7th February 2023

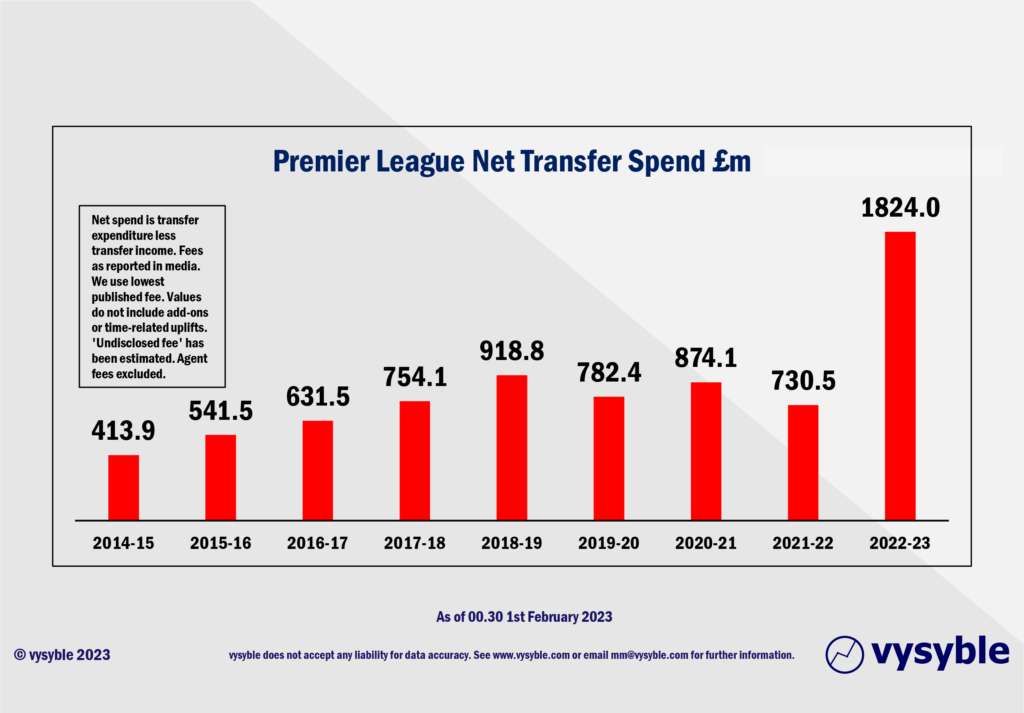

January. Arguably the most miserable month of the year but then there is always the engaging distraction of watching events unfold in the football transfer market. This time around it has been something of a bumper period; Premier League clubs spent (without considering income from sales) £755.9m plus add-ons and other fees, and by way of context, the total net spend for the 2017-18 season which includes both summer and winter transfer windows was ‘just’ £754.1m.

Notwithstanding income due from player sales – £100.2m – we arrive at an eye-watering record net spend of £655.7m for the post-Christmas period. The previous transfer window of the summer of 2022 resulted in a net spend of £1.168bn. Therefore, the nation’s stand-out sporting division has accumulated a record-breaking net spend of £1.824bn in a single season, almost doubling the previous high of £918.8m in 2018-19.

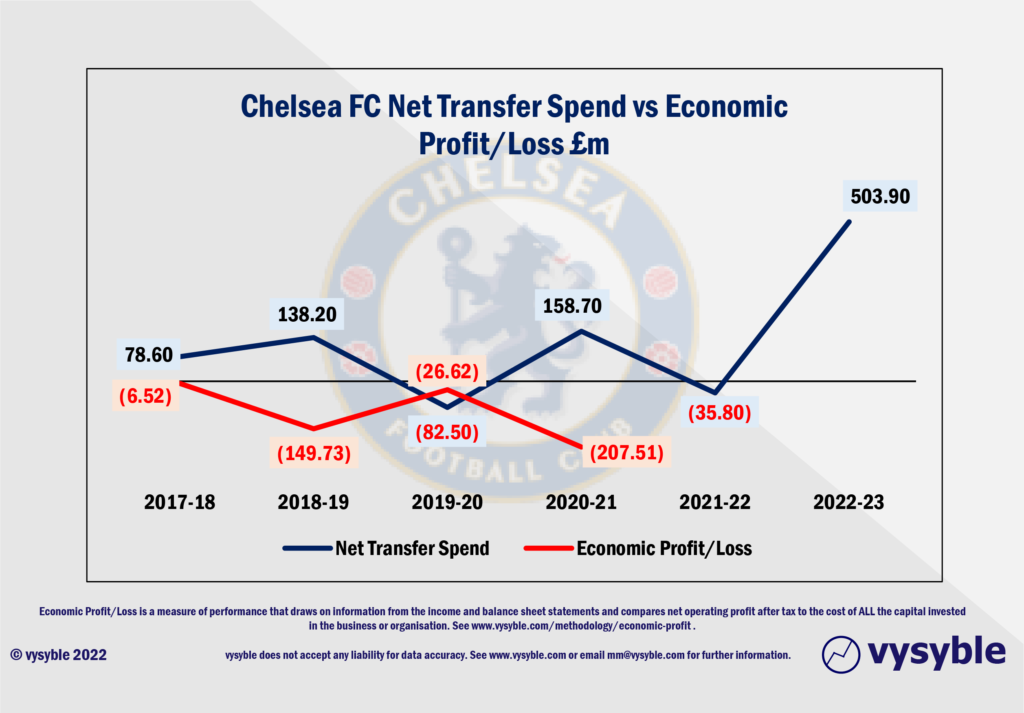

The focus during both transfer windows has been drawn towards Chelsea and their new American owners who have been particularly bold and ambitious in spending a net £503.9m in a single season on new and allegedly improved talent.

At this point we recall Mr. Richard Scudamore’s aspiration, expressed in the early days of his Premier League stewardship, to attract American investment and ownership into the division with a view to leveraging their financial and marketing expertise. In due course, it was hoped that they would expand both the reach and financial worth of England’s senior clubs. Despite some American disruption from Manchester and Liverpool in trying to take their jumpers and move onto a seemingly bigger and more lucrative pitch called the European Super League, the new executive team at Chelsea have made quite the impression so far but not necessarily with Mr Scudamore’s aspirations in mind..

Much of the recent attention has focused on the frankly ridiculous commentary relating to amortisation with Chelsea offering longer contracts with the apparent intention of spreading the cost of that contract over an extended period. The result of this practice is to reduce any short-term year-by-year potential impact regarding FFP (Financial Fair Play).

Of course, despite one BBC journalist describing this as “brilliant”, there is a rather obvious downside in that if a player is sold, say three years into an eight-year contract, then this practice may come to haunt them because the asset (in this case the player) may not have been written down enough to match the lower market value and hence the potential sale could crystallise a loss – in other words they may have under-amortised the asset.

We are not saying or seeking to imply that amortisation in itself is a bad thing. We just don’t happen to believe that the true problems evident within the game stem from whether Chelsea’s amortisation policy differs from that of Aston Villa or Arsenal or indeed any other football club.

Nevertheless, whatever the length of the contract, it is highly unlikely that Chelsea’s new employees are going to be paid at national minimum wage levels. Thus, the annual staff cost for the club could rise significantly, which again could be an issue further down the track as UEFA seek to implement restrictions on squad operational costs vs revenue.

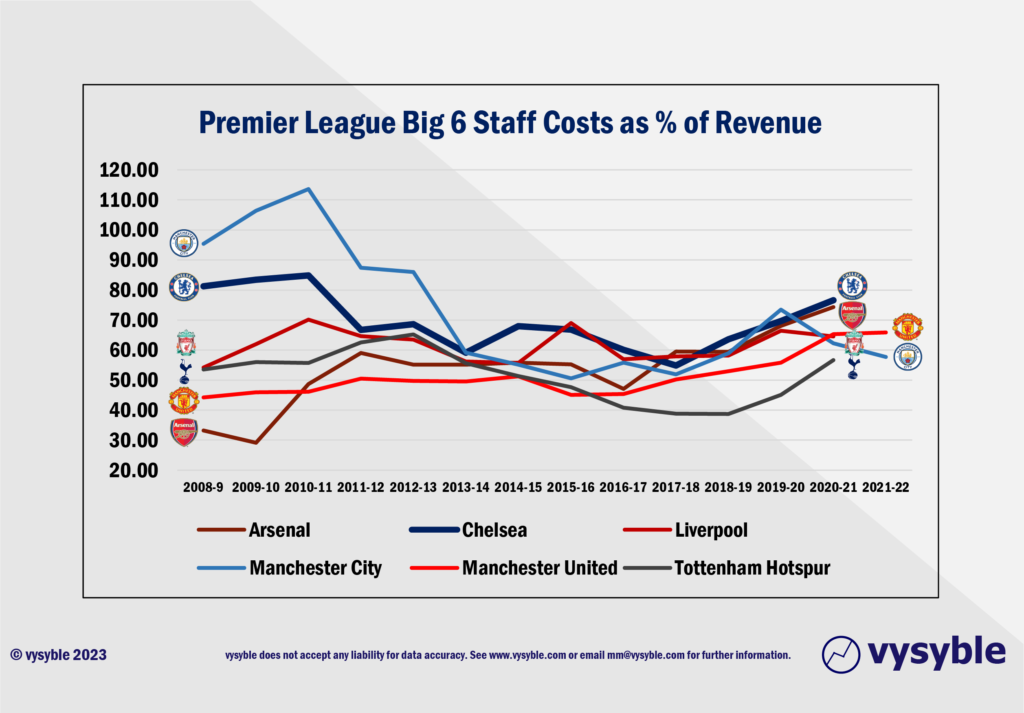

Furthermore, as the graphic below demonstrates, even before the takeover, Chelsea have had the highest staff costs to revenue ratio within the Premier League Big 6 group in recent years (i.e. before the club was sold by Mr. Abramovitch.)

When Chelsea spent money on talent in net terms, the club under Abramovich usually achieved an economic loss (see graphic below).

We expect that the 2021-22 economic loss to be significantly less than the previous year but given that Chelsea has failed to achieve an economic surplus at any point since 2008-9, it is highly unlikely that an economic profit will materialise which, in a rational, logical market, will affect the ultimate valuation. In fact, the cumulative economic loss over the period 2008-9 through to 2020-21 comes to £1.001bn.

However, logic also tells us that the potential is there for Chelsea to achieve the biggest ever economic loss in football once again (the club’s £207.51m economic loss in 2020-21 is the current record) driven by the purchase price of £2.5bn plus the club’s recent acquisitions becoming part of the overall quantum of Invested Capital, unless there is a radical upturn in revenue and operational efficiency. And this is Chelsea’s challenge going forward.

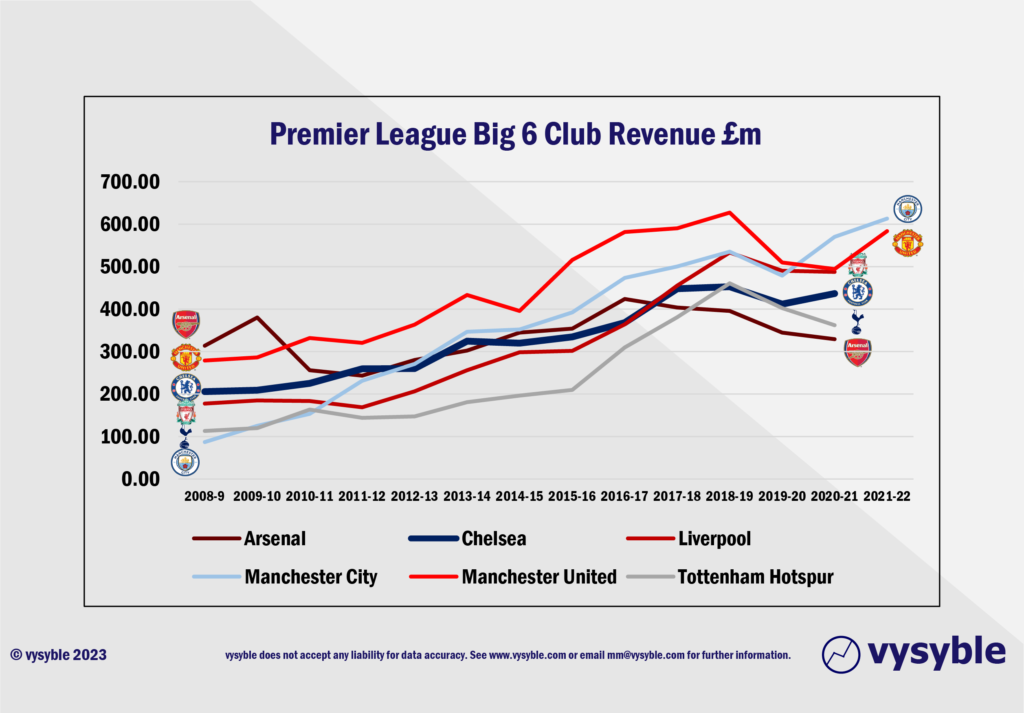

Our previous graphic illustrating the staff costs to revenue ratio shows Chelsea at the higher end of the Big 6 pack in recent years. Behind the data is a consistent trend of higher staff costs and lower revenues relative to the likes of the two Manchester clubs (City in more recent years) and Liverpool.

The lower revenue level can be seen below…

The new Chelsea regime has referred to a new stadium which through a narrow revenue lens could improve matters given that the club’s annual matchday revenue is some £50m short of Manchester United’s matchday income. However, the considerable funds required to fund such a project would add to the invested capital amount and thus further increase the annual capital charge which in turn would depress economic performance even more. It is certainly not cheap or easy to build a new stadium in one of the most expensive zip/post codes on the planet for real estate.

Other options for increasing revenue include enhanced sponsorship agreements and partnerships. After all, making the headlines can be productive in other ways. Also, there is the increase in broadcast revenues expected from the Premier League’s improved international contracts. However, it is very difficult to see any of these options getting close to covering the transfer outlay that we’ve seen so far not only from Chelsea but from the Premier League as a whole. Furthermore, as we have highlighted elsewhere, Comcast recently wrote off $8.5bn concerning the Sky business. According to Comcast’s own narrative, this write-down is a consequence of a fall in projected revenue.

In Chelsea’s case, the club’s total revenue over the period 2018-21 came to £1.748bn. Our own transfer data (before add-ons, agent fees and other additional charges) points to Chelsea’s net expenditure over the same period as £293m. Therefore, the ratio of net spend to revenue is 16.7%. If, for the sake of argument, this ratio is to be maintained in 2022-23, given a net spend of £503.9m, the club’s annual revenue would have to be £3.017bn which is a far cry from the stated revenue in the most recently released financial statements (for the year ended 30 June 2021) of £437m.

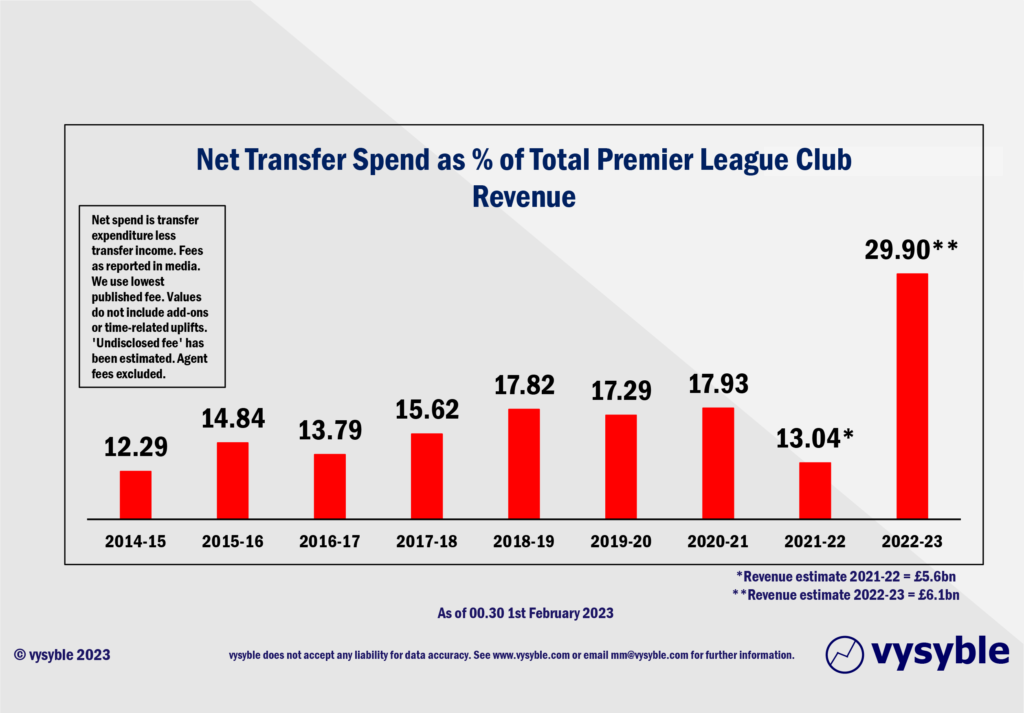

At divisional level, the issue for the Premier League becomes even more apparent…

If the 2022-23 net spend of £1.824bn represents 29.9% of an estimated £6.1bn revenue then to revert to the Premier League 2015-22 average of 15.43% between 2015-22, the divisional revenue level would have to hit £11.821bn for 2022-23.

We can safely say that whilst Chelsea’s transfer adventure will challenge not only the balance sheet but also the club’s strategic path, the wider issue is that, to us at least, the Premier Leagues clubs have taken what can only be described as a “very brave and aggressive” step into the future given the above calculation.

Of course, the psychology may be that a regulator is imminent as are UEFA’s new financial regulations and this most recent spending spree is a means of stockpiling talent before the shop shuts. From a financial perspective, it looks like a dangerous high wire financial experiment and given even more recent events concerning financial behaviour emanating from Manchester, the credibility of what has been so far a marketing and image-exporting phenomenon is now under serious scrutiny for a lack of timely probity.

For Chelsea’s new owners, it may spur them on to go further and ‘buy’ the market. But the problem with buying markets is that you end up becoming the market and that is a very, very perilous place to be.

vysyble

Follow vysyble on Twitter

24th November 2022 – Going Back Home – Not just Liverpool but Manchester United up for sale too.

9th November 2022 – The Leaving of Liverpool –Club owners appear to call it a day and mull sale of club.

30th September 2022 – Theatre of Breaking Dreams – Manchester United achieves its biggest annual economic loss.

4th August 2022 – Soccerball – Over-enthusiastic, over-subscribed and over here. The American invasion into English football is in full swing.

17th May 2022 – Money Heights – Valuation models fail to match the price paid to buy loss-making Chelsea.

25th April 2022 – Same but Different – UEFA’s proposed changes to Champions League qualification mirrors aspects of aborted Super League.

18th March 2022 – Let It Go – With a freeze on Russian assets, Chelsea hits the market following a record economic loss.

10th February 2022 – Underwater – Manchester United’s share price fails to defy gravity and sinks below its IPO level. Has the market got wise to the club’s poor economic performance?

1st December 2021 – Fantasy Football – The Fan-Led Review findings fall short of the necessary value-driven approach to regulatory reform.

23rd June 2021 – Road to Nowhere – Football stands at the crossroads ahead of the Fan-Led Review process. We examine the key questions that it must answer.

11th May 2021 – Prime Numbers – Football’s elite clubs seek a route to profit as fans yearn for sporting tradition. In between lies a gulf of mistrust and misapprehension.

26th April 2021 – A Bitter Pill – GSK’s new strategic direction fails to find riches in the middle of a pandemic when other pharma companies have prospered.

25th April 2021 – The Wrong Stuff – American-style football league won’t wash but the conditions that led to its launch are still present and are likely to get worse.

19th April 2021 – Super League Arrives – As we predicted, football’s elite breakaway emerges from the shadows.

30th March 2021 – $hooting B£ank$ – Arsenal’s commercial performance analysed.

22nd February 2021 – Measure for Measure – Take two financial measures, add pandemic and stir.

18th January 2021 – The Football Factory – If football was an industrial entity…

8th January 2021 – The Oil Majors – An Update – A shareholder return performance review of the 4 major oil companies in 2020.

10th December 2020 – Pump Up The Volume – ExxonMobil comes under fire from an agitated investor.

16th November 2020 – The Pain Game – Manchester United’s Q1 2021 financial release opens the lid on a Covid-19-affected financial can of worms.

11th November 2020 – A Tight Squeeze – Football’s Elephant in the Room leaving little space for financial relief.

29th October 2020 – Form and Function – Proposals-a-plenty for football’s structural reform.

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport.

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy.

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses.

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return.

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak.

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances.

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle.

12th December 2019 – The Cost of Chasing Gold– In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League.

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club.

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes.

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League.

5th July 2019 – Chopping Board – Knives out for former Tesco chief.

25th May 2019 –Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’– Why the Economic Profit metric is the most transparent measure of business performance.

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness.

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance.

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table.

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics.

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds.

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs