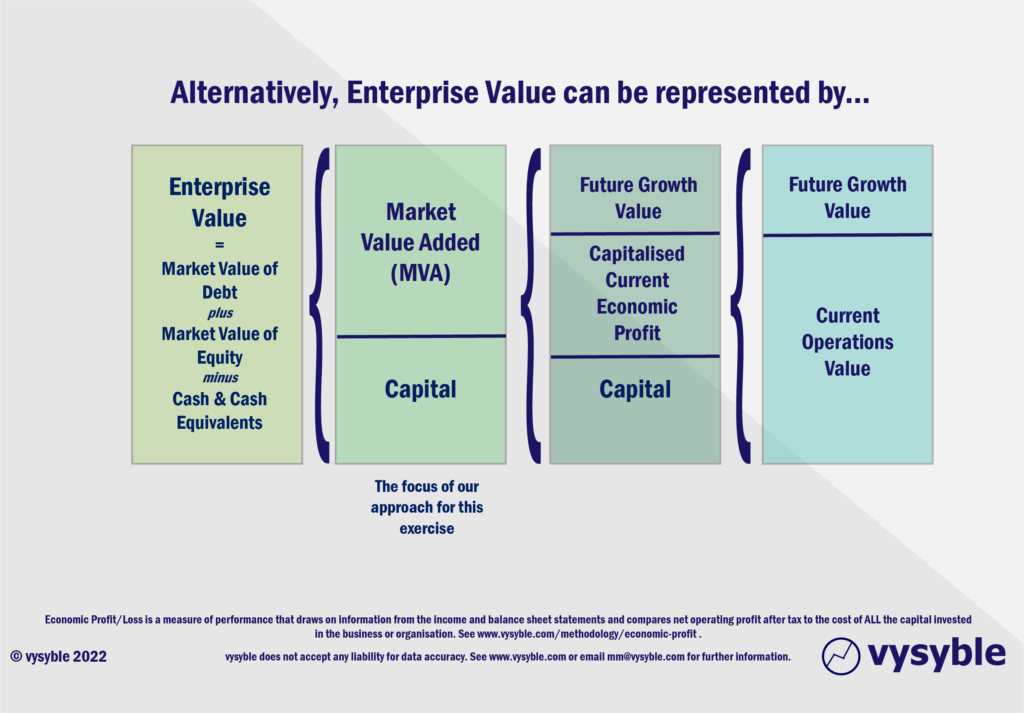

Another way to think about the Enterprise Value

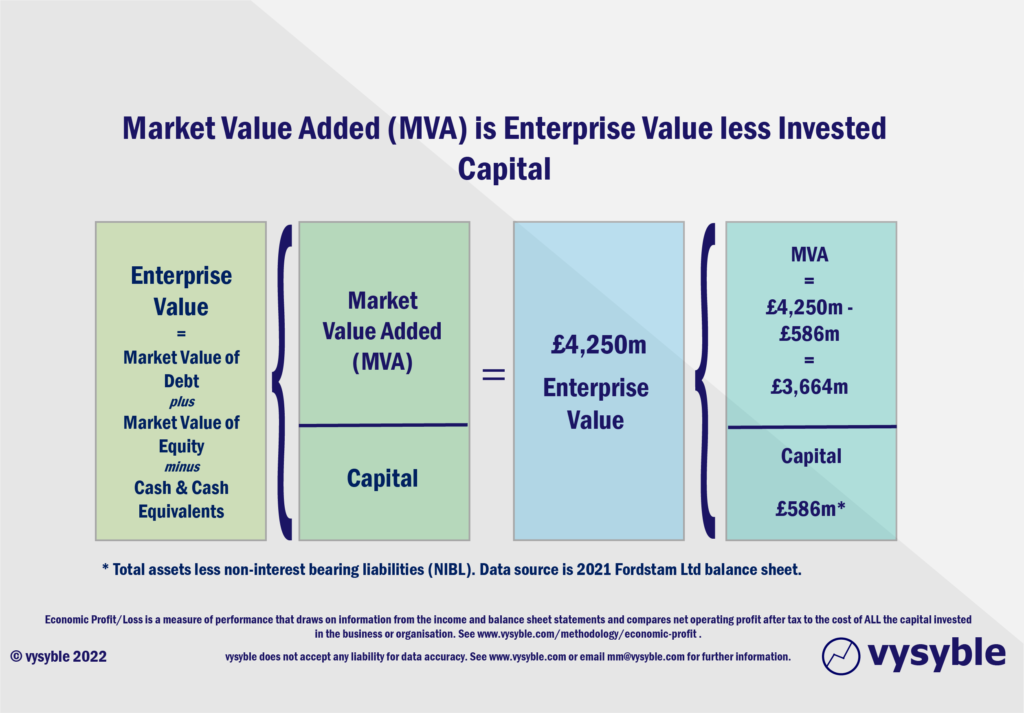

The diagram below is often helpful in unpicking the underlying assumptions for a given value…

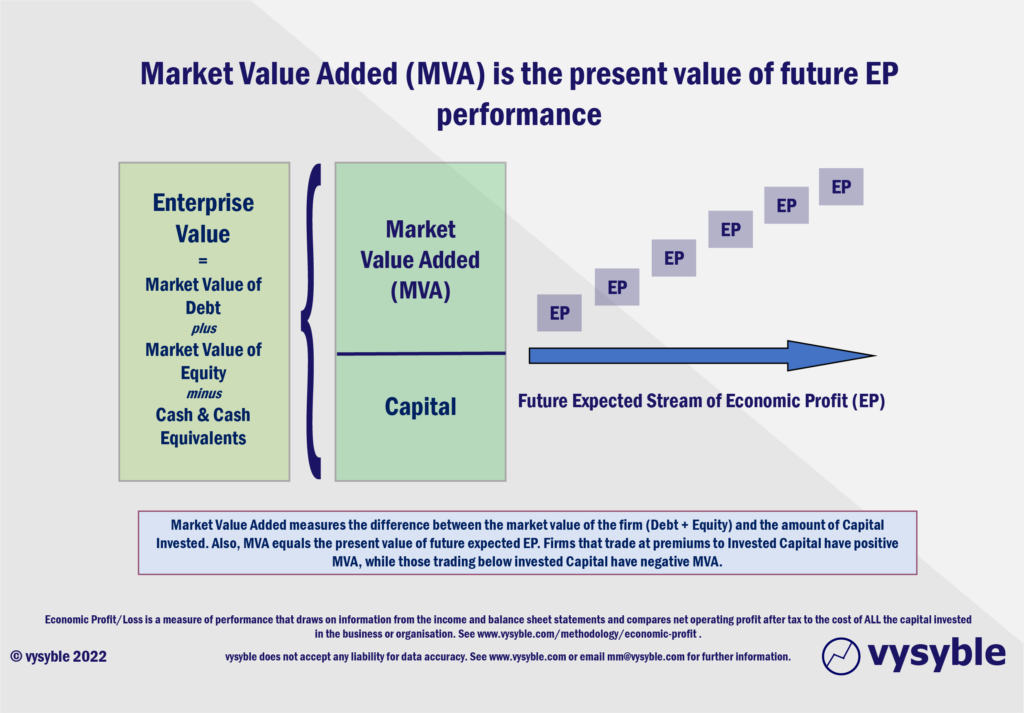

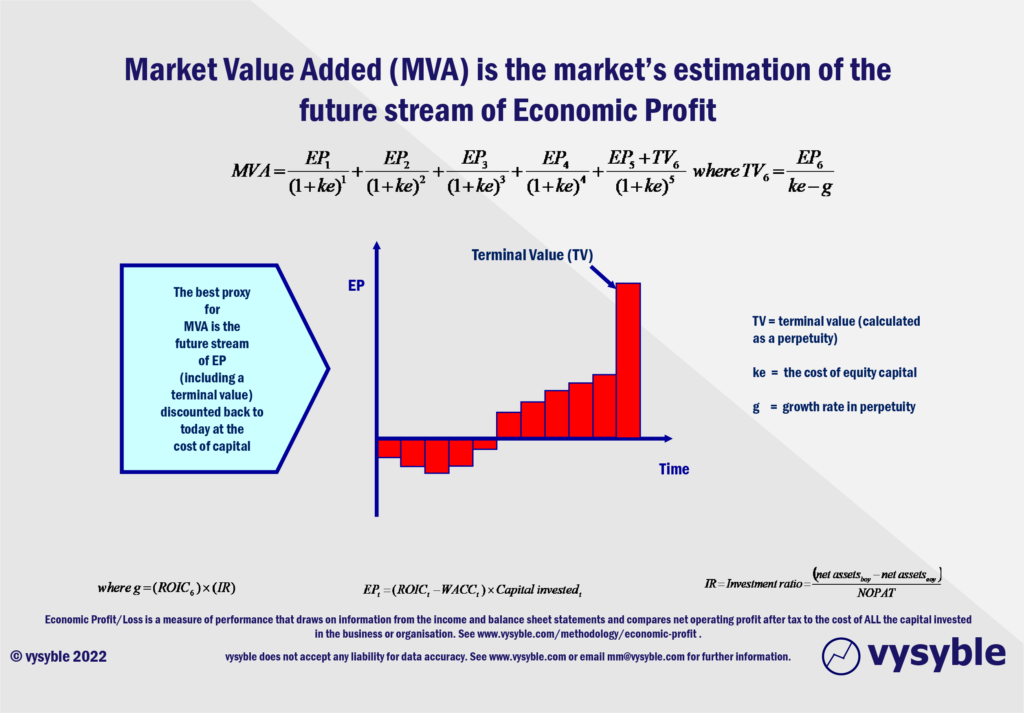

In other words, Enterprise Value, in this case £4.25bn, is equal to Invested Capital plus Market Value Added (or MVA). MVA is the discounted future stream of economic profit…

So, we know the price – £4.25bn

From the last published balance sheet for Chelsea (contained with the Fordstam accounts), we know the Invested Capital balance (Total Assets less short-term non-interest-bearing liabilities (typically trade creditors, accruals, and deferred income)) and therefore we can ascertain the assumed future stream of EP underpinning the EV of £4.25bn (see below).

In order to justify a price of £4.25bn and achieve some notion of economic neutrality, the strategies adopted by the club need to generate a discounted economic profit of £3,664m between now and infinity.

Our approach in principle is set out below. We are going to assume a very sympathetic cost of equity capital (Ke) of 5%. In addition, we will produce a forecast which, when discounted back at the cost of equity, establishes a value of £3,664m. This will consist of a ten-year forecast and then a terminal value (which takes care of economic performance beyond year ten).

So what?

The graphic above reveals the size of the step change in economic profit performance required just to be economically ‘neutral’ given an Enterprise Value of £4.25bn. With Manchester United’s current EV running at approximately £2.2bn, this is hardly a surprise.

More fundamentally, Chelsea has incurred economic losses over the last 10 years of £736m. In the next 10 years the business needs to achieve (before discounting) an economic surplus of £595m just to remain ‘neutral’. This is a turnaround of £1.3bn (£595m+£736m) against a wider backdrop i.e. the English Premier League, where economic surpluses have only arisen in approx. one in every five balance sheets since 2009.

We will leave it to the reader to decide whether this seems likely or feasible?

Of course, Mr Boehly may revert to the previous model of shoring up economic loss after economic loss with a long-term interest free loan which, admittedly, would keep the show on the road. However, after even the most cursory review of Mr Boehly’s formidable business career so far, this seems highly unlikely. So, what do we think are the motivations for spending so much money on a business that is unlikely under current conditions to generate a return greater than the cost of capital and its associated costs?

Chelsea’s sale to US interests is, in our opinion, another major stepping stone in the evolution of the European game. Along with the influx of US investors into Italy and a smattering of activity in Spain and France, this sale represents a shift in that the result will be that four of the English Premier League’s Big 6 clubs will be under US ownership.

If we recall ‘recent’ events, Project Big Picture, the structural reform initiative from US-owned Liverpool and Manchester United came and went in 2020 only to be followed by the aborted Super League launch in 2021. The propellant of consistent economic losses achieved by England’s (and Europe’s) senior clubs was the obvious and determining factor leading up to these events, as we had been predicting since 2016.

However, as we mentioned in our previous blog, football is somewhat hampered by a lack of merger activity which would normally be found in a financially dysfunctional market. Thus, the only two viable routes to profit without the ability to acquire competitors is either operational change or structural change.

Consider this, if you will. If you were to put Todd Boehly, Joel Glazer, John Henry and Stan Kroenke in a room and ask them to come up with a solution to the following question ‘how do you make money in football?’, do you think that they would replicate what we have in place today? The answer is probably going to be a very firm ‘no’.

It is more likely that they would opt for a premium competition on a Europe-wide basis with extensive cost controls whilst encouraging participation on a local level with a mix of nursery teams and lower-ability clubs to ensure a throughput of talent into the elite ranks. Why risk non-qualification when a closed league offers no risk at all? Perhaps a variation in terms of interest would be clubs invited to participate from ‘secondary’ leagues such as Greece or Turkey.

But, of course, will it keep the fans onside? Well, given the shambles of Super League v1.0, it doesn’t take too much of a stretch of the imagination to see that a determined and organised group could make a decent case for it. After all, conisistent losses are no fun, even if you are very rich indeed. And they are definitely no fun for your return-seeking investors.

Also, given the increasing concentration of American interests in the media distribution of live and recorded football in Europe, the ingredients for such a premium competition with significant media backing are very much evident. Super League v2.0, no?

With all this in mind, Mr. Boehly’s investment in Chelsea might not be so ambitious after all. Indeed, he might have got his timing just right. The recently enhanced Champions League format offers a halfway house to such a premium competition under UEFA control but there is nothing like being the owner of your own destiny without the risk . We suspect that our four US roommates may well be thinking the along the same lines.

For now, Mr Boehly must contend with a challenging balance sheet and a business model that does not aim for profit.

However, we know from other industries that consistent economic losses produce one of two outcomes. Bad and very bad. Football, despite the looming Independent Regulator, needs to change immediately and with a deep focus on how it operates otherwise the Americans might just put a very decent marketing plan together.

It is going to be an interesting summer…

vysyble

25th April 2022 – Same but Different – UEFA’s proposed changes to Champions League qualification mirrors aspects of aborted Super League.

18th March 2022 – Let It Go – With a freeze on Russian assets, Chelsea hits the market following a record economic loss.

10th February 2022 – Underwater – Manchester United’s share price fails to defy gravity and sinks below its IPO level. Has the market got wise to the club’s poor economic performance?

1st December 2021 – Fantasy Football – The Fan-Led Review findings fall short of the necessary value-driven approach to regulatory reform.

23rd June 2021 – Road to Nowhere – Football stands at the crossroads ahead of the Fan-Led Review process. We examine the key questions that it must answer.

11th May 2021 – Prime Numbers – Football’s elite clubs seek a route to profit as fans yearn for sporting tradition. In between lies a gulf of mistrust and misapprehension.

26th April 2021 – A Bitter Pill – GSK’s new strategic direction fails to find riches in the middle of a pandemic when other pharma companies have prospered.

25th April 2021 – The Wrong Stuff – American-style football league won’t wash but the conditions that led to its launch are still present and are likely to get worse.

19th April 2021 – Super League Arrives – As we predicted, football’s elite breakaway emerges from the shadows.

30th March 2021 – $hooting B£ank$ – Arsenal’s commercial performance analysed.

22nd February 2021 – Measure for Measure – Take two financial measures, add pandemic and stir.

18th January 2021 – The Football Factory – If football was an industrial entity…

8th January 2021 – The Oil Majors – An Update – A shareholder return performance review of the 4 major oil companies in 2020.

10th December 2020 – Pump Up The Volume – ExxonMobil comes under fire from an agitated investor.

16th November 2020 – The Pain Game – Manchester United’s Q1 2021 financial release opens the lid on a Covid-19-affected financial can of worms.

11th November 2020 – A Tight Squeeze – Football’s Elephant in the Room leaving little space for financial relief.

29th October 2020 – Form and Function – Proposals-a-plenty for football’s structural reform.

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport.

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy.

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses.

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return.

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak.

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances.

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle.

12th December 2019 – The Cost of Chasing Gold– In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League.

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club.

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes.

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League.

5th July 2019 – Chopping Board – Knives out for former Tesco chief.

25th May 2019 –Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’– Why the Economic Profit metric is the most transparent measure of business performance.

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness.

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance.

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table.

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics.

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds.

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.