30th September 2022

Margaret Thatcher famously said, “You can’t buck the markets”. With this in mind, it is that time of the year again when Manchester United has released its latest 12-month numbers and we ponder the financial conundrum laid out before us. Did we tell you that it has been 9 years since the club last achieved an economic profit?

This year, however, English football itself is somewhat different following two years of Covid and a weakening economy. The American invasion is now in full swing with Chelsea having fallen into the hands of Todd Boehly and Co. who have quickly embraced the operational nuances of the local game by spending a net value of £221m on new talent and firing the manager in double-quick time.

Meanwhile, AFC Bournemouth is currently subject to a bid from a US-based consortium whilst Wolves’ Chinese owner Fosun is facing difficulties with its domestic business and may offload the club in the not too distant future. The club’s minority US investor, Peak6, will no doubt be monitoring closely…

For the other English clubs with minority US shareholders, the strength of the US Dollar presents an opportunity to become a major shareholder at an exchange rate that is almost 20% cheaper due to the collapse in the British Pound than would have been the case this time last year. Fans of Leeds United should take note.

Indeed, with English football getting cheaper to foreign investors by the day, the attraction of buying a loss-achieving club must be overwhelming…

Yet, for those who have already trodden this path from the shores of the western Atlantic, the picture is less than rosy and this is certainly true for Manchester United’s owners and shareholders. At the time of writing (27th September 2022), the share price stands at $12.70. By way of context, a year ago it was $14.54 (October 2021) and five years ago it stood at $17.95 (October 2017). Arguably, following the ravages of Covid and what should have been a revenue-recovery-and-diminishing-of-costs season, the numbers are sadly more challenging.

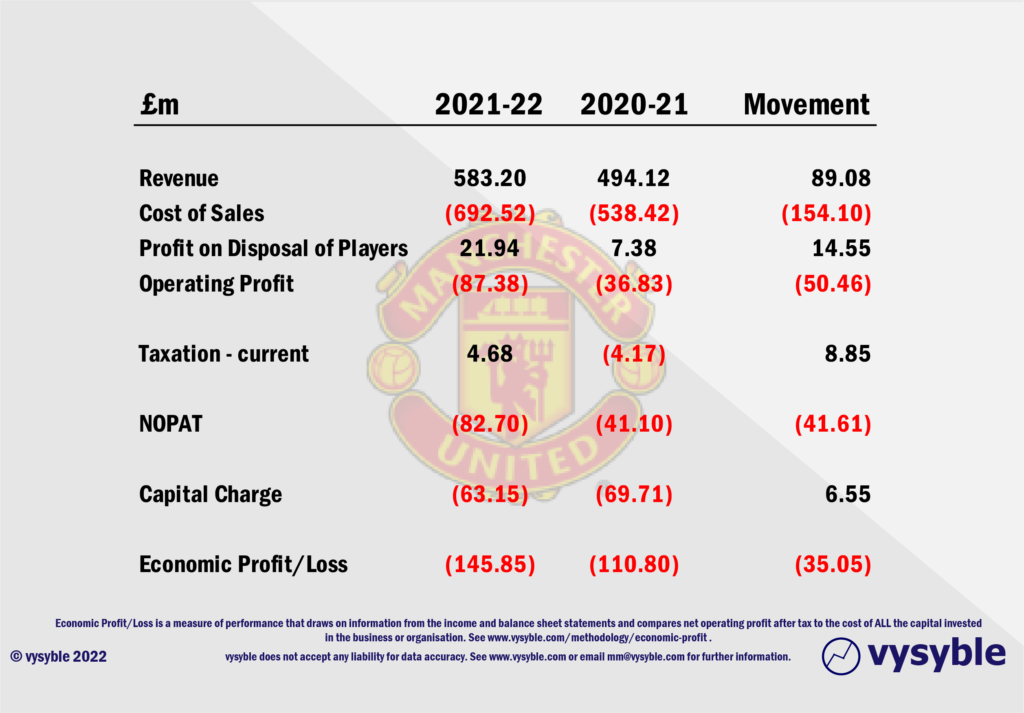

Set out below is a summary of the latest 2022 financial performance with a year-on-year movement:

The good news is that revenue year-on-year increased by £89m or 18%. The more worrying development is that the cost base increased by £154.1m or 28%. Included within the expense line is an annual record staff cost level for English Football (£384m).

Even before we get to consider the charges for capital, the net operating profit before tax for 2022 comes in at a negative £82.7m, some £41.6m worse than the 2021 negative number of £41.1m. When the charge for capital is applied (assuming a WACC of 7.00%), the economic loss totals £145.85m – some £35.05m worse than the 2021 loss of £110.80m.

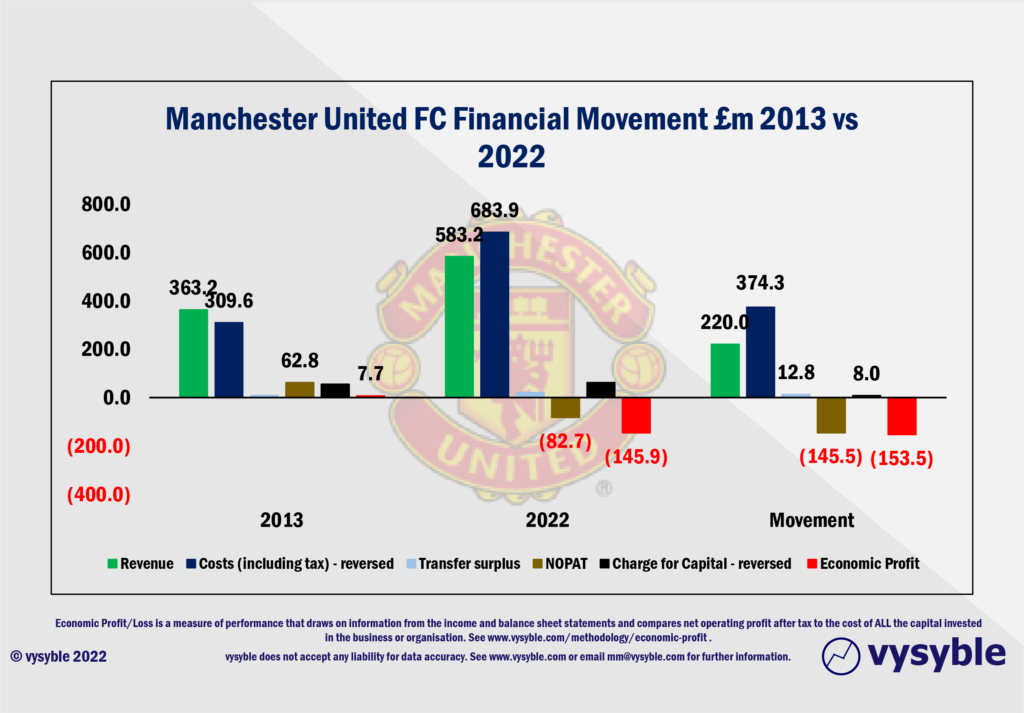

Looking over the 9-year period from 2013 to 2022, despite revenues of just under £5.1bn, the total economic loss comes in at £484.59m. Not exactly small change.

More concerning is the overall movement when comparing the 2013 performance with the latest data (see below). Even though revenue has improved by £220.0m over the 9-year period, costs have risen by £374.3m or by a value 70% greater than the revenue improvement. This has resulted in an economic loss differential of £153.5m. Little wonder that the share price is delivering sub-optimal performance.

In a wider context, the club’s economic losses are less than those achieved by Manchester City (£553.6m) and Chelsea (£639.2m) between 2013-21 (both clubs have yet to publish their 2021-22 accounts) but the direction of travel in terms of economic performance is firmly downwards. And yet, despite losses and poor share performance, the Glazer family continues to extract dividends from the business. Whilst they may be a fraction of annual turnover in terms of value, the optics of doing so are not easy on the eye.

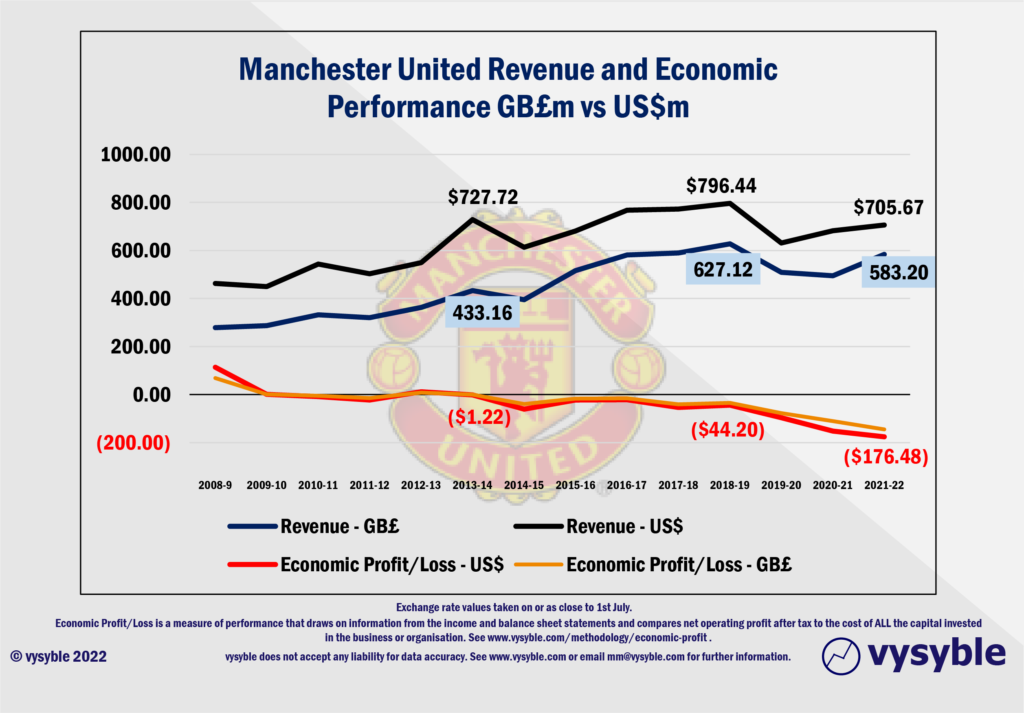

The declining British Pound (and arguably, very recent events in terms of financial market turmoil) places American business owners of British businesses in a difficult position. When we compare the US Dollar version of United’s financial performance since 2009 to the British Pound version, it becomes increasingly clear that Sterling (the currency, not the player) has been declining at such an alarming rate that the club’s revenues have essentially flatlined in US Dollar terms since 2014, coupled with increasing economic losses.

Further afield, football continues to fret over its future. Not a week goes by without a soundbite from Gary Football or Jamie Banter on Sky TV about the state of the game. Those of you who are familiar with our work will have noted that the themes which we previously highlighted in the last decade such as the potential ramifications from increasing American investment in English football have suddenly become a cause célèbre for our pair of pundits.

Indeed, the latest round of angst concerns the proposed adoption of an independent regulator.

We have, of course, previously offered our own considered opinion with regard to the role of an independent regulator in football. Broadly speaking, we believe it is something that we think would be of benefit to the game. We also maintain that the role will require the support of the Government of the day in terms of providing concessions to the sport in company law and giving broader powers to the regulator when compared to similar oversight roles in other industries/markets.

The example we have previously referred to is that of the energy regulator. Given the ongoing turmoil concerning energy pricing despite the presence of a regulator, the football version may only end up being a facilitator of an improved owners and directors’ test. What is clear is that operational reform is required within the game. Whether an independent regulator will be given the bandwidth to enact just that is still very much open to debate. And we maintain that without the implementation of a robust financial framework, the game will continue to struggle against a tide of self-interest and increasing losses.

Additionally, the current Conservative government remains ideologically opposed to increased regulation. However, the free market approach almost allowed football to financially digest itself into a Super League with the remainder of the sport picking up the crumbs. And, of course, the Americans were never too far away having given us all a big clue with the Project Big Picture opener.

Against this backdrop of heightened anxiety, United’s results provide the first and telling insight into the 2021-22 financial reporting season and from our perspective the picture is not good . Given the current travails in the markets with rising interest rates, rising energy costs and a general financial squeeze in the offing, football finds itself drifting further into a financial offside position.

One could argue that United is a special case, but the balance sheet reveals the challenges of fluctuating currency rates, increasing labour charges and a continuation of costs rising faster than revenue (see above). All are common characteristics for the majority of Premier League clubs. In this case, the position of the club in falling behind its peers in terms of the trophy count and the pressure to perform to expectations has amplified the numbers. Nevertheless, the TV revenues are designed to offset some of this financial turmoil as they always increase in value, no?

Thus, we suspect that football’s recovery from Covid will not be the profit bonanza that some might hope for. With just two collective economic profits achieved by Premier League club cohorts since 2009, the odds and omens are stacked very much against a profitable recovery play. But with a cheap British Pound and a ‘can do’ attitude, the game remains an intriguing punt from the shores of the USA. Except for the owners of Manchester United and its sub-IPO level share price.

Bucking the market really is a long shot.

vysyble

Follow vysyble on Twitter

4th August 2022 – Soccerball – Over-enthusiastic, over-subscribed and over here. The American invasion into English football is in full swing.

17th May 2022 – Money Heights – Valuation models fail to match the price paid to buy loss-making Chelsea.

25th April 2022 – Same but Different – UEFA’s proposed changes to Champions League qualification mirrors aspects of aborted Super League.

18th March 2022 – Let It Go – With a freeze on Russian assets, Chelsea hits the market following a record economic loss.

10th February 2022 – Underwater – Manchester United’s share price fails to defy gravity and sinks below its IPO level. Has the market got wise to the club’s poor economic performance?

1st December 2021 – Fantasy Football – The Fan-Led Review findings fall short of the necessary value-driven approach to regulatory reform.

23rd June 2021 – Road to Nowhere – Football stands at the crossroads ahead of the Fan-Led Review process. We examine the key questions that it must answer.

11th May 2021 – Prime Numbers – Football’s elite clubs seek a route to profit as fans yearn for sporting tradition. In between lies a gulf of mistrust and misapprehension.

26th April 2021 – A Bitter Pill – GSK’s new strategic direction fails to find riches in the middle of a pandemic when other pharma companies have prospered.

25th April 2021 – The Wrong Stuff – American-style football league won’t wash but the conditions that led to its launch are still present and are likely to get worse.

19th April 2021 – Super League Arrives – As we predicted, football’s elite breakaway emerges from the shadows.

30th March 2021 – $hooting B£ank$ – Arsenal’s commercial performance analysed.

22nd February 2021 – Measure for Measure – Take two financial measures, add pandemic and stir.

18th January 2021 – The Football Factory – If football was an industrial entity…

8th January 2021 – The Oil Majors – An Update – A shareholder return performance review of the 4 major oil companies in 2020.

10th December 2020 – Pump Up The Volume – ExxonMobil comes under fire from an agitated investor.

16th November 2020 – The Pain Game – Manchester United’s Q1 2021 financial release opens the lid on a Covid-19-affected financial can of worms.

11th November 2020 – A Tight Squeeze – Football’s Elephant in the Room leaving little space for financial relief.

29th October 2020 – Form and Function – Proposals-a-plenty for football’s structural reform.

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport.

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy.

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses.

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return.

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak.

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances.

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle.

12th December 2019 – The Cost of Chasing Gold– In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League.

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club.

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes.

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League.

5th July 2019 – Chopping Board – Knives out for former Tesco chief.

25th May 2019 –Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’– Why the Economic Profit metric is the most transparent measure of business performance.

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness.

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance.

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table.

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics.

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds.

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.